Tractor Supply (TSCO): Reviewing Valuation After Two Years of Weak Same-Store Sales and Slower Revenue Growth

Recent commentary around Tractor Supply (TSCO) has zeroed in on two weak spots: slower revenue growth and soft same store sales, which together suggest its rural retail formula is feeling the heat from tougher competition and thinner margins.

See our latest analysis for Tractor Supply.

The recent 1 month share price return of minus 2.9 percent and 3 month share price return of minus 11.6 percent suggest momentum is fading at the current 51.40 dollars share price, even though the 5 year total shareholder return of almost 90 percent still signals a solid long term track record.

With Tractor Supply under pressure, this could be a good moment to explore other retail adjacent opportunities using fast growing stocks with high insider ownership.

With revenue growth lagging, sentiment soft, and shares trading below the average analyst price target, should investors treat Tractor Supply as a mispriced rural stalwart or assume the market already sees slower growth ahead?

Most Popular Narrative Narrative: 19.0% Undervalued

With Tractor Supply last closing at 51.40 dollars against a narrative fair value near 63 dollars, the story leans toward mispricing rather than stagnation.

Strong transaction growth, unit growth in consumable, usable, and edible categories, and record customer retention indicate sustained demand, likely bolstering future revenue.

Tractor Supply's success with strategic initiatives like their Chick Days and direct sales efforts, including PetRx integration, may enhance customer engagement and drive revenue and margin improvements.

Curious how steady demand and expanding margins could justify a richer future earnings multiple than the wider retail sector commands today? The most followed narrative ties together multi year revenue growth, fatter net margins, and a premium valuation profile that might surprise investors used to thinking of Tractor Supply as a slow moving rural retailer. Want to see the exact earnings path and profitability assumptions that underpin that higher fair value?

Result: Fair Value of $63.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer comparable sales and persistent pressure on big ticket categories could easily derail those earnings and valuation assumptions if consumer caution deepens.

Find out about the key risks to this Tractor Supply narrative.

Another View: Multiples Flash a Caution Signal

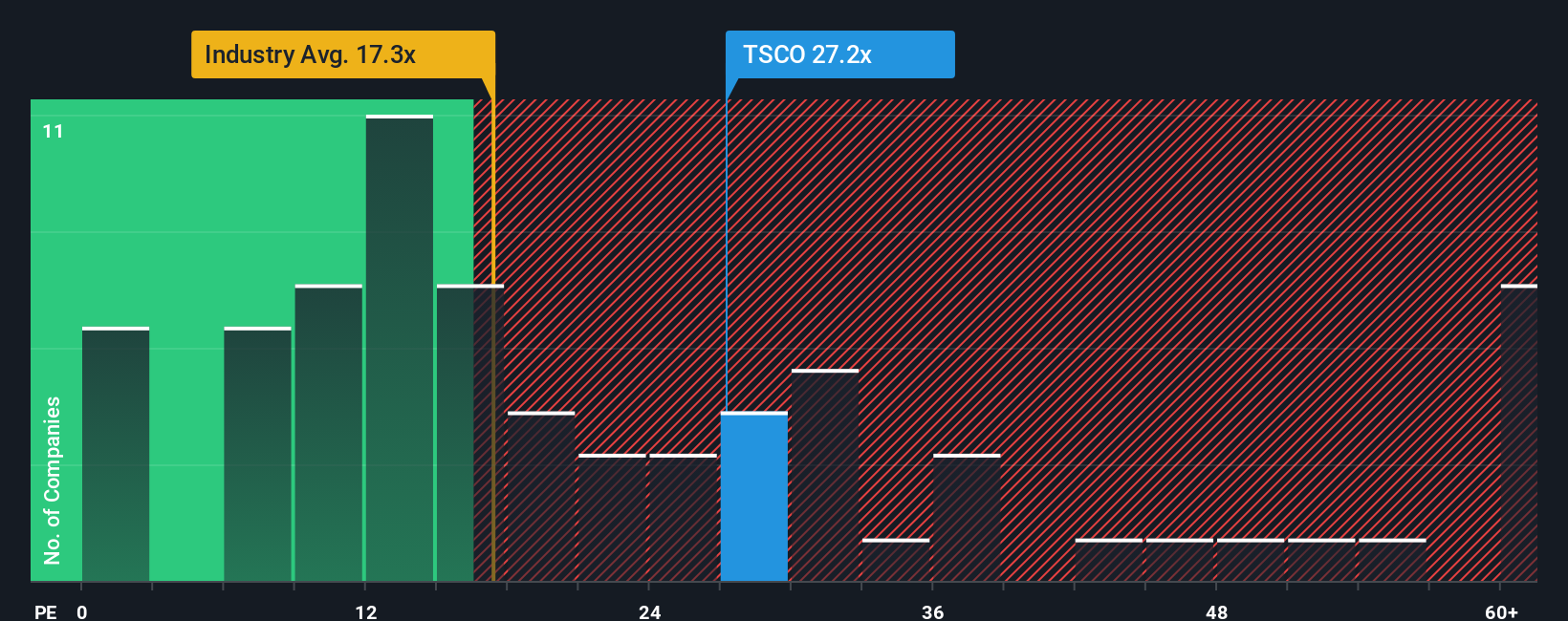

Our DCF style narrative suggests upside, but the price to earnings ratio tells a cooler story. TSCO trades on 24.6 times earnings, above the US Specialty Retail average of 20.3 times and a fair ratio of 18.7 times, hinting at downside risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Tractor Supply for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Tractor Supply Narrative

If you see the outlook differently or prefer to dig into the numbers yourself, you can craft a fresh, personalized narrative in just minutes: Do it your way.

A great starting point for your Tractor Supply research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put Simply Wall Street to work and uncover fresh opportunities that match your strategy, or you could miss the next big winner entirely.

- Capitalize on income potential by screening for companies offering reliable yields through these 12 dividend stocks with yields > 3% that can support your long term cash flow.

- Explore the innovation wave in automation and intelligent software by focusing on names across these 24 AI penny stocks for growth oriented portfolios.

- Find attractive entry points by targeting stocks priced below their estimated intrinsic value with these 914 undervalued stocks based on cash flows before the broader market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报