How Analyst Downgrades At Moelis (MC) Have Changed Its Investment Story

- Recently, Keefe, Bruyette & Woods downgraded Moelis & Company from an “Outperform” to a “Market Perform” rating, while other firms also revisited their views on the investment bank.

- This cluster of analyst opinion changes highlights a reassessment of Moelis’ prospects and risk profile, even as its advisory-focused model remains intact.

- Next, we’ll examine how this downgrade, amid broader analyst recalibration, affects Moelis’ existing investment narrative around growth and margins.

Find companies with promising cash flow potential yet trading below their fair value.

Moelis Investment Narrative Recap

To own Moelis, you need to believe its advisory centric, capital light model can convert improving deal activity into durable earnings, despite a historically cyclical fee pool and elevated hiring costs. The Keefe, Bruyette & Woods downgrade, even with a modestly higher price target, does not materially change the near term catalyst of earnings momentum or the key risk that compensation and expansion expenses could compress margins if deal flow softens.

The most relevant recent development here is Moelis’ run of stronger results, with net income rising to US$145.17 million for the first nine months of 2025 from US$46.62 million a year earlier. That profitability rebound supports the near term narrative of margin recovery, but it also raises the stakes around maintaining revenue growth fast enough to absorb higher compensation and expansion costs if capital markets activity slows again.

Yet behind the earnings rebound, investors should be aware of how Moelis’ aggressive hiring and expansion could pressure margins if...

Read the full narrative on Moelis (it's free!)

Moelis' narrative projects $2.1 billion revenue and $381.7 million earnings by 2028. This requires 15.3% yearly revenue growth and about a $183.6 million earnings increase from $198.1 million today.

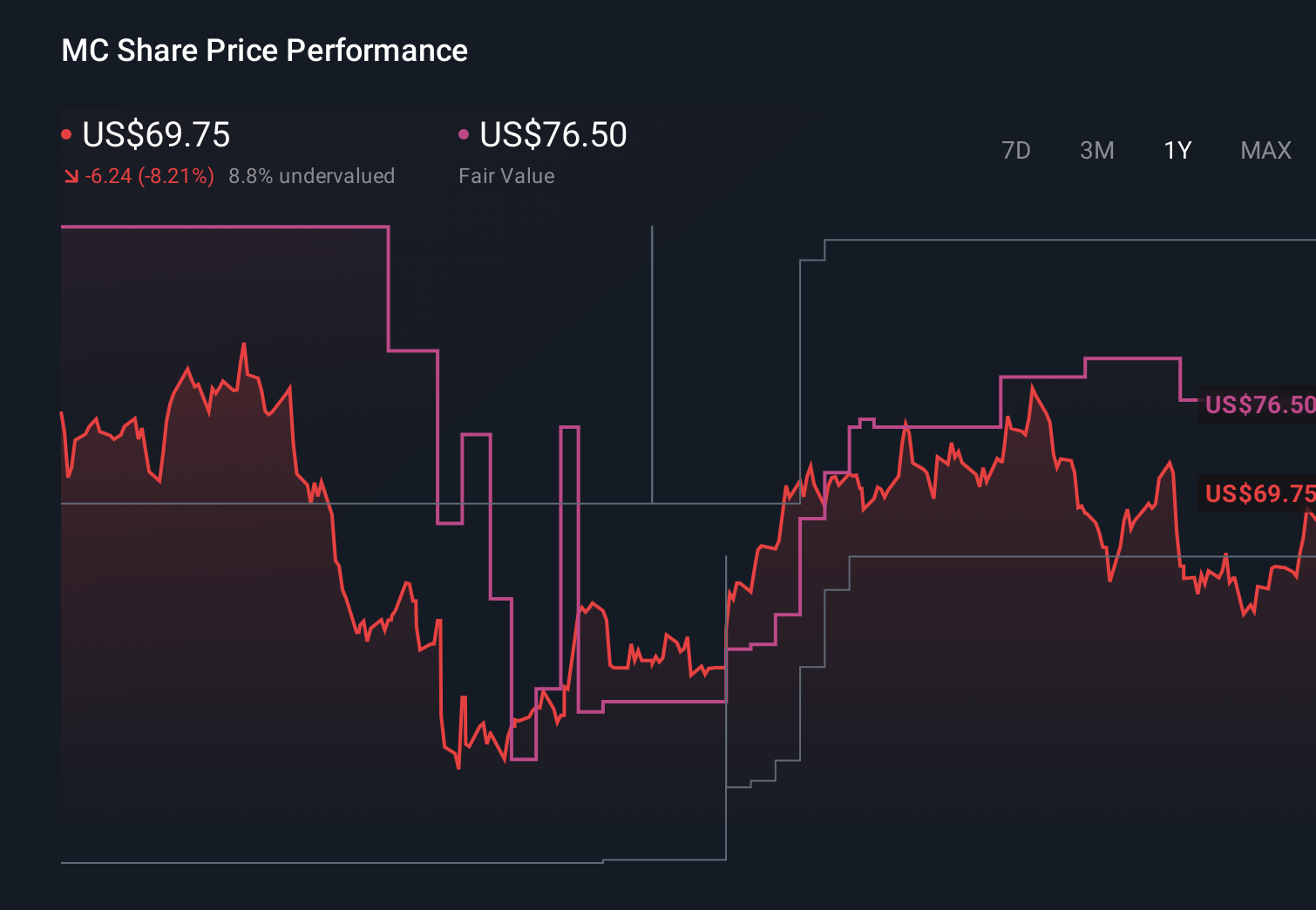

Uncover how Moelis' forecasts yield a $76.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members see Moelis’ fair value between about US$57 and US$77 across 2 independent views, underscoring how far opinions can spread. Set this against Moelis’ improving earnings but still margin sensitive, transaction driven model, and you can see why it pays to examine several perspectives before forming your own view.

Explore 2 other fair value estimates on Moelis - why the stock might be worth as much as 9% more than the current price!

Build Your Own Moelis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Moelis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Moelis' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报