Assessing Amgen (AMGN) Valuation After UPLIZNA Approval and New U.S. Drug Pricing Agreements

Amgen (AMGN) just checked two big boxes at once, tightening its partnership with Washington on drug pricing while winning FDA approval for UPLIZNA in generalized myasthenia gravis, and the stock is reacting accordingly.

See our latest analysis for Amgen.

That backdrop of tariff relief and drug price cooperation, combined with the fresh UPLIZNA approval, comes on top of a strong run, with Amgen’s share price up 26.27% year to date and a 5 year total shareholder return of 71.89%, which suggests that momentum has been building rather than fading.

If this mix of innovation and policy tailwinds has you rethinking healthcare exposure, this may be an appropriate time to scan other opportunities among healthcare stocks.

With Amgen trading near consensus targets yet screening as materially undervalued on intrinsic metrics, investors face a key question: is this momentum move already fully priced in, or does UPLIZNA driven growth leave room to buy?

Most Popular Narrative: 1% Overvalued

Against Amgen's last close of $327.38, the most followed narrative pegs fair value slightly lower, implying a modest premium baked into the current price.

Analysts expect earnings to reach $8.2 billion (and earnings per share of $15.5) by about September 2028, up from $6.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $12.5 billion in earnings, and the most bearish expecting $4.9 billion.

Curious how relatively modest revenue growth, higher profit margins, and a richer future earnings multiple can still justify this price? See the full narrative assumptions behind that call.

Result: Fair Value of $322.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, mounting drug pricing pressure and intensifying biosimilar competition could quickly erode margins and stall the upbeat earnings trajectory embedded in current expectations.

Find out about the key risks to this Amgen narrative.

Another Lens on Value

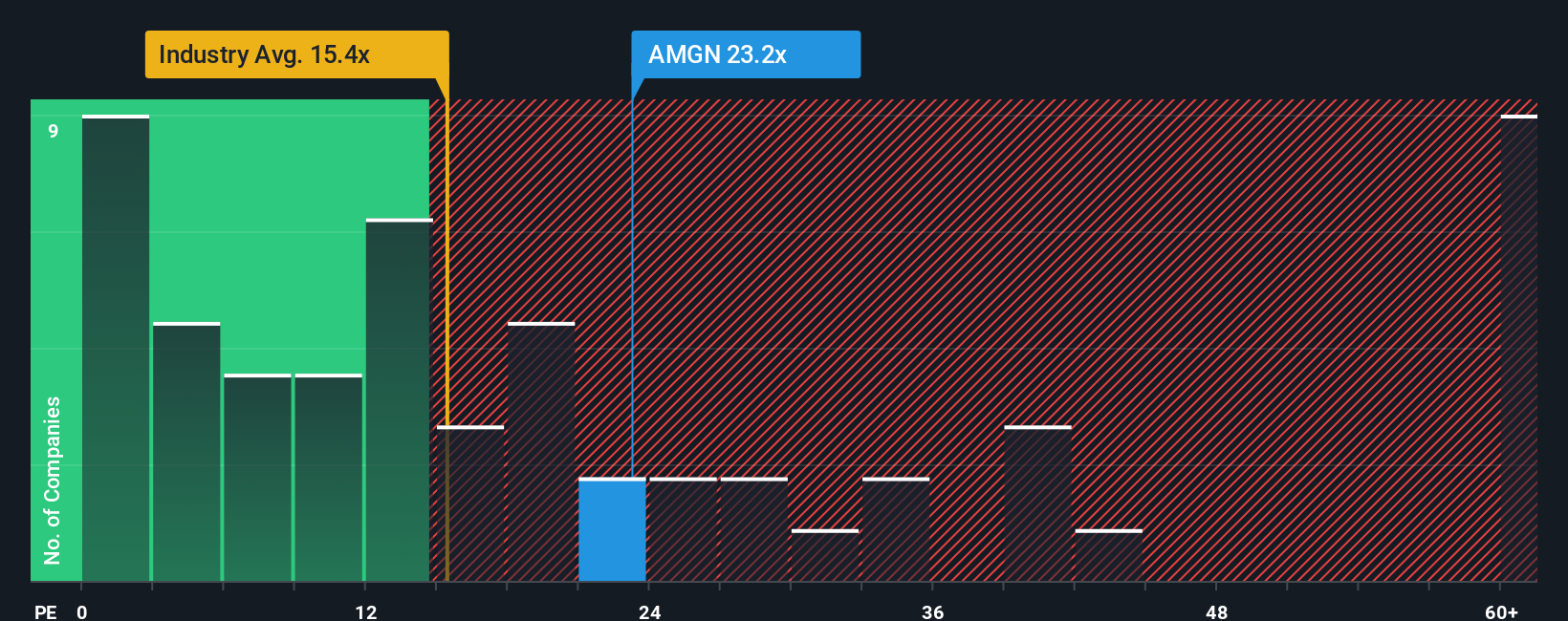

While the consensus narrative sees Amgen as slightly overvalued on future earnings assumptions, today’s price to earnings of 25.2 times sits below a fair ratio of 29.4 times and well under peer levels near 59.6 times, suggesting the market may be underpricing upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amgen Narrative

If you are not convinced by this framing or would rather dive into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single stock. Turn this momentum into a more diversified portfolio by acting now on fresh, data driven ideas from our screeners.

- Capture potential mispriced opportunities early by running these 913 undervalued stocks based on cash flows, which is backed by cash flows rather than hype.

- Position yourself ahead of the next productivity wave by screening cutting edge innovators with these 24 AI penny stocks before they become crowded trades.

- Seek more stable income streams by targeting companies in these 12 dividend stocks with yields > 3% that already reward shareholders with stronger yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报