Reassessing Church & Dwight (CHD): Has the Recent Slide Opened a Better Valuation Entry Point?

Church & Dwight (CHD) has quietly slipped about 18% this year, even as its earnings and revenue keep inching higher. That disconnect is what has value focused investors taking a closer look right now.

See our latest analysis for Church & Dwight.

The recent slide has come despite steady mid single digit revenue and high single digit net income growth, suggesting investors are reassessing how much they are willing to pay for this defensive staples name rather than reacting to any sharp fundamental shock. Putting it in context, the stock has posted an 18.1% year to date share price decline and a 12 month total shareholder return of minus 18.8%, yet longer term holders still see a positive 3 year total shareholder return of 7.4%. This points to fading near term momentum but a still respectable multi year compounding story.

If Church & Dwight’s pullback has you rethinking where to find steady growers, it could be a good moment to explore healthcare stocks for other resilient, essentials based businesses.

With earnings still growing and the share price sliding, has Church & Dwight quietly reset to an attractive entry point? Or is today’s valuation already baking in most of the household products group’s future growth?

Most Popular Narrative Narrative: 13% Undervalued

With Church & Dwight last closing at $85.08 against a narrative fair value near $97, the story hinges on earnings power holding up in a tougher backdrop.

The analysts have a consensus price target of $100.053 for Church & Dwight based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $73.0.

Want to see what kind of revenue engine and margin lift would justify that spread of targets? The narrative leans on surprisingly ambitious profitability and valuation assumptions. Curious which numbers do the heavy lifting?

Result: Fair Value of $97.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in vitamins and escalating input costs could erode margins, challenging the view that Church & Dwight’s earnings power is safely insulated.

Find out about the key risks to this Church & Dwight narrative.

Another Angle on Valuation

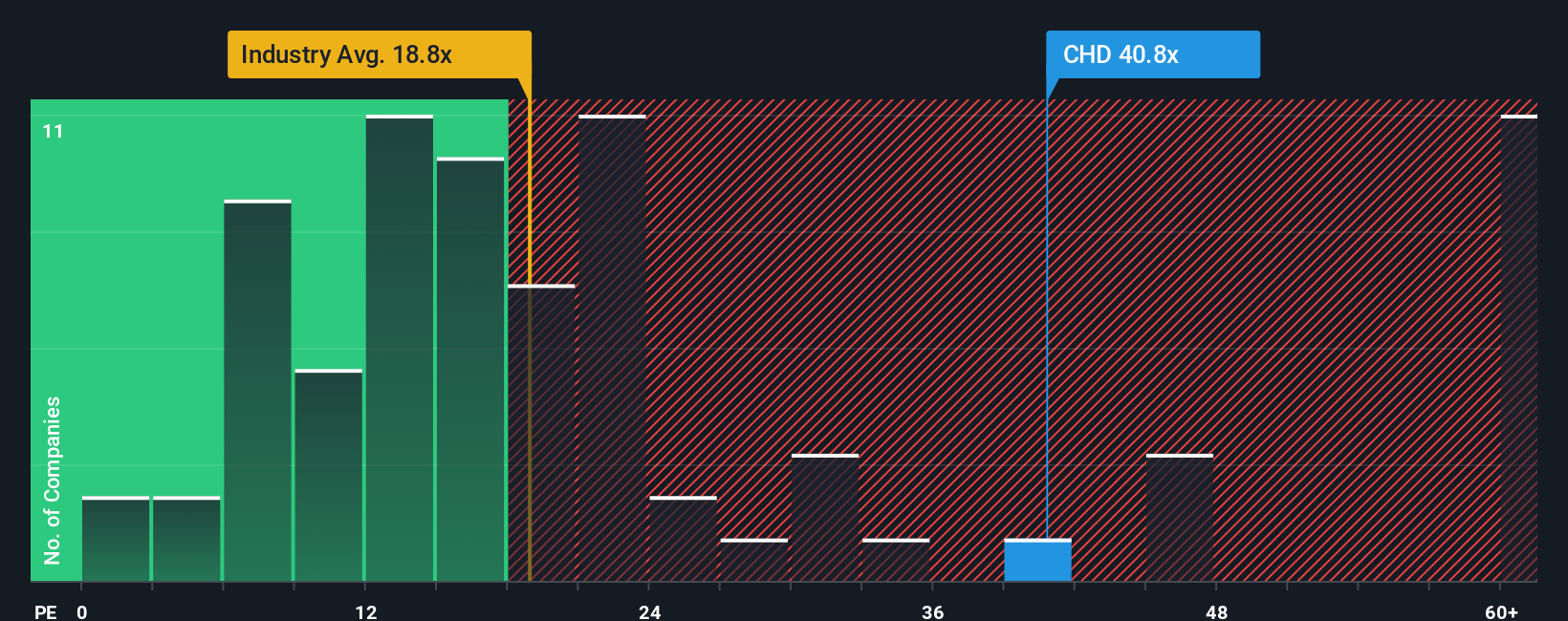

On earnings, Church & Dwight looks pricey. It trades on a 26.1x P/E, well above the Global Household Products average of 16.9x, its peer average of 17.6x, and even its own 18x fair ratio. That premium narrows the margin for error if growth underdelivers.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Church & Dwight Narrative

If you are unconvinced by this view, or simply prefer digging into the numbers yourself, you can build a fresh perspective in minutes, Do it your way

A great starting point for your Church & Dwight research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one household name. Use the Simply Wall Street Screener to uncover targeted opportunities before other investors catch on and prices move ahead of you.

- Boost your income potential by reviewing these 12 dividend stocks with yields > 3% that could strengthen your portfolio’s yield without stretching into risky territory.

- Position yourself for tomorrow’s breakthroughs by scanning these 28 quantum computing stocks that aim to reshape computing, security, and data intensive industries.

- Harness market mispricing by checking these 914 undervalued stocks based on cash flows where current prices may not yet reflect long term cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报