Taking Stock of Glacier Bancorp (GBCI) After Piper Sandler’s Overweight Upgrade and Margin Expansion Outlook

Piper Sandler recently raised its rating on Glacier Bancorp (GBCI) to overweight, citing expectations for improving margins through 2027, solid earnings momentum, and a valuation that still appears attractive relative to its long-term track record.

See our latest analysis for Glacier Bancorp.

The upgrade lands after a solid near term run, with a 1 month share price return of just over 8 percent helping claw back some of this year’s weakness. However, the year to date share price return and 1 year total shareholder return are still slightly negative, suggesting early momentum is starting to rebuild rather than fully turn the trend.

If this kind of rerating story appeals, it is also worth seeing which banks and financials are showing steady earnings power and insider confidence by exploring fast growing stocks with high insider ownership.

With earnings accelerating and the share price still lagging its upgraded target, is Glacier Bancorp quietly offering value, or are investors already paying up for years of margin expansion and deal driven growth ahead?

Most Popular Narrative Narrative: 14.4% Undervalued

Glacier Bancorp last closed at 45.63 dollars, while the most followed narrative pegs fair value near 53.33 dollars, framing a meaningful upside gap investors are trying to explain.

The continued migration and population growth in Glacier Bancorp's core markets of the Mountain West and Pacific Northwest are driving robust loan and deposit growth, positioning the bank for sustainable revenue and earnings expansion as these regions urbanize and develop.

Curious how rapid regional growth, rising margins, and a richer future earnings multiple all converge into that valuation gap? Want to see the exact blueprint driving this fair value call and the profit trajectory it assumes?

Result: Fair Value of $53.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising noninterest expenses and heavier exposure to commercial real estate could pressure margins and asset quality, challenging the long term earnings and valuation narrative.

Find out about the key risks to this Glacier Bancorp narrative.

Another Way to Look at Value

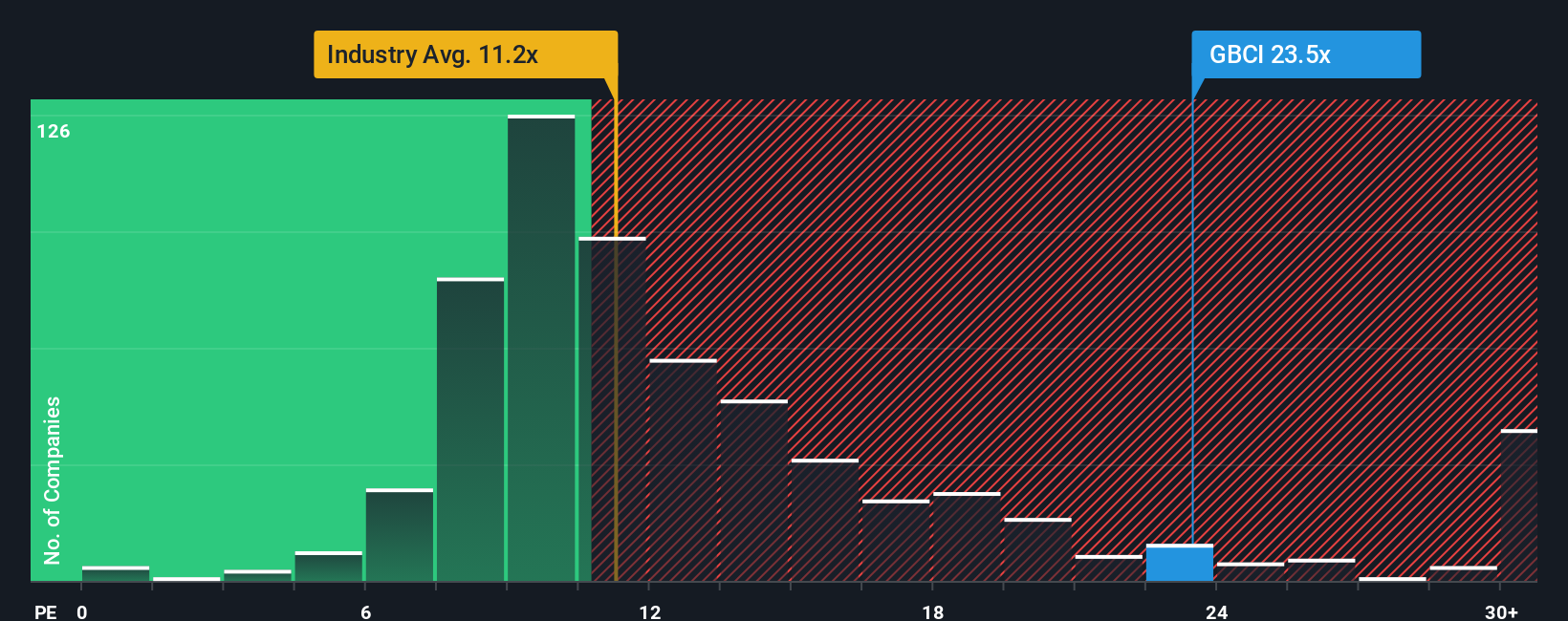

On earnings, Glacier Bancorp looks stretched, trading at about 25 times profits versus roughly 11.9 times for the wider US banks industry and a fair ratio of 19.2 times. That premium can quickly unwind if growth or margins disappoint. Is the upside really worth the valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Glacier Bancorp Narrative

If you see the story differently or want to stress test these assumptions with your own data driven view, you can build a personal narrative in just minutes: Do it your way.

A great starting point for your Glacier Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Glacier Bancorp when you can systematically uncover fresh opportunities on Simply Wall Street, where targeted screeners help you move faster and with more conviction.

- Capture high potential growth by using these 24 AI penny stocks to pinpoint companies turning artificial intelligence into real competitive advantages and expanding revenue streams.

- Lock in potential income streams with these 12 dividend stocks with yields > 3%, focusing on businesses offering yields above 3 percent backed by sustainable cash flows.

- Position yourself ahead of the crowd through these 79 cryptocurrency and blockchain stocks, where you can track listed plays on digital assets, blockchain infrastructure, and next generation payment networks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报