NIO (NYSE:NIO) Reaches 30,000 ES8 Deliveries – What Does This Growth Milestone Say About Its Valuation?

NIO (NIO) just hit its 30,000th ES8 delivery barely three months after launch, even while juggling chip and battery shortages, and that rapid scale up is exactly what has analysts rethinking the stock’s trajectory.

See our latest analysis for NIO.

That milestone caps a choppy year in the market, with NIO’s share price at $4.99 and a positive year to date share price return, but a weak 3 year total shareholder return signalling momentum is only tentatively rebuilding as investors weigh rapid delivery growth against still heavy losses and execution risk.

If NIO’s latest moves have your attention, this could be a good moment to see how it stacks up against other auto manufacturers that might be quietly setting up their next leg of growth.

With deliveries racing ahead, a roughly 21 percent intrinsic discount and mixed analyst sentiment, is NIO still trading below its long term potential, or is the market already pricing in the next wave of growth?

Most Popular Narrative: 26% Undervalued

With NIO last closing at $4.99 versus a narrative fair value near $6.75, the most widely followed view still sees meaningful upside grounded in longer term earnings power.

In-house technological advancements, including proprietary smart driving chips and high integration 900V architecture, are reducing production costs, supporting aggressive but profitable pricing, and setting the stage for higher net margins as scale increases.

Want to see why this outlook assigns a premium style multiple to an auto stock, and how future revenue, margins, and earnings are modeled? The underlying projections may surprise you.

Result: Fair Value of $6.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained net losses and intensifying EV competition could derail margin recovery and force investors to rethink whether current upside expectations remain realistic.

Find out about the key risks to this NIO narrative.

Another Take on Valuation

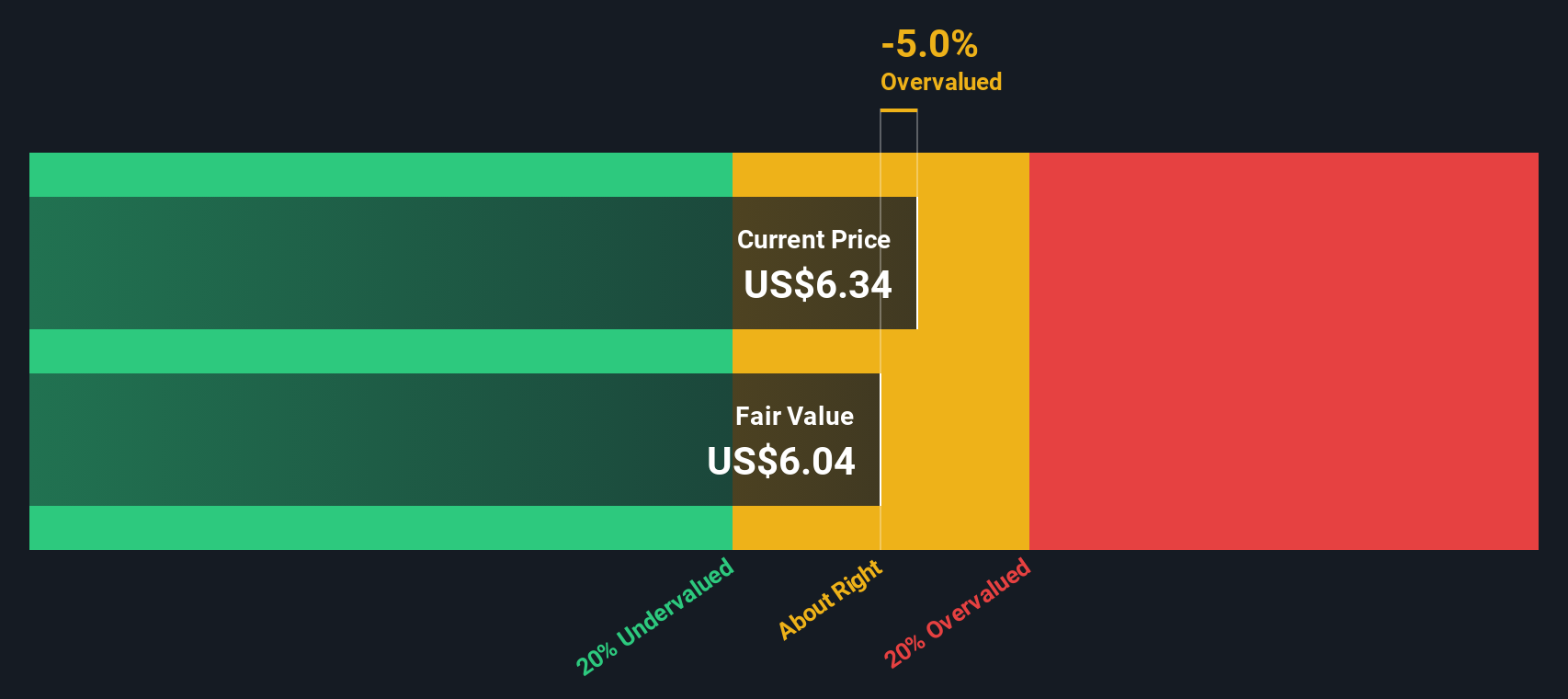

Our SWS DCF model also flags NIO as attractive, with the shares trading about 21 percent below an estimated fair value near $6.35. That supports the upside story, but it also leans heavily on strong growth and margin recovery. How comfortable are you with those assumptions?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NIO Narrative

If these views do not line up with your own, dig into the numbers, stress test the assumptions, and craft a personalized perspective in minutes: Do it your way.

A great starting point for your NIO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop building their watchlist, so use the Simply Wall St Screener now to uncover fresh opportunities before the crowd catches on.

- Capture potential high-upside moves by targeting beaten down value candidates with these 913 undervalued stocks based on cash flows that still boast strong underlying cash flows.

- Position yourself early in transformational tech by scanning these 24 AI penny stocks that are reshaping industries with real world artificial intelligence adoption.

- Consider cash flow today and the potential for compounding over time by focusing on reliable income names through these 12 dividend stocks with yields > 3% with sustainable yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报