SS&C Technologies (SSNC): Valuation Check After Improved Hedge Fund Redemption Trends Signal Stronger Asset Retention

SS&C Technologies Holdings (SSNC) just reported that its GlobeOp Forward Redemption Indicator slipped to roughly 2% in December, down from the prior month and last year. This hints at steadier hedge fund assets on its platform.

See our latest analysis for SS&C Technologies Holdings.

That backdrop of steadier hedge fund assets comes after a busy period, including SS&C presenting at the Nasdaq Investor Conference in London. It helps explain why the stock’s roughly 16% year to date share price return and strong multi year total shareholder returns suggest momentum is gradually rebuilding from last quarter’s dip.

If this kind of steady compounding appeals to you, it is worth also exploring fast growing stocks with high insider ownership for other ideas where growth potential and insider conviction line up.

Yet with earnings still growing, a double digit discount to analyst targets, and an even steeper gap to some intrinsic value estimates, investors have to ask: is SS&C still mispriced or is the market already baking in its next leg of growth?

Most Popular Narrative: 13.3% Undervalued

The most followed narrative sees SS&C Technologies Holdings trading below an implied fair value in the low $100s per share compared with the recent close, setting up a case built around steady growth and margin expansion.

The integration of AI driven automation platforms like Blue Prism, designed to enhance operational efficiency, is anticipated to reduce costs and improve net margins over time. The strategic lift out agreement with Insignia Financial is set to contribute significantly to SS&C's revenue in the latter half of 2025, supporting a stronger revenue forecast.

Want to see the full math behind this upside view? The narrative leans on disciplined revenue growth, rising margins, and a future earnings multiple that assumes SS&C keeps compounding at a premium pace. Curious which specific profit and valuation assumptions need to land perfectly to justify that fair value range?

Result: Fair Value of $101.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat thesis could be challenged if FX volatility intensifies or if SS&C’s sizable net debt becomes more burdensome in a higher rate environment.

Find out about the key risks to this SS&C Technologies Holdings narrative.

Another Lens on Value

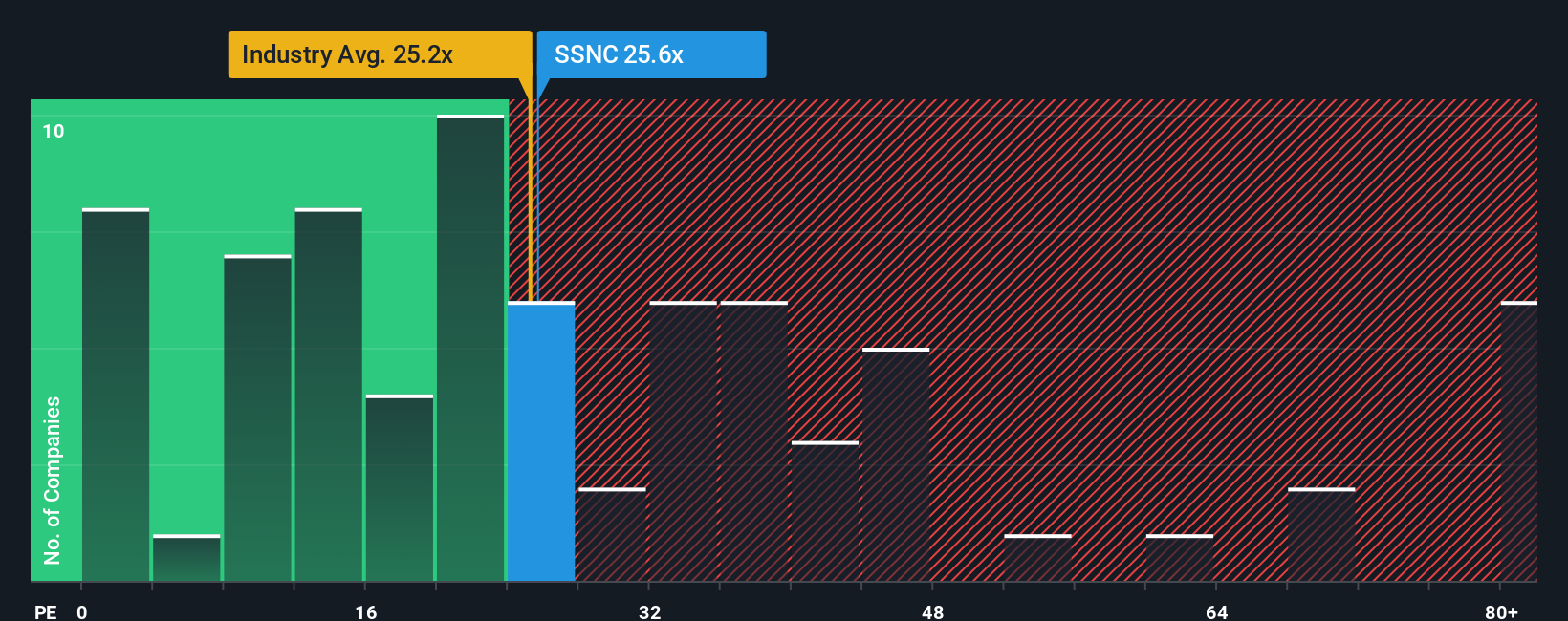

On earnings multiples, SS&C looks far less of a bargain. It trades on about 25.1 times earnings, a premium to the US Professional Services industry at 24.4 times and peers at 21.7 times, even though our fair ratio sits higher at 28.9 times. Is that premium justified if growth cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SS&C Technologies Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in minutes with Do it your way.

A great starting point for your SS&C Technologies Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall St Screener to uncover focused sets of stocks that could sharpen your portfolio edge and future returns.

- Target potential mispricings by running through these 913 undervalued stocks based on cash flows that may offer stronger upside based on cash flow strengths.

- Ride powerful innovation trends by scanning these 24 AI penny stocks shaping how artificial intelligence transforms real world industries.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that can help anchor returns with reliable cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报