HASEKO (TSE:1808) Treasury Share Cancellation Triggers Fresh Look at an Already Stretched Valuation

HASEKO (TSE:1808) just approved the cancellation of 8,314,500 treasury shares, about 3% of its float. This is a tidy balance sheet move that can subtly lift per share metrics and shareholder appeal.

See our latest analysis for HASEKO.

The move comes after a powerful run, with the share price up around 9% over the past month and a year to date share price return above 50%. The five year total shareholder return of well over 200% shows long term momentum is still very much intact.

If this kind of capital allocation story interests you, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership.

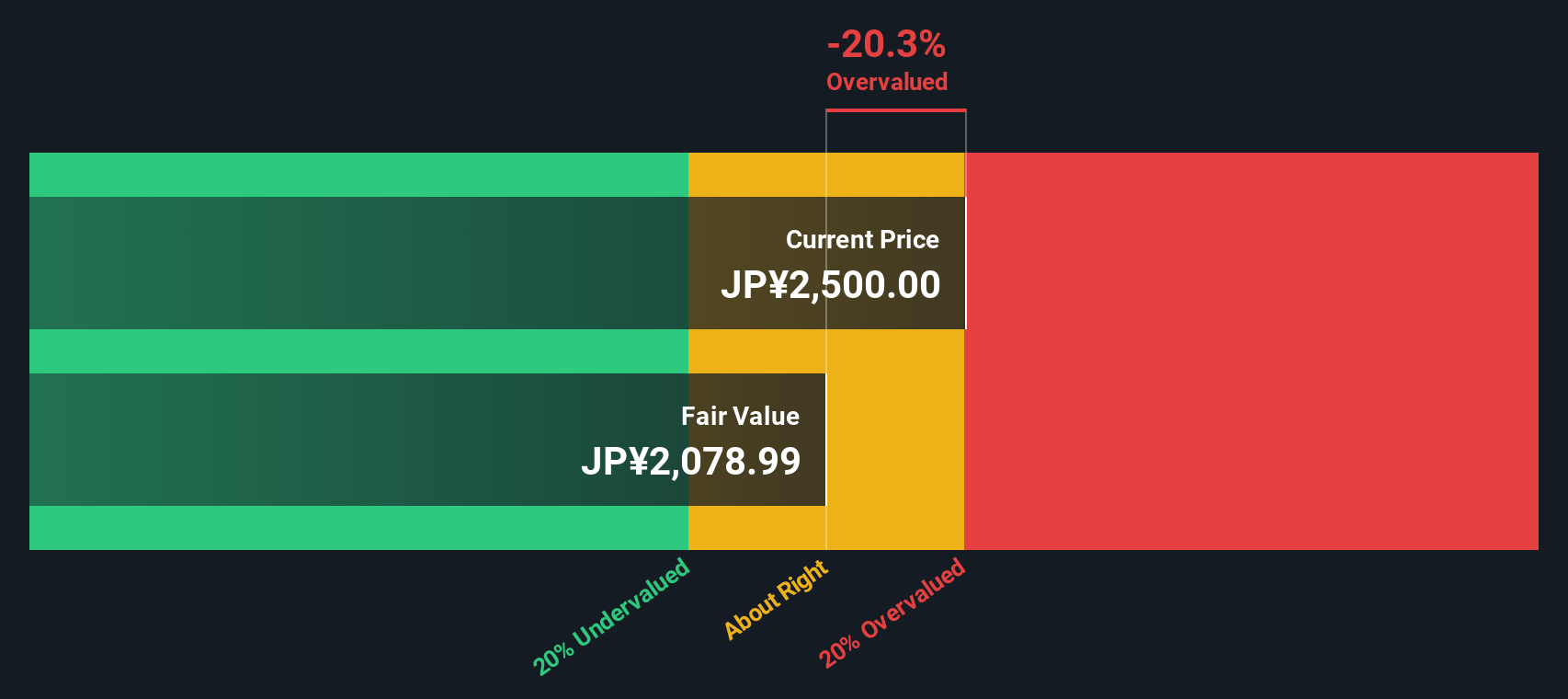

Yet with HASEKO trading near record highs, a modest value score, and a slight premium to analyst targets, investors now face a tougher call: is this still a buying opportunity, or is future growth already priced in?

Price-to-Earnings of 20.9x: Is it justified?

HASEKO's recent close at ¥3,110 implies a price-to-earnings ratio of 20.9x, putting the stock on a clear premium footing versus peers.

The price-to-earnings multiple compares what investors are willing to pay today for each unit of current earnings, a key lens for a mature, earnings-driven business like construction and real estate development.

In this case, the market appears to be paying up in anticipation of stronger profit growth than history would suggest, even though 1808 is trading above both analyst targets and our DCF fair value estimate, and its return on equity is flagged as low with margins that have recently slipped.

That premium is stark when stacked against the JP Consumer Durables industry average P/E of 11.7x and a peer group average of 11x, and it even sits slightly above the SWS estimated fair price-to-earnings ratio of 20.7x, suggesting limited room for further rerating if earnings do not accelerate decisively.

Explore the SWS fair ratio for HASEKO

Result: Price-to-Earnings of 20.9x (OVERVALUED)

However, stretched valuation and slowing revenue growth mean any earnings disappointment or broader housing downturn could quickly unwind recent share price optimism.

Find out about the key risks to this HASEKO narrative.

Another View: DCF Flags a Very Different Story

While the market is paying up on a 20.9x earnings multiple, our DCF model paints HASEKO as deeply overvalued, with fair value closer to ¥946.61 versus the current ¥3,110. That gap suggests investors are either betting on a major upside surprise or ignoring valuation risk entirely.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HASEKO for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HASEKO Narrative

If you see the numbers differently or prefer to dig into the details yourself, you can build a complete story in minutes. Do it your way.

A great starting point for your HASEKO research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Now is the moment to broaden your opportunity set, build a smarter watchlist, and uncover fresh ideas with strong potential before other investors catch on.

- Capitalize on mispriced businesses by targeting these 913 undervalued stocks based on cash flows that pair solid fundamentals with attractive valuations.

- Tap into powerful secular themes through these 24 AI penny stocks positioned at the heart of machine learning and automation growth.

- Boost your income potential with these 12 dividend stocks with yields > 3% that combine reliable payouts with resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报