Armstrong World Industries (AWI) Valuation After $910.6 Million Credit Refi and Growth Push

Armstrong World Industries (AWI) just refreshed its balance sheet in a meaningful way, locking in $910.6 million of new credit capacity that runs to 2030. This gives the ceiling specialist more room to fund growth and buybacks.

See our latest analysis for Armstrong World Industries.

Investors seem to like that Armstrong World is arming itself for more growth, with the latest refinancing arriving after a strong year to date, including a 32.88 percent year to date share price return and a powerful 3 year total shareholder return of 176.91 percent. This suggests momentum is still broadly intact even after some recent consolidation around the current 186.21 dollar share price.

If this kind of balance sheet flex has you thinking about what else could surprise to the upside, now is a good time to explore fast growing stocks with high insider ownership.

But with the shares already up strongly and trading about 14 percent below analyst targets, is Armstrong World still being underestimated by the market, or are investors simply paying up for years of future growth today?

Most Popular Narrative: 11.8% Undervalued

With Armstrong World Industries closing at 186.21 dollars versus a narrative fair value near 211 dollars, expectations for steady, compounding growth are already reflected in the price.

Analysts expect earnings to reach 389.4 million dollars (and earnings per share of 9.53 dollars) by about September 2028, up from 296.0 million dollars today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.2x on those 2028 earnings, down from 28.4x today.

Curious what justifies paying a premium multiple for a ceiling specialist, even after a huge run up? The narrative leans on disciplined revenue growth, rising margins, and a future earnings profile that starts to resemble quality compounders rather than cyclical builders. Want to see which specific long term assumptions make that valuation tick?

Result: Fair Value of $211.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged commercial construction softness and slower than expected adoption of new solutions could quickly challenge these upbeat growth and margin assumptions.

Find out about the key risks to this Armstrong World Industries narrative.

Another Angle on Valuation

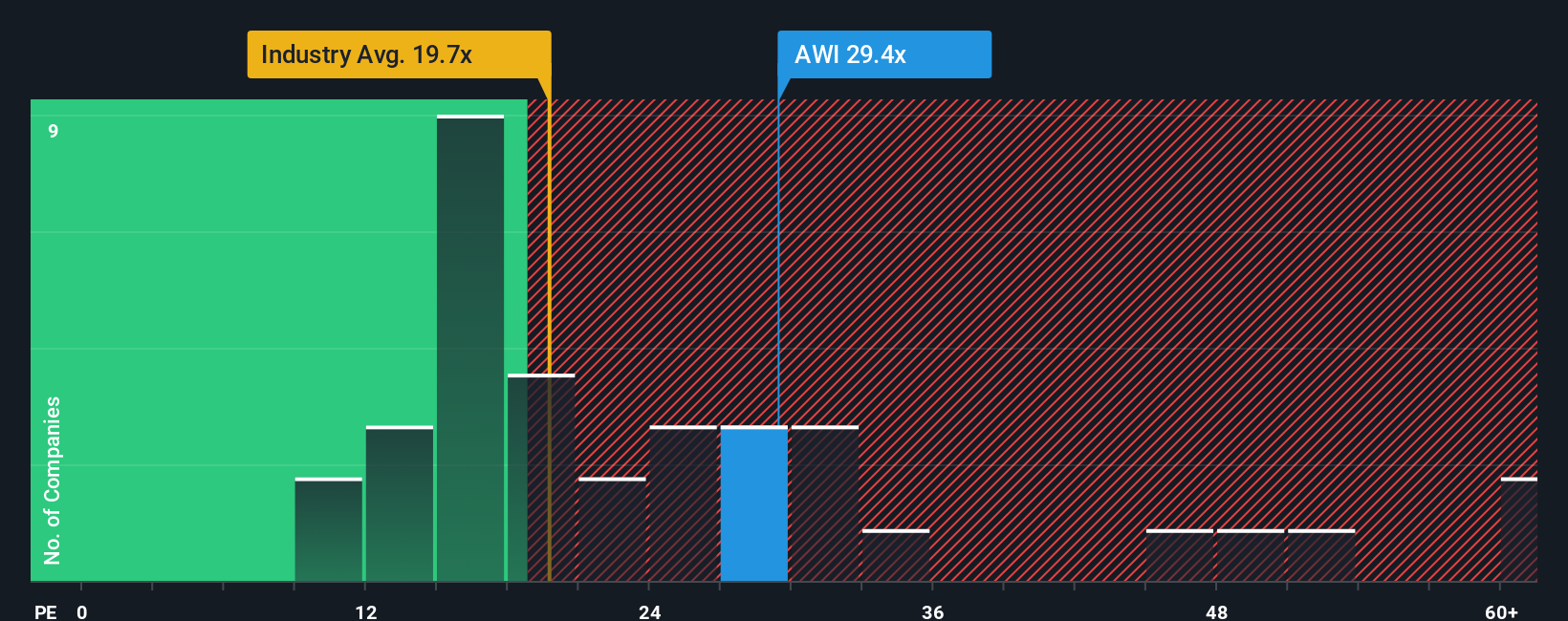

On earnings based ratios, Armstrong World looks far less forgiving. The stock trades on a price to earnings of about 26.3x versus a fair ratio of 22.1x, well above the US Building industry at 19.3x, yet cheaper than peer averages near 30x. That mix of premium and relative value raises a simple question: is this a quality premium worth paying, or a margin for error that has already disappeared?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Armstrong World Industries Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Armstrong World Industries.

Looking for more investment ideas?

Armstrong World might look compelling, but do not stop here. The next big winner could be waiting in another corner of the market.

- Capture potential mispricings by scanning these 914 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully recognized yet.

- Ride structural growth trends by targeting these 29 healthcare AI stocks transforming patient outcomes with scalable, data driven innovation.

- Position yourself for volatility and upside by tracking these 79 cryptocurrency and blockchain stocks aligned with blockchain adoption and real world utility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报