Undiscovered Gems in Asia to Watch This December 2025

As December 2025 unfolds, the Asian markets are drawing attention amid significant economic shifts, such as the Bank of Japan's interest rate hike to levels not seen in three decades. Against this backdrop, identifying promising small-cap stocks requires a keen eye on companies that can navigate these changing conditions and capitalize on regional growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 64.50% | 7.33% | 58.64% | ★★★★★★ |

| Nanfang Ventilator | NA | -10.23% | 25.64% | ★★★★★★ |

| Nextronics Engineering | 20.23% | 11.39% | 24.54% | ★★★★★★ |

| Jiangsu Rainbow Heavy Industries | 25.93% | 19.62% | 2.58% | ★★★★★☆ |

| Toukei Computer | NA | 5.71% | 14.11% | ★★★★★☆ |

| Xinjiang Torch Gas | 0.14% | 17.07% | 14.43% | ★★★★★☆ |

| Huasi Holding | 6.89% | 4.80% | 41.72% | ★★★★★☆ |

| Iljin DiamondLtd | 2.08% | -4.09% | 13.10% | ★★★★☆☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Lungyen Life Service | 10.77% | 3.67% | 0.09% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Zhejiang Asia-Pacific Mechanical & ElectronicLtd (SZSE:002284)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Asia-Pacific Mechanical & Electronic Co., Ltd specializes in the development, production, and sale of automotive parts and components both in China and internationally, with a market capitalization of CN¥10.11 billion.

Operations: Zhejiang Asia-Pacific Mechanical & Electronic Co., Ltd generates revenue primarily from the automotive parts segment, totaling CN¥5.23 billion. The company operates with a market capitalization of approximately CN¥10.11 billion.

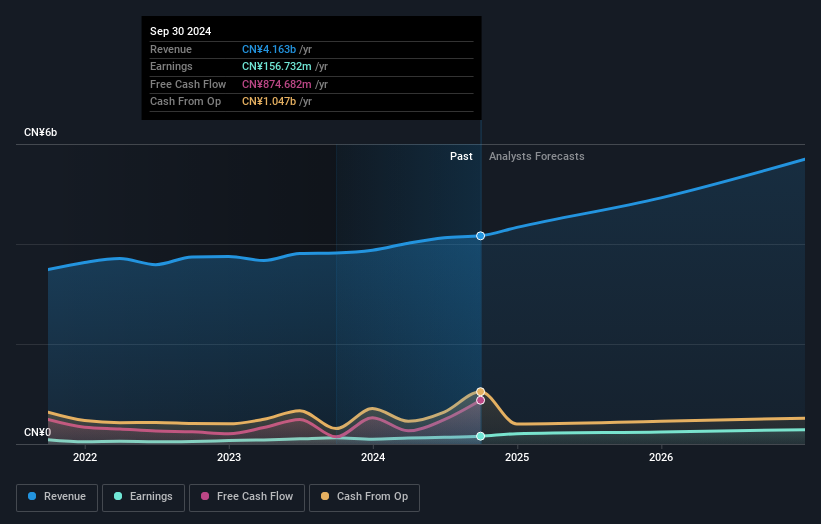

Zhejiang Asia-Pacific Mechanical & Electronic Ltd. has been making waves with its impressive financial performance, boasting a net income of CNY 328.43 million for the first nine months of 2025, up from CNY 157.06 million the previous year. The company reported sales of CNY 3,973.43 million, reflecting robust growth in the auto components industry where it outpaced peers with a remarkable earnings growth rate of 145% last year compared to the industry's 8%. Trading at a significant discount to its estimated fair value, it holds more cash than total debt and maintains positive free cash flow, suggesting strong financial health and potential for future expansion despite an increased debt-to-equity ratio over five years from 41% to 50%.

Wuhan Ligong Guangke (SZSE:300557)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuhan Ligong Guangke Co., Ltd. specializes in providing optical fiber sensor products and Internet of Things solutions for security and fire protection applications in China, with a market capitalization of approximately CN¥4.75 billion.

Operations: Wuhan Ligong Guangke generates revenue primarily from its Optical Fiber Sensor and Smart Instrument Manufacturing Industry, amounting to CN¥703.29 million. The company's financial performance is highlighted by a notable trend in its gross profit margin, which reflects the efficiency of its production processes and cost management strategies.

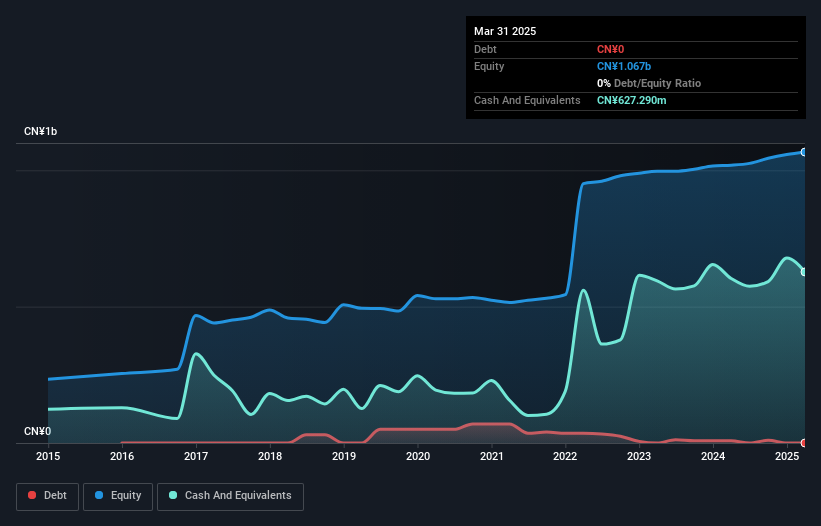

Wuhan Ligong Guangke, a smaller player in the electronics sector, has demonstrated impressive earnings growth of 37.8% over the past year, outpacing the industry's 9.4%. The company reported sales of ¥469.22 million for the first nine months of 2025, up from ¥412.37 million last year, with net income rising to ¥39.61 million from ¥26.84 million. Despite its volatile share price recently, Wuhan Ligong Guangke boasts high-quality earnings and remains debt-free with no interest coverage concerns since its debt to equity ratio was once at 13.1% five years ago but is now zero.

GMO internet (TSE:4784)

Simply Wall St Value Rating: ★★★★★☆

Overview: GMO Internet, Inc. operates in the internet infrastructure sector in Japan and has a market capitalization of ¥208.15 billion.

Operations: GMO Internet generates revenue primarily from its internet infrastructure services, focusing on domain registration, hosting, and cloud services. The company's net profit margin has shown variability over recent periods.

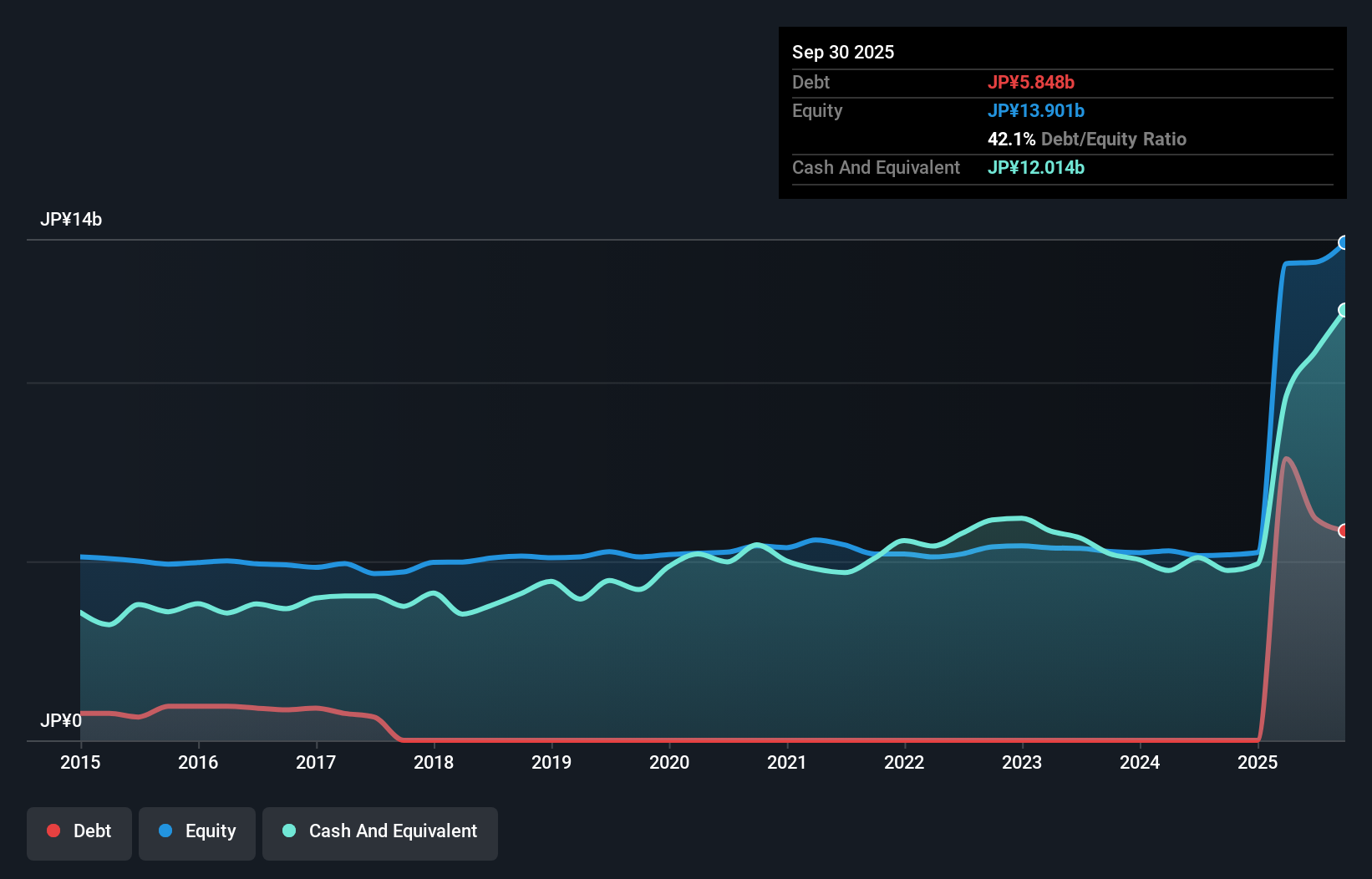

GMO Internet, a dynamic player in the tech space, recently showcased remarkable financial resilience. For the nine months ending September 2025, sales surged to ¥58.35 billion from ¥9.62 billion a year prior, while net income rebounded to ¥4.01 billion from a loss of ¥48 million. Despite facing a one-off loss of ¥1.8 billion in the last year, its interest payments are well-covered by EBIT at 56x coverage and it remains free cash flow positive with more cash than total debt. However, shareholder dilution occurred over the past year amid this impressive turnaround story and highly volatile share price movements.

Turning Ideas Into Actions

- Navigate through the entire inventory of 2492 Asian Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报