How China’s New Oversight of Overseas Port Sales Will Impact CK Hutchison Holdings (SEHK:1) Investors

- Earlier this week, China’s Ministry of Commerce announced it would review and supervise CK Hutchison Holdings’ overseas port asset sales to ensure fair competition and protect national sovereignty, security, and development interests.

- This added layer of Chinese regulatory oversight introduces fresh uncertainty around the timing and structure of CK Hutchison’s port divestments, potentially affecting how investors assess its portfolio reshaping efforts.

- Next, we’ll examine how this new Chinese regulatory supervision of overseas port sales could reshape CK Hutchison’s previously outlined investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

CK Hutchison Holdings Investment Narrative Recap

To own CK Hutchison, you need to believe that a diversified, infrastructure heavy conglomerate can steadily convert complex assets into cash and maintain resilient cash flows, despite thinner margins and volatile earnings. The new Chinese review of overseas port sales adds uncertainty to the timing of a key portfolio reshaping catalyst, but it does not yet change the core near term swing factors, which still centre on earnings quality and pressure in Chinese Health & Beauty retail.

The most relevant recent development here is CK Hutchison’s ongoing effort to sell stakes in its global ports portfolio, including talks with infrastructure investors over multi billion US dollar transactions. With first half 2025 earnings sharply lower and margins compressed, the market has been watching these potential disposals as a way to recycle capital and simplify the business, so any delay or reshaping from added Chinese oversight feeds directly into how investors think about...

Read the full narrative on CK Hutchison Holdings (it's free!)

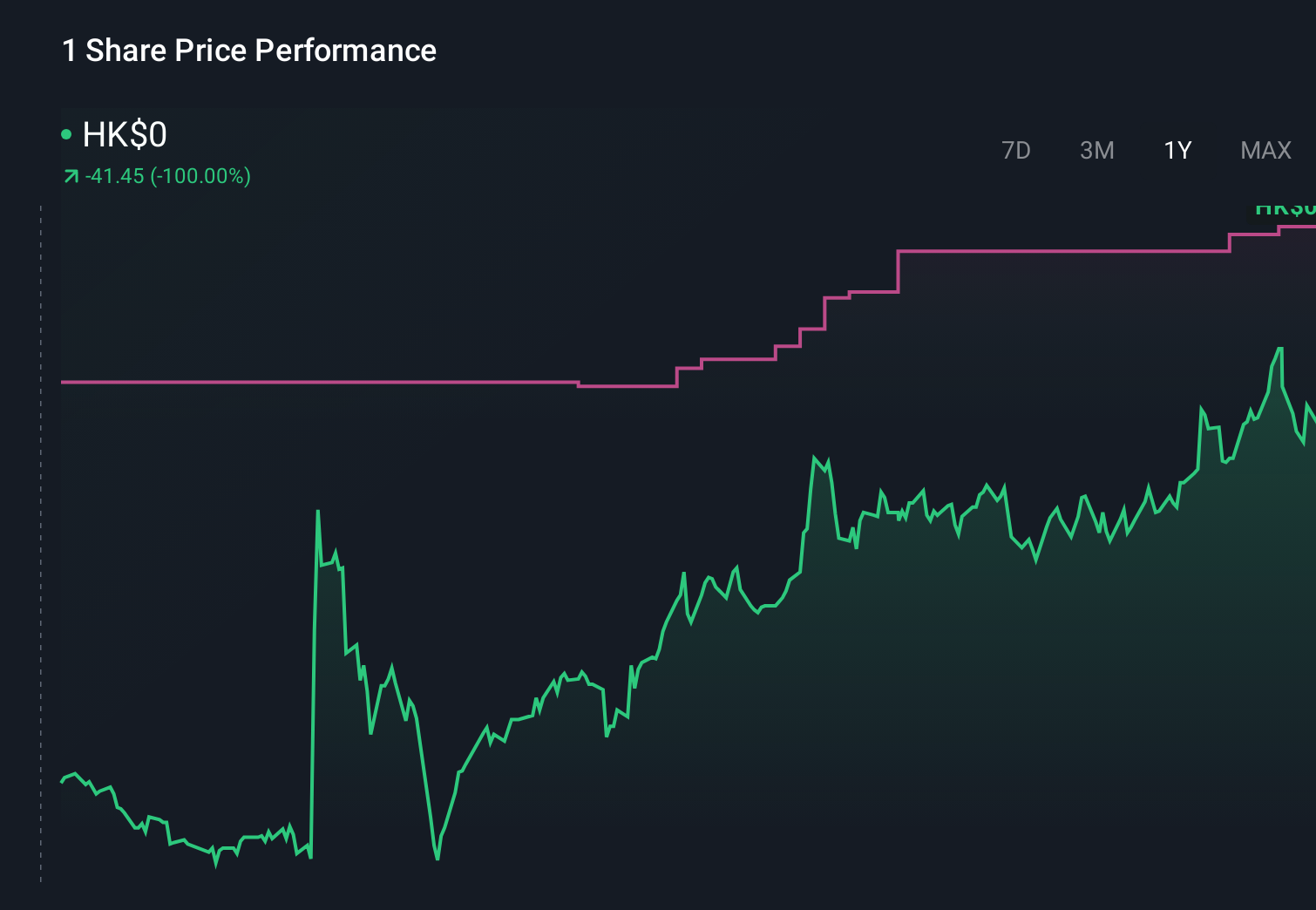

CK Hutchison Holdings' narrative projects HK$385.4 billion revenue and HK$35.2 billion earnings by 2028. This requires 10.7% yearly revenue growth and about HK$27.5 billion earnings increase from HK$7.7 billion today.

Uncover how CK Hutchison Holdings' forecasts yield a HK$62.01 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for CK Hutchison span about HK$38.75 to roughly HK$132.44, showing how far apart individual views can be. As you weigh those perspectives, remember that tighter regulatory scrutiny across CK Hutchison’s ports and other regulated assets could influence execution risk and timing for any future portfolio moves and, in turn, the company’s overall performance.

Explore 5 other fair value estimates on CK Hutchison Holdings - why the stock might be worth 29% less than the current price!

Build Your Own CK Hutchison Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CK Hutchison Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CK Hutchison Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CK Hutchison Holdings' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报