PARK24 (TSE:4666): Reassessing Valuation After Dividend Hike, Earnings Growth Guidance and Early Loan Repayment Plan

PARK24 (TSE:4666) just packed several shareholder friendly moves into one update, lifting its dividend outlook, guiding for higher sales and profits, and planning early repayment of a large subordinated loan.

See our latest analysis for PARK24.

The upbeat guidance, richer dividend outlook and early loan repayment plan come after a choppy stretch. The latest ¥2,067.5 share price sits against a modestly negative year to date share price return but a solid positive five year total shareholder return, suggesting sentiment is only now starting to turn more constructive.

If PARK24’s renewed momentum has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership as another source of ideas with conviction behind them.

With earnings and dividends now set to climb and the balance sheet looking sturdier, should investors view PARK24’s recent pullback as a mispricing of its growth runway, or are markets already discounting those brighter prospects?

Most Popular Narrative: 23.1% Undervalued

Against PARK24’s last close at ¥2,067.5, the most widely followed narrative points to a materially higher fair value, hinging on earnings power and margins.

The Mobility Business has been successful in increasing the usage fees per vehicle per month and expects continuous growth. This increase in usage fees will likely enhance net margins and overall earnings in the Mobility segment.

Curious how steady revenue gains, rising margins and a confident earnings target can all coexist in one story? The crucial twist is the future profit multiple. Wondering what growth path and profitability leap need to line up for that premium to make sense? Read on to uncover the assumptions behind this fair value call.

Result: Fair Value of ¥2,688 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses and impairments in the U.K. and Australia, combined with tax headwinds, could undercut those margin gains and slow earnings progress.

Find out about the key risks to this PARK24 narrative.

Another Lens on Valuation

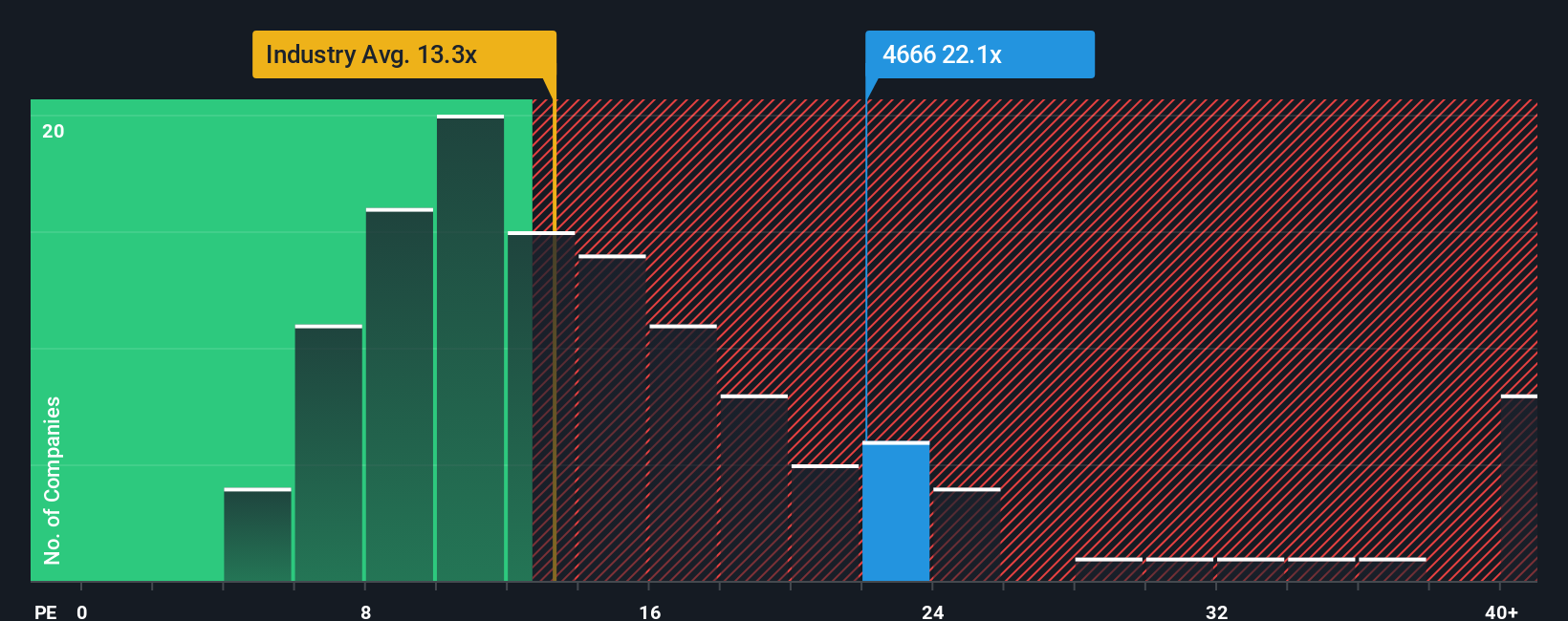

Analysts see PARK24 as 23.1% undervalued, but its 22.2x price to earnings ratio still sits well above the JP Commercial Services average of 14.2x and peer average of 17.9x. With a fair ratio of 22.4x, is today’s price really a bargain or just fully loaded with expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PARK24 Narrative

If you are not convinced by this view or would rather lean on your own analysis, build a fresh perspective in just minutes, Do it your way.

A great starting point for your PARK24 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider using the Simply Wall Street Screener to uncover fresh, data driven ideas that others may still be overlooking.

- Explore potential mispricings by targeting quality companies trading below intrinsic value through these 913 undervalued stocks based on cash flows and position yourself ahead of sentiment shifts.

- Look for structural growth trends by focusing on innovators in automation and machine learning with these 24 AI penny stocks before the wider market catches up.

- Strengthen your income stream by focusing on reliable payers using these 12 dividend stocks with yields > 3% and identify opportunities with dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报