TransDigm Group (TDG): Assessing Valuation After Recent Share Price Pullback

Recent performance and what is driving interest

TransDigm Group (TDG) has been quietly recalibrating after a strong multi year run, with the stock slipping about 5% over the past month even as fundamentals continue to trend higher.

See our latest analysis for TransDigm Group.

That recent pullback sits against a much stronger backdrop, with the latest share price at $1,276.83 and multi year total shareholder returns still comfortably in triple digit territory. This suggests that momentum is easing, but the long term story remains intact.

Given TransDigm’s aerospace footprint, it could also be worth scanning other aerospace and defense stocks to see which names show similar resilience and long runway potential.

With earnings still climbing, a premium valuation, and a share price sitting below consensus targets, the key question now is whether TransDigm is trading at a rare discount or if markets are already pricing in years of growth ahead.

Most Popular Narrative: 19.3% Undervalued

With TransDigm’s fair value estimate at $1,581 versus the last close of $1,276.83, the most followed narrative sees meaningful upside grounded in earnings power.

TransDigm's strategic focus on acquiring niche, proprietary aerospace suppliers, as evidenced by recent deals like Servotronics and Simmonds, expands its high aftermarket content portfolio, driving inorganic revenue growth and enhancing EBITDA margins through operational synergies.

Curious how steady mid cycle growth, rising margins, and a richer future earnings multiple all combine to justify that higher value? The full narrative connects the dots.

Result: Fair Value of $1581 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story is not risk free. Slower aftermarket growth and TransDigm’s elevated leverage are both potential pressure points for this bullish case.

Find out about the key risks to this TransDigm Group narrative.

Another Angle on Valuation

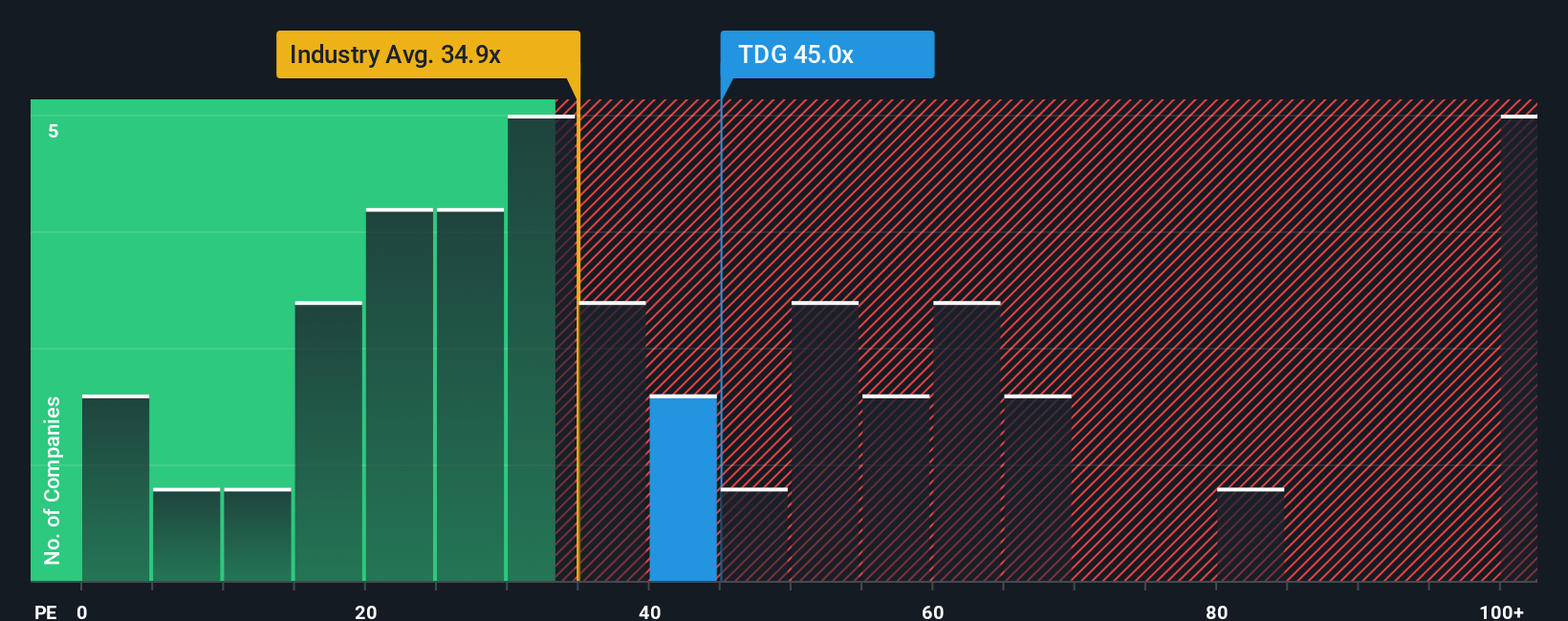

Looked at through earnings multiples, TransDigm looks far less cheap. Its price to earnings ratio sits around 38.5 times, higher than the US Aerospace and Defense average of 37.3 times, the peer average of 32.2 times, and even our fair ratio of 32.9 times. That gap hints at valuation risk rather than a clear bargain. The question for investors is which story seems more compelling: the upside narrative or the relatively rich multiple?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransDigm Group Narrative

If you see the numbers differently, or simply prefer to dig into the details yourself, you can craft a custom view in minutes, Do it your way.

A great starting point for your TransDigm Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning a few focused shortlists on Simply Wall Street that many investors overlook until it is too late.

- Target reliable passive income by reviewing these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s cash flow.

- Tap into structural growth trends with these 24 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence.

- Explore potential mispricing by checking these 914 undervalued stocks based on cash flows that our models flag as trading below their estimated fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报