Assessing Anheuser-Busch InBev (ENXTBR:ABI) Valuation After U.S. Brewery Closures and Production Consolidation

Anheuser-Busch InBev (ENXTBR:ABI) has investors talking after announcing plans to close its Fairfield and Merrimack breweries and sell its Newark facility, consolidating U.S. production to sharpen efficiency and support higher growth brands.

See our latest analysis for Anheuser-Busch InBev.

The consolidation news lands after a solid run, with an 11.43% 3 month share price return and a 16.87% one year total shareholder return suggesting momentum is quietly rebuilding around the story.

If this kind of strategic reshaping has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other high conviction ideas.

With the shares still trading at a sizeable discount to analyst targets despite double digit earnings growth and fresh global partnerships, is Anheuser Busch InBev a mispriced turnaround, or is the market already baking in its next leg of growth?

Most Popular Narrative Narrative: 19.1% Undervalued

Compared to the last close at €55.48, the most followed narrative points to a noticeably higher fair value, framing Anheuser-Busch InBev as a discounted compounder with room for earnings and margin expansion.

Ongoing operational optimization, including disciplined resource allocation, productivity initiatives, supply chain efficiencies, and deleveraging (net debt/EBITDA improving YoY), is supporting margin expansion (EBITDA margin up 116bps in Q2) and generating increased free cash flow. This provides more flexibility for shareholder returns and future investments, benefiting net earnings over the longer term.

Curious how steady mid single digit growth, rising margins, and shrinking share count combine into that upside case? The narrative leans on a future earnings power and valuation multiple normally reserved for sector leaders. Want to see the precise assumptions it makes about revenue, profitability, and the price investors might pay for ABI in a few years time?

Result: Fair Value of $68.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent volume softness in key emerging markets and elevated leverage could quickly undermine the optimistic earnings and multiple expansion embedded in this narrative.

Find out about the key risks to this Anheuser-Busch InBev narrative.

Another Angle on Valuation

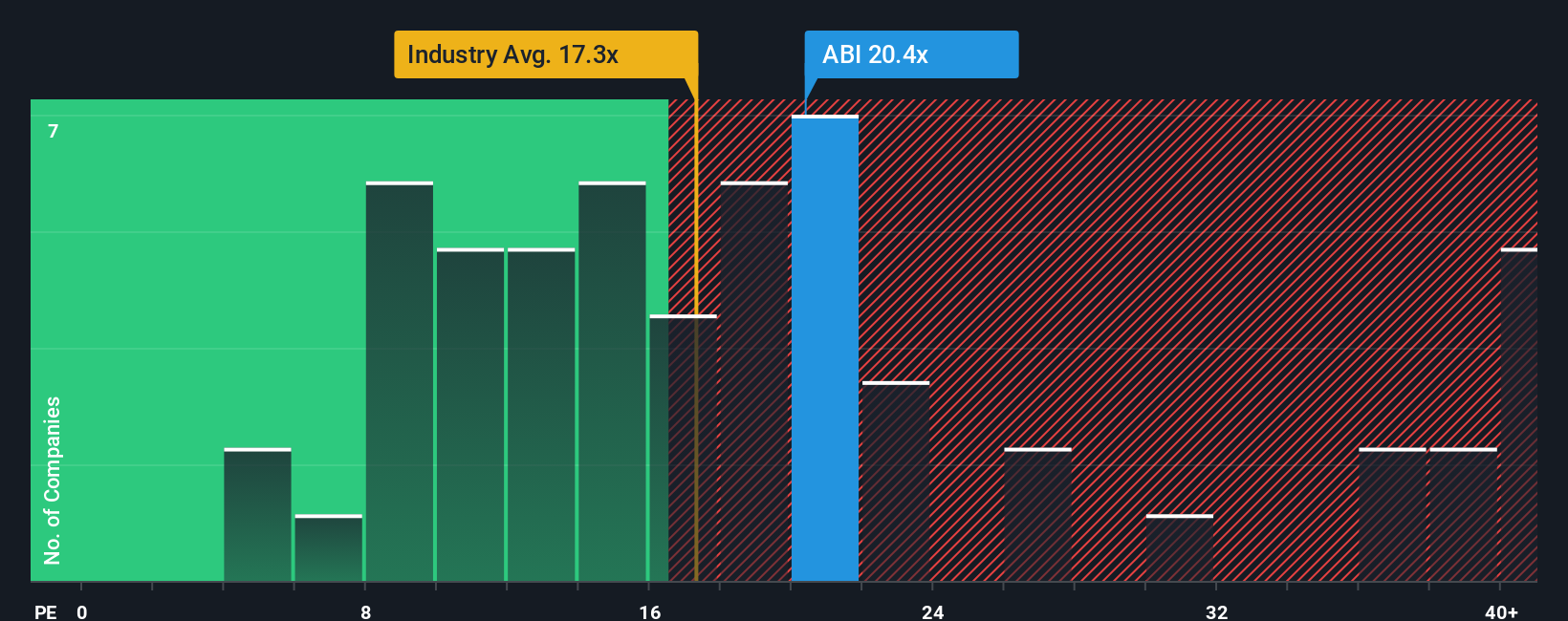

On earnings, the picture is less clear cut. ABI trades at 20.8x earnings, richer than the European beverage average of 17.7x, yet below peers at 23.1x and its own fair ratio of 36.9x. Is this a justified quality premium, or a margin of safety in disguise?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Anheuser-Busch InBev Narrative

If the story so far does not quite fit your view, you can dive into the numbers yourself and build a fresh take in minutes: Do it your way.

A great starting point for your Anheuser-Busch InBev research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If Anheuser-Busch InBev has sharpened your focus, do not stop here, your next high conviction opportunity could be hiding in plain sight on Simply Wall St.

- Capture potential multi baggers early by scanning these 3632 penny stocks with strong financials that already show strong financial foundations instead of just hype.

- Position yourself ahead of the next productivity revolution with these 24 AI penny stocks targeting companies building real world AI solutions, not just buzzwords.

- Identify more compelling risk reward setups by filtering for these 913 undervalued stocks based on cash flows where robust cash flows are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报