Bitdeer (BTDR): Reassessing Valuation After Q3 2025 Miss, SEAL04 Delays and New Class Action Lawsuits

Bitdeer Technologies Group (BTDR) is back in the spotlight after disappointing third quarter 2025 results and delays in its SEAL04 ASIC chip sparked multiple securities class action lawsuits and fresh questions about the miner's growth story.

See our latest analysis for Bitdeer Technologies Group.

The recent wave of lawsuits and SEAL04 delays comes after a sharp reset in sentiment, with the 90 day share price return sitting at around negative 38 percent and the one year total shareholder return also firmly negative. This is despite a modest bounce to an $11.01 share price and a positive one month share price return, which suggests only tentative rebuilding of momentum.

If this kind of volatility has you looking beyond a single miner, it could be worth scanning high growth tech and AI stocks for other high growth computing and infrastructure plays that match your risk appetite.

Yet with revenue still growing quickly, a share price far below consensus targets, and lawsuits clouding visibility, is Bitdeer now an unloved growth asset trading at a steep discount, or is the market correctly pricing in execution risk?

Most Popular Narrative: 67.8% Undervalued

With Bitdeer Technologies Group last closing at $11.01 against a narrative fair value near $34.15, the story hinges on aggressive growth translating into lasting profitability.

The planned ramp up to 40 exahash in self mining capacity by Q4 2025, leveraging newly developed ASICs and expanded power capacity, is expected to significantly increase Bitcoin production, thereby driving revenue and potentially improving margins due to economies of scale.

Curious how this big capacity bet turns into that high valuation? The narrative focuses on rapid revenue expansion, margin uplift, and a future earnings multiple that echoes mature software leaders. Want to see exactly which projections have to come true for that upside to hold?

Result: Fair Value of $34.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent hosting revenue declines and heavy capex for new power projects could strain cash flows and derail the aggressive growth narrative.

Find out about the key risks to this Bitdeer Technologies Group narrative.

Another Lens on Value

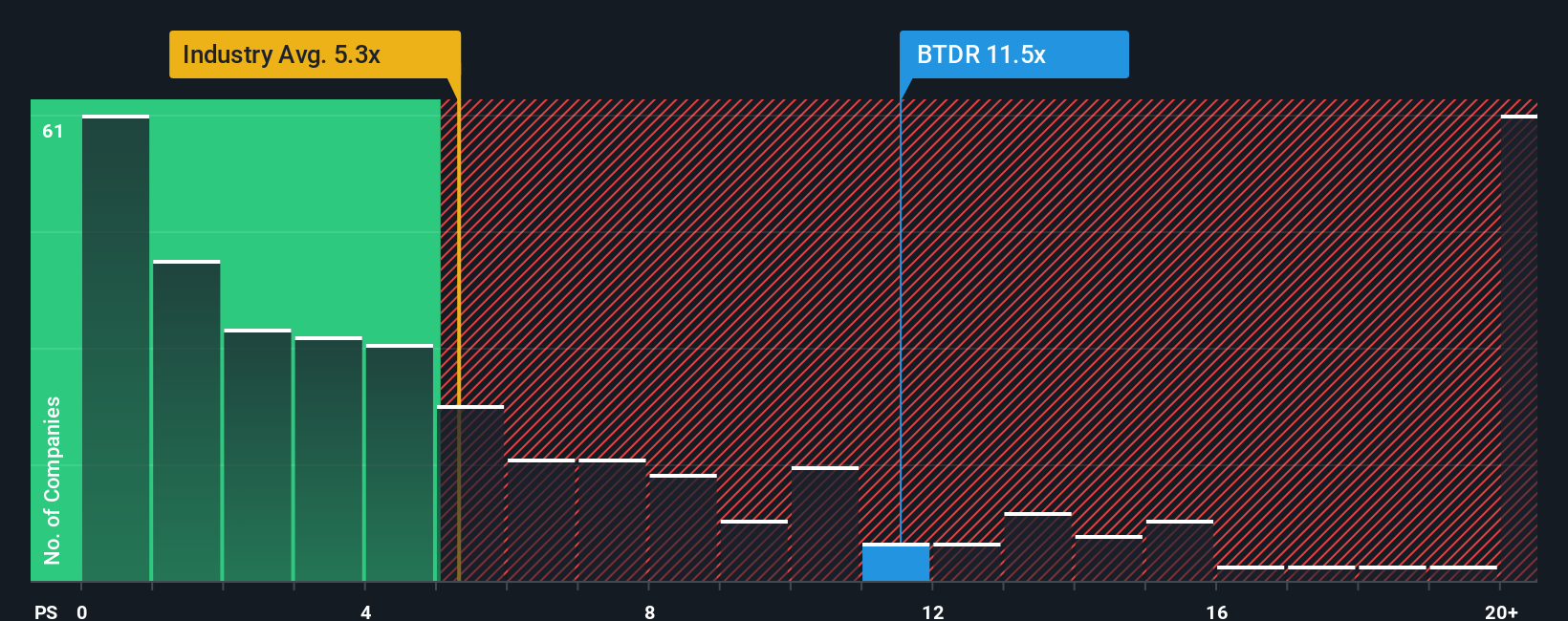

On a simple sales based view, Bitdeer looks punchy, trading at about 5.6 times revenue compared with 4.9 times for the US software sector and 3.3 times for peers. Yet our fair ratio suggests the market could drift toward roughly 9 times. Is today’s premium a warning sign or an early rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bitdeer Technologies Group Narrative

If this perspective does not fully resonate with you, or you prefer to dig into the numbers yourself, you can craft a personalized view in minutes: Do it your way.

A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning hand picked stock ideas in minutes so you never miss the next standout opportunity again.

- Capitalize on high potential under the radar companies by reviewing these 3633 penny stocks with strong financials that pair tiny market caps with surprisingly solid fundamentals.

- Harness structural growth in automation and data by checking out these 24 AI penny stocks focused on real revenue traction in artificial intelligence.

- Lock in potential mispricings by weighing these 913 undervalued stocks based on cash flows that trade well below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报