A Look at Phillips Edison (PECO) Valuation After the Springs Plaza Joint Venture Acquisition

The latest joint venture acquisition of the 195,000 square foot Springs Plaza center in Bonita Springs puts Phillips Edison (PECO) back in focus and highlights how it is leaning into high growth, necessity retail markets.

See our latest analysis for Phillips Edison.

That Springs Plaza deal slots neatly into a year where momentum has been steady rather than spectacular, with a modest positive multi month share price return and a solid three year total shareholder return of 25 percent suggesting longer term confidence is intact.

If this kind of steady, income oriented growth story appeals, it might be worth seeing how other real estate focused names compare or whether something different in fast growing stocks with high insider ownership better matches your return expectations.

With shares still trading at a discount to analyst targets and a longer term track record of income growth, the key question now is whether PECO remains undervalued or if the market is already pricing in future expansion.

Most Popular Narrative: 8% Undervalued

With the most followed narrative placing fair value modestly above the recent 36.05 close, the gap rests on a specific long term growth logic.

Active portfolio recycling and disciplined acquisitions of high-growth, grocery-anchored properties, often below replacement cost and at 6%+ cap rates with 9%+ target IRRs, enhance asset quality and earnings potential. At the same time, cash acquisitions and low leverage (5.4x EBITDAre, 5.7 years weighted avg. maturity, 95% fixed-rate debt) allow for opportunistic external growth without the need for dilutive equity issuance, supporting long-term FFO/EPS expansion.

Want to see the math behind this confidence, from revenue and margin expansion to a future earnings multiple usually reserved for faster growth stories? Dig into the full narrative to uncover the assumptions driving that valuation gap.

Result: Fair Value of $39.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained e commerce pressure or a shock to key grocery anchors could undermine occupancy, rent growth, and the upbeat long term earnings narrative.

Find out about the key risks to this Phillips Edison narrative.

Another View: Multiples Paint a Richer Picture

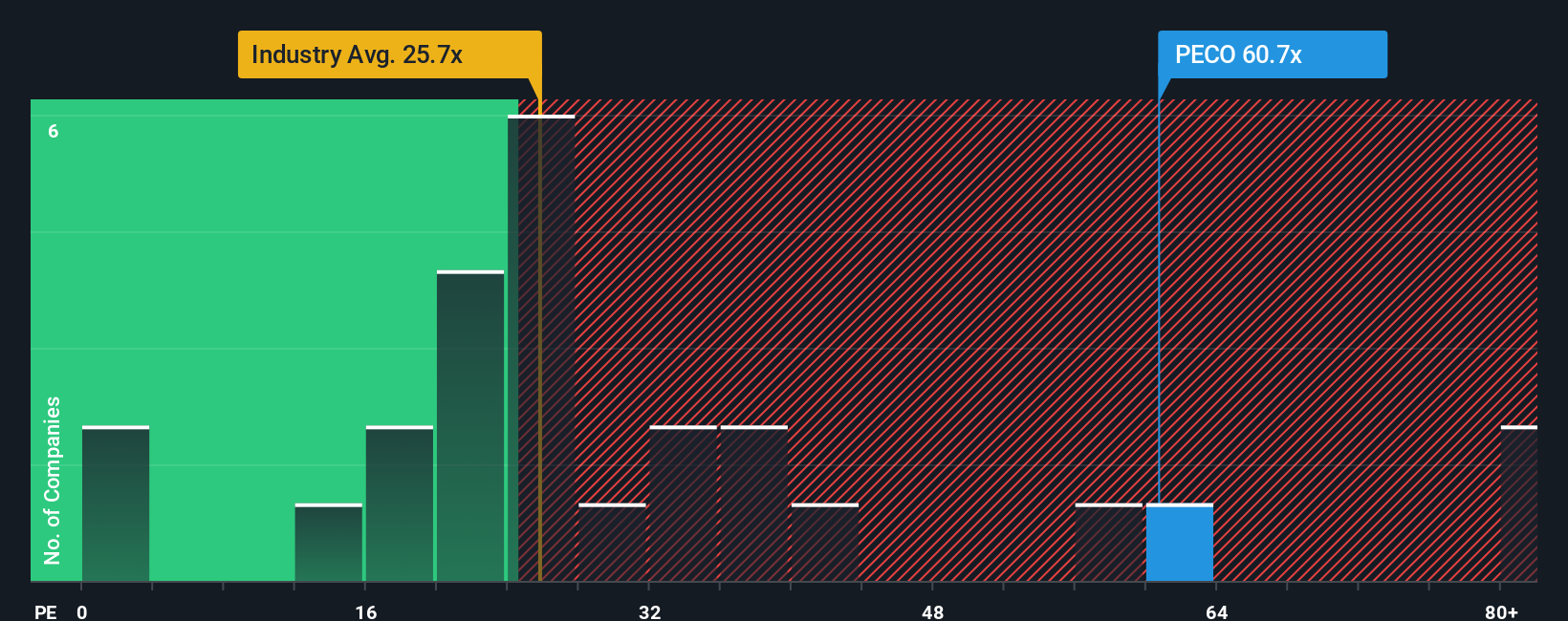

Step away from narrative fair value and PECO looks much less forgiving. Its current P/E of 55.3 times is far higher than both the US Retail REITs average of 27.2 times and a fair ratio of 33.2 times, pointing to real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips Edison Narrative

If this perspective does not quite fit your view, or you would rather dig into the numbers yourself, you can build a custom, data driven take in just a few minutes, Do it your way.

A great starting point for your Phillips Edison research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next opportunity runs away from you, put Simply Wall Street’s Screener to work and line up fresh, data backed candidates that fit your strategy.

- Capture potential value and future upside by screening for these 913 undervalued stocks based on cash flows that the market may be overlooking today.

- Tap into powerful innovation trends with these 24 AI penny stocks positioned at the forefront of artificial intelligence and automation.

- Lock in steadier cash returns by focusing on these 12 dividend stocks with yields > 3% that can support a growing income stream over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报