CareDx (CDNA): Reassessing Valuation After Governance Reform Settlement and Legal Resolution Proposal

CareDx (CDNA) just moved to settle long running shareholder derivative lawsuits, tying the legal truce to a package of governance reforms that tighten oversight, disclosure practices, and compliance monitoring across the company.

See our latest analysis for CareDx.

The legal settlement and recent bylaw changes come as CareDx’s share price has climbed to about $19.45, with a 30 day share price return of 13.21% and a three year total shareholder return of 72.74%. This suggests improving sentiment after a difficult five year stretch.

If you are rethinking your exposure to healthcare diagnostics after CareDx’s governance reset, this could be a good moment to explore similar opportunities across healthcare stocks.

With lawsuits winding down, governance tightening, and shares still trading below analyst targets, is the recent rebound just a relief rally or the start of a mispriced recovery that leaves room for further upside?

Most Popular Narrative: 15.4% Undervalued

With CareDx last closing at 19.45 dollars against a narrative fair value of 23 dollars, the story leans toward a discounted recovery built on growth and richer future multiples.

The launch of AI-driven diagnostics like AlloSure Plus and integration into electronic health record systems (e.g., EPIC), positions CareDx to benefit from the broader adoption of precision medicine and personalized diagnostics, likely boosting adoption rates, aiding reimbursement, and ultimately supporting net margin improvements.

Want to see what powers that higher valuation? This narrative focuses on accelerating top line growth, tighter margins, and a future earnings multiple usually reserved for sector leaders. Curious which precise assumptions place fair value above today’s price? Explore the full earnings and revenue roadmap behind that 23 dollar target.

Result: Fair Value of $23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting Medicare reimbursement policies and bundled payment proposals could quickly undercut AlloSure volumes, pressuring margins and challenging the bullish recovery case.

Find out about the key risks to this CareDx narrative.

Another Lens on Valuation

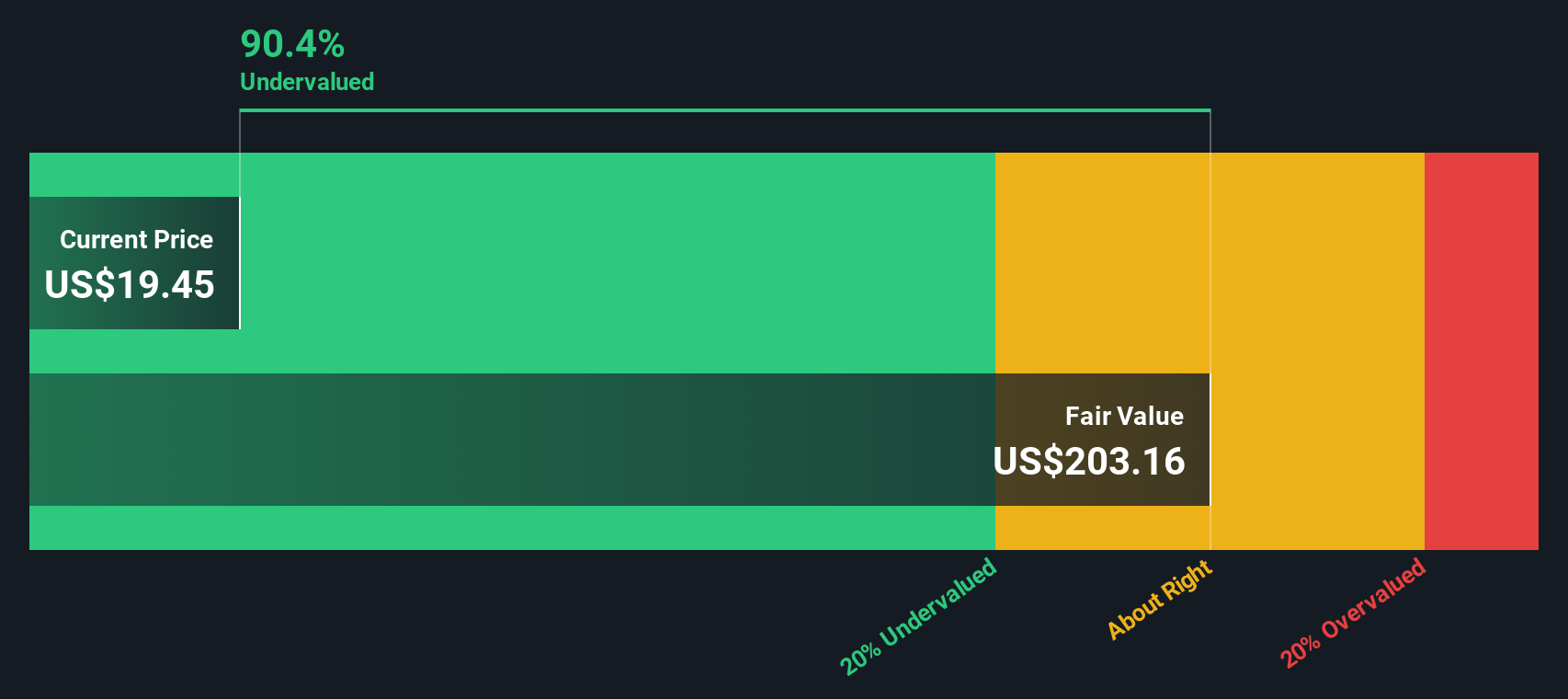

Step away from narratives and the SWS DCF model paints an even starker picture, implying fair value near 203.16 dollars, around 10 times the current price. If that cash flow path is even partly right, is the market missing a structural growth story or overestimating risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CareDx Narrative

If you would rather challenge these assumptions and rely on your own research, you can quickly build a tailored view in under three minutes: Do it your way.

A great starting point for your CareDx research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider a few fresh opportunities by scanning hand picked stock ideas on Simply Wall St that could help reshape your portfolio’s next stage of development.

- Target income potential by reviewing these 12 dividend stocks with yields > 3% that focus on a balance of reliable payouts and solid underlying businesses.

- Explore innovation at the edge of computing through these 28 quantum computing stocks focused on emerging hardware and software platforms.

- Review these 914 undervalued stocks based on cash flows identified as trading below their estimated cash flow potential to evaluate possible long term value opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报