Camden Property Trust (CPT): Reassessing Valuation After Dual Listing, 2025 Guidance Upgrade and JP Morgan Rating Boost

Camden Property Trust (CPT) just packed three catalysts into one stretch: a fresh NYSE Texas dual listing, higher 2025 guidance, and a JP Morgan upgrade, all reshaping how investors are sizing up the stock.

See our latest analysis for Camden Property Trust.

Those catalysts arrive after a choppy stretch, with the share price at $107.28 and a negative year to date share price return but a positive five year total shareholder return suggesting longer term momentum is still intact even as near term sentiment resets.

If Camden’s move has you rethinking your real estate exposure, it might be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With the shares still trading below both analyst targets and some estimates of intrinsic value, and coming off years of strong total returns, is Camden quietly offering upside or is the market already baking in the next leg of growth?

Most Popular Narrative: 8.1% Undervalued

With Camden Property Trust last closing at $107.28 against a narrative fair value of $116.67, the storyline leans toward modest upside driven by operating momentum and capital discipline.

Ongoing asset repositioning (kitchen and bath renovations) and disciplined recycling into newer, lower-capex communities are boosting rental yields and margin expansion, positioning Camden for higher net operating income as market conditions normalize.

Curious how steady rent growth, slow but positive revenue gains, and a richer future earnings multiple combine to justify that higher value? The narrative knits together assumptions on long term margins, moderate top line expansion, and a premium price tag usually reserved for faster growing names. Want to see exactly how those projections stack up over time and why a relatively low discount rate still supports upside? Read on and test whether the story behind this fair value matches your own expectations.

Result: Fair Value of $116.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if Sun Belt oversupply lingers or a weaker job market dents occupancy, rent growth, and Camden’s margin expansion plans.

Find out about the key risks to this Camden Property Trust narrative.

Another Lens on Valuation

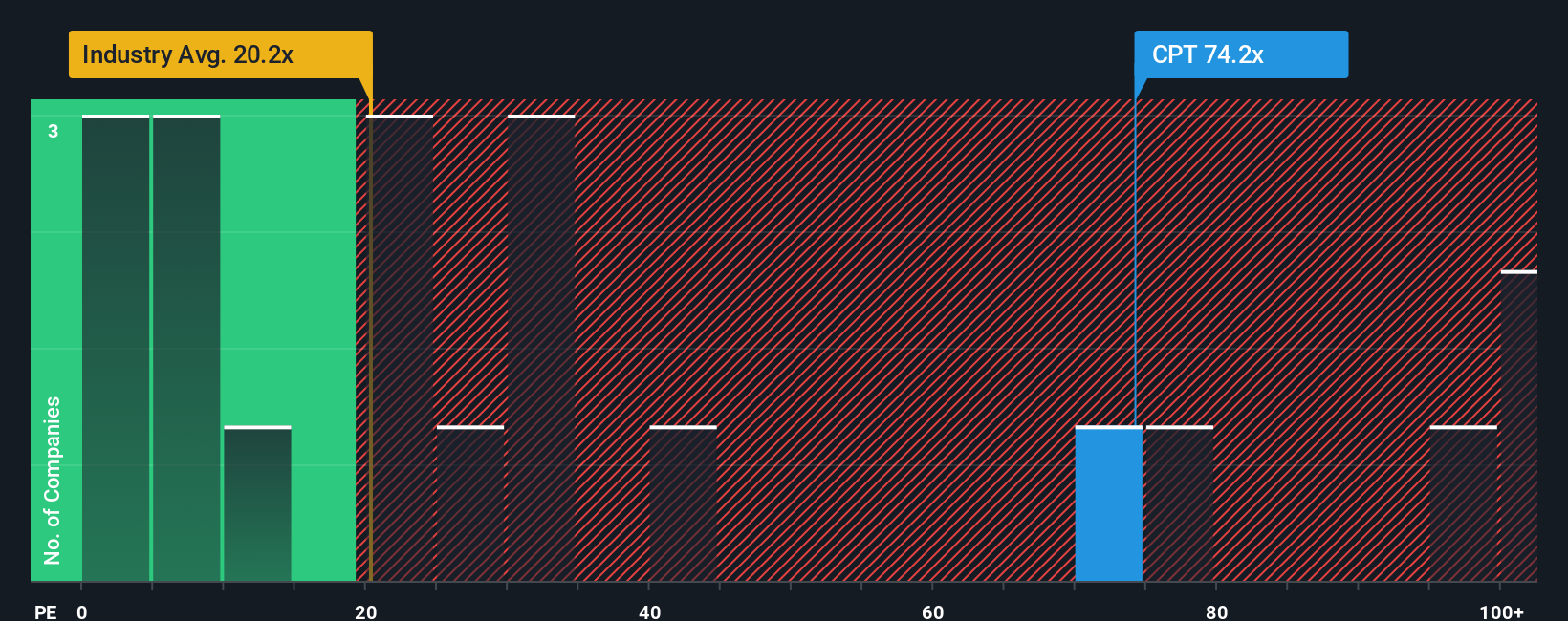

Step away from fair value models and Camden suddenly looks pricey. At 42.5 times earnings, it trades richer than both peers at 37.4 times and a fair ratio of 24.5 times, suggesting investors are already paying up and leaving less margin for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Camden Property Trust Narrative

If you are not fully aligned with this view or would rather stress test the assumptions yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Camden Property Trust research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one promising REIT. Use the Simply Wall Street Screener to uncover fresh opportunities tailored to your strategy before the market catches on.

- Capture potential mispricings early by using these 913 undervalued stocks based on cash flows that may offer stronger upside than widely followed names.

- Position your portfolio for the next wave of innovation by targeting these 24 AI penny stocks shaping how businesses and consumers use intelligent technology.

- Strengthen your income stream by focusing on these 12 dividend stocks with yields > 3% that can help support long term returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报