Revisiting Houlihan Lokey’s Valuation: Is HLI’s Long-Term Outperformance Already Priced In?

Houlihan Lokey (HLI) has quietly outperformed many Wall Street peers over the past few years, so with the stock hovering near 176 dollars, it is a good moment to revisit what investors are actually paying for.

See our latest analysis for Houlihan Lokey.

Over the past year, Houlihan Lokey’s share price return has been modest even as the 5 year total shareholder return of 188.52 percent signals a powerful longer term compounding story, suggesting recent momentum is cooling rather than breaking the thesis.

If steady compounding names like Houlihan Lokey are on your radar, it is also worth exploring fast growing stocks with high insider ownership for ideas with more explosive growth potential.

With shares now trading just below 177 dollars and analysts still seeing upside to around 208 dollars, the key question is whether Houlihan Lokey remains undervalued or if the market is already pricing in years of future growth.

Most Popular Narrative: 16.3% Undervalued

With Houlihan Lokey last closing at 176.56 dollars against a narrative fair value of about 210.86 dollars, the story centers on durable growth and richer future earnings.

Analysts are assuming Houlihan Lokey's revenue will grow by 12.5% annually over the next 3 years. Analysts assume that profit margins will increase from 16.5% today to 18.5% in 3 years time.

To see what powers that higher target, including a sharper earnings curve, thicker margins, and a premium multiple typically reserved for market darlings, unpack the full narrative.

Result: Fair Value of $210.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer global M&A volumes or rising compensation costs could squeeze margins and derail the growth and valuation assumptions that underpin the bullish narrative.

Find out about the key risks to this Houlihan Lokey narrative.

Another Take: Rich Multiples Temper the Story

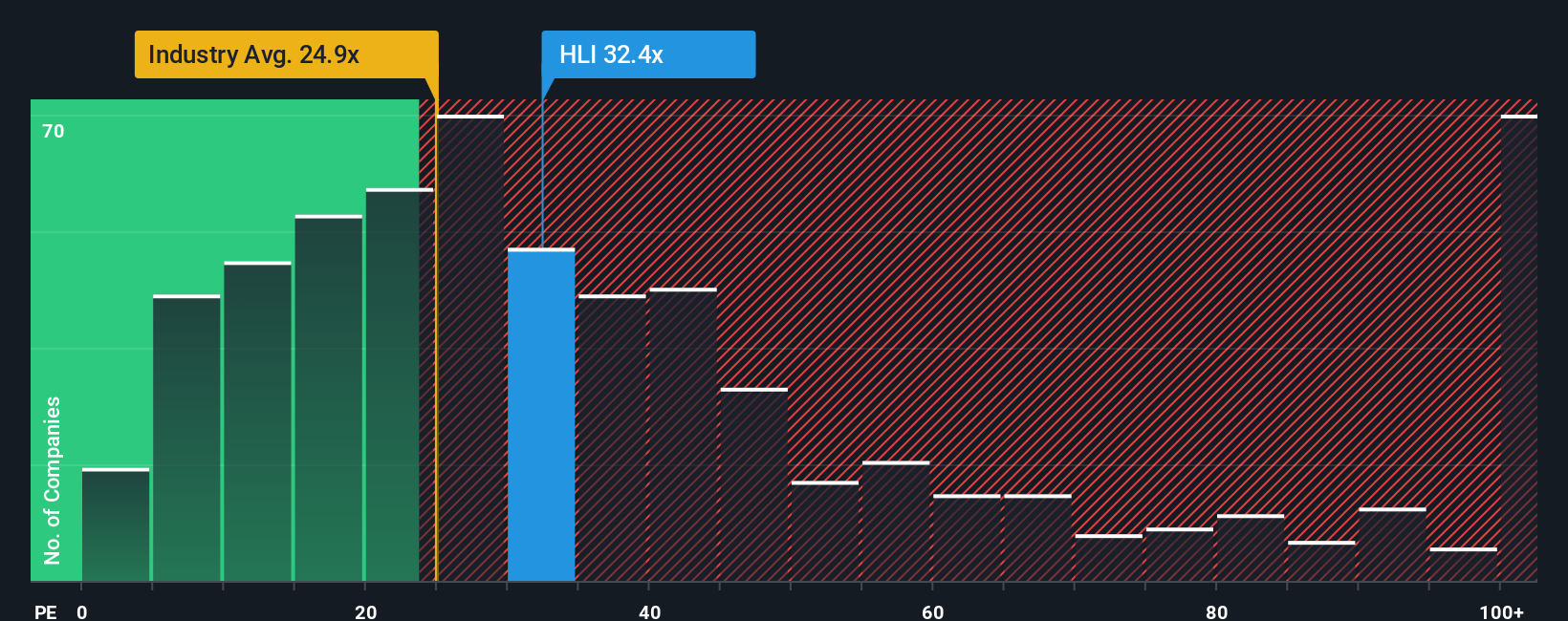

While the narrative fair value points to meaningful upside, Houlihan Lokey already trades at about 29 times earnings, well above both the US Capital Markets industry at 25.1 times and its own fair ratio of 15.7 times. This raises the risk that expectations, not fundamentals, are doing more of the heavy lifting.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Houlihan Lokey Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Houlihan Lokey.

Looking for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall Street Screener to line up your next moves before the market realizes what you see.

- Capture dependable cash flow by scanning these 12 dividend stocks with yields > 3% that can help anchor your portfolio with steady income while rates and markets shift around you.

- Explore opportunities in the AI space by targeting these 24 AI penny stocks that are involved in developing or applying cutting edge innovation.

- Identify potential mispricings by focusing on these 914 undervalued stocks based on cash flows where market pessimism may have pushed quality businesses below their estimated intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报