Corcept Therapeutics (CORT): Assessing Valuation After a Strong Year-to-Date Share Price Surge

Corcept Therapeutics (CORT) has quietly turned into a strong performer this year, with the stock up about 68% year to date and roughly 63% over the past year, far outpacing the broader market.

See our latest analysis for Corcept Therapeutics.

The recent 1 month share price return of 8.37% and the latest close at $83.76 suggest investors are steadily repricing Corcept as growth expectations and perceived pipeline risks shift, building on a powerful multi year total shareholder return.

If Corcept’s run has you rethinking your healthcare exposure, it could be worth scanning other potential winners across healthcare stocks for your watchlist.

With revenue and earnings growing briskly, and the stock still trading well below consensus targets, Corcept’s surge raises a key question: is this momentum story still undervalued, or is the market already pricing in future growth?

Most Popular Narrative: 34.2% Undervalued

Compared with Corcept Therapeutics' last close at $83.76, the most followed narrative points to a materially higher fair value, underpinned by aggressive growth and margin assumptions.

The analysts have a consensus price target of $134.5 for Corcept Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $145.0, and the most bearish reporting a price target of just $121.0.

Curious what kind of revenue surge, margin expansion and future earnings multiple are needed to justify that upside case, and how bold those projections really are? Dig into the full narrative to see the assumptions behind this valuation leap.

Result: Fair Value of $127.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on smooth execution; patent litigation outcomes and pharmacy transition hiccups could quickly challenge even the most optimistic growth projections.

Find out about the key risks to this Corcept Therapeutics narrative.

Another View: Rich Multiples Challenge the Undervalued Story

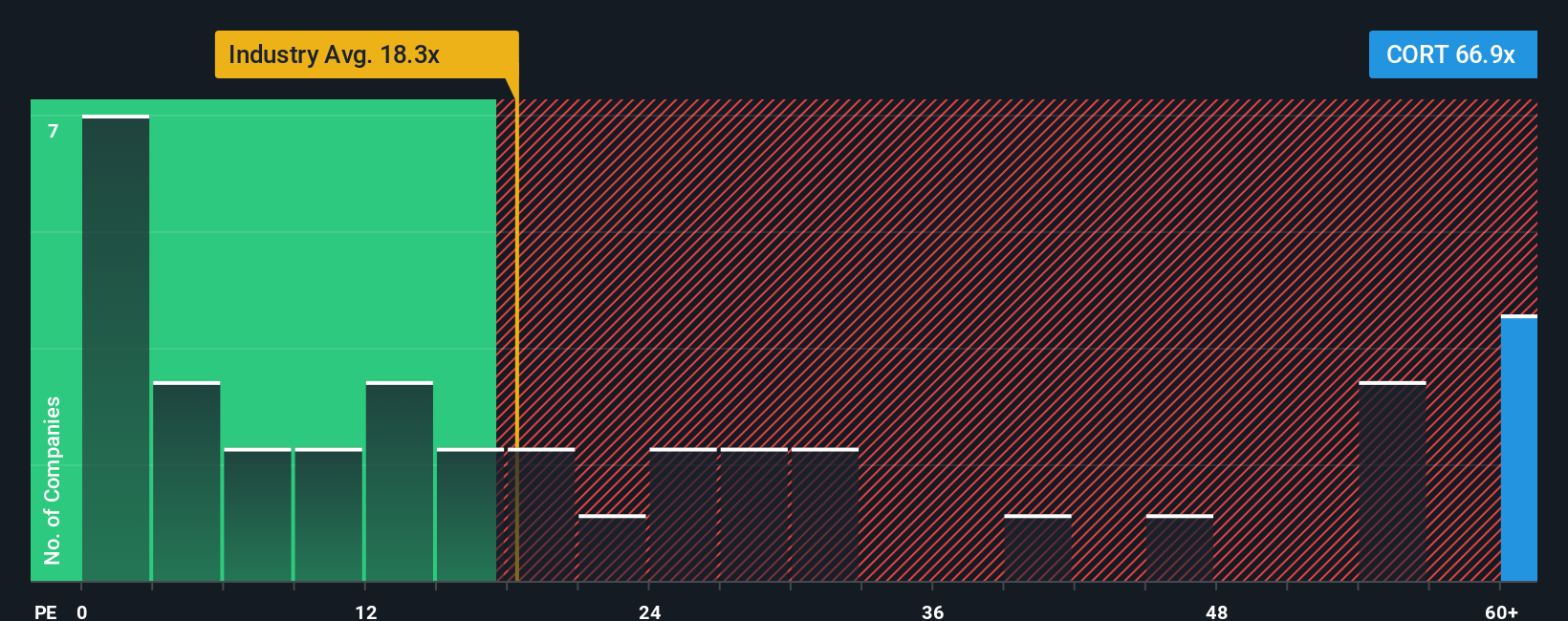

While the narrative points to upside, Corcept’s current price to earnings ratio of 84.2 times is more than double peers at 37.5 times and far above its 44.6 times fair ratio. This suggests the market already bakes in a lot of good news and raises the question of whether this represents a cushion or a cliff.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corcept Therapeutics Narrative

If you are not fully convinced by this view, or prefer hands on research rooted in your own assumptions, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more actionable investment ideas?

Do not stop with Corcept. Put Simply Wall Street’s Screener to work now so you can spot quality opportunities before the crowd and strengthen your portfolio.

- Capitalize on potential mispricing by targeting quality businesses trading below intrinsic value through these 913 undervalued stocks based on cash flows and position yourself ahead of a sentiment shift.

- Accelerate your growth strategy with these 24 AI penny stocks, focusing on companies reshaping industries with real world artificial intelligence applications and scalable business models.

- Lock in meaningful portfolio income by zeroing in on these 12 dividend stocks with yields > 3% that can support long term returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报