A Look at Yum! Brands (YUM) Valuation Following Its New Food Safety Alliance Commitment

Yum! Brands (YUM) is drawing fresh investor attention after joining the Alliance to Stop Foodborne Illness, a cross industry group focused on stronger food safety culture and tools that directly tie into brand trust.

See our latest analysis for Yum! Brands.

The move comes as Yum! Brands' share price has climbed to around $153.75, with a solid year to date share price return and healthy multi year total shareholder returns suggesting steady, not frantic, momentum as investors reward its growth and brand resilience.

If Yum!'s story around brand trust and scale appeals to you, this could be a good moment to scout other consumer names via fast growing stocks with high insider ownership.

With the shares up strongly over the past year and trading only modestly below analyst targets, the key question now is whether Yum is quietly undervalued or whether the market is already baking in its next leg of growth.

Most Popular Narrative: 7.1% Undervalued

With Yum! Brands trading around $153.75 against a narrative fair value of $165.56, the prevailing view points to a modest valuation gap driven by long term earnings power.

The asset light, heavily franchised operating model minimizes capital intensity and allows for recurring, predictable cash flows while enabling rapid global expansion with improved franchisee economics via proprietary tech (Byte). This further supports long term operating profit and EPS growth. The increasing digital mix (now at 57%, with significant year over year gains) and expansion of direct to consumer channels are expected to support greater efficiency, improved order accuracy, and higher margin sales, ultimately benefiting net margin and free cash flow over time as digital penetration continues to rise.

Want to see the math behind that optimism? The growth engine is a blend of rising sales, fatter margins, and a future earnings multiple that might surprise you. Curious which assumptions really move the fair value dial? Dive in to see how those forecasts stack up over time.

Result: Fair Value of $165.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft consumer demand in key regions and uncertain returns on heavy digital investments could easily derail those upbeat long term assumptions.

Find out about the key risks to this Yum! Brands narrative.

Another Way to Look at Value

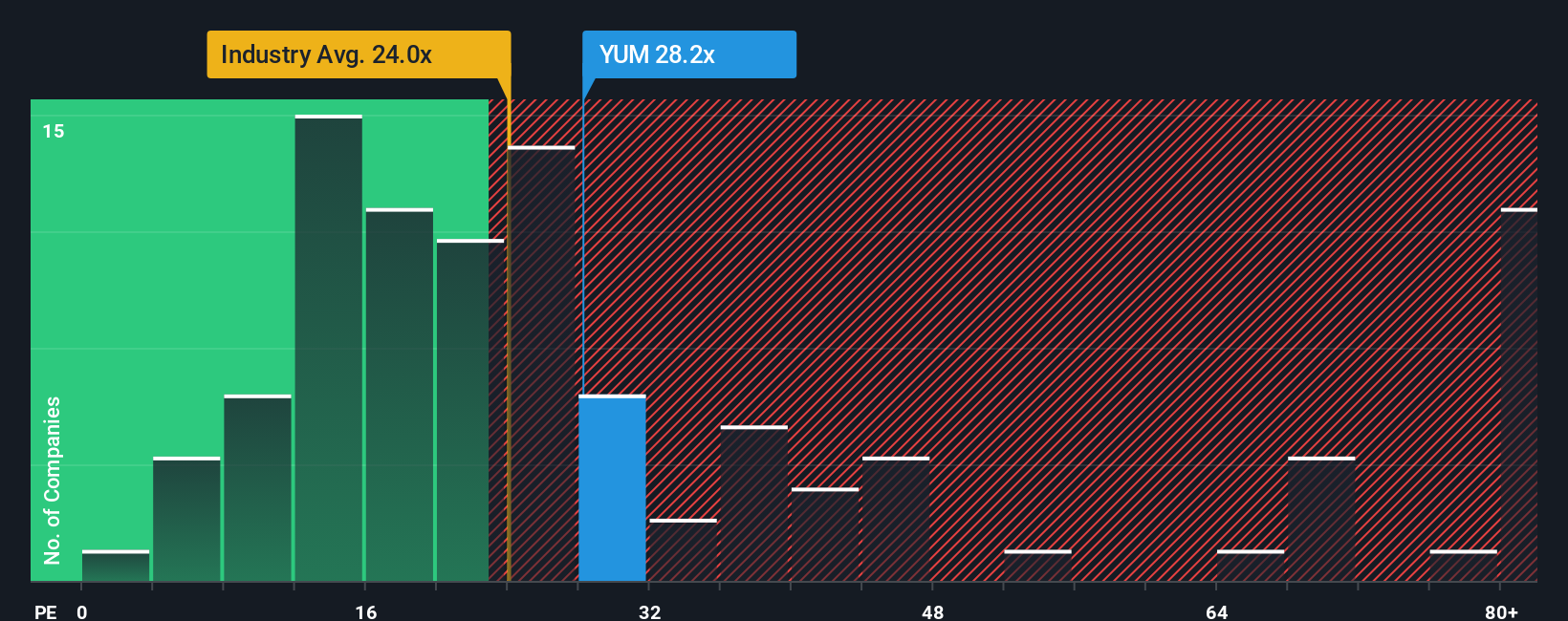

On earnings, the picture flips. Yum trades at 29.5 times profit, richer than the US Hospitality average of 22 times and above a fair ratio of 26.6 times suggested by regression, even if still cheaper than peers at 32.7 times. Is the market overpaying for safety and brands?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Yum! Brands Narrative

If you are not fully aligned with this view or want to dig into the numbers yourself, you can quickly craft a personalized story in under three minutes: Do it your way.

A great starting point for your Yum! Brands research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next opportunity?

Before you move on, lock in your advantage by scanning fresh ideas on Simply Wall St’s Screener, where focused themes can sharpen your next move.

- Target reliable income streams by zeroing in on these 12 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow.

- Ride structural growth by backing companies at the forefront of these 24 AI penny stocks and long term innovation.

- Position yourself ahead of market reratings with these 914 undervalued stocks based on cash flows that may still trade below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报