Keppel REIT (SGX:K71U): Reassessing Valuation After Its SGD 886m Rights Issue and Capital Raise

Keppel REIT (SGX:K71U) has kicked off a sizeable rights issue, filing a follow on equity offering of about SGD 886 million at SGD 0.96 per unit. This is a move that directly reshapes its near term capital structure and investor calculations.

See our latest analysis for Keppel REIT.

The rights issue comes after a relatively resilient run, with a year to date share price return of 13.79% and a 1 year total shareholder return of 27.81%. This suggests momentum is still broadly constructive despite recent volatility.

If this capital raise has you reassessing your income plays, it could be worth scanning for other steady compounders via stable growth stocks screener (None results).

With the units trading just above the rights price and still showing a sizeable intrinsic value gap, investors now face a key question: is Keppel REIT a mispriced recovery play or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 5.1% Undervalued

With Keppel REIT last closing at SGD 0.99 against a narrative fair value of about SGD 1.04, the story points to modest upside anchored in cash flows and margins.

Ongoing repricing of debt at lower floating rates and reduced borrowing margins, together with expectations for further benchmark rate cuts (notably SORA and RBA), is expected to progressively lower interest costs, which would in turn expand net margins and distributable income from H2 2025 onward.

Curious how shrinking top line expectations can still coexist with fatter margins and a richer earnings multiple by 2028? Unpack the assumptions, step by step.

Result: Fair Value of $1.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent currency headwinds and any deeper softening in Australian office occupancy could quickly offset margin gains and derail the recovery narrative.

Find out about the key risks to this Keppel REIT narrative.

Another Lens on Value

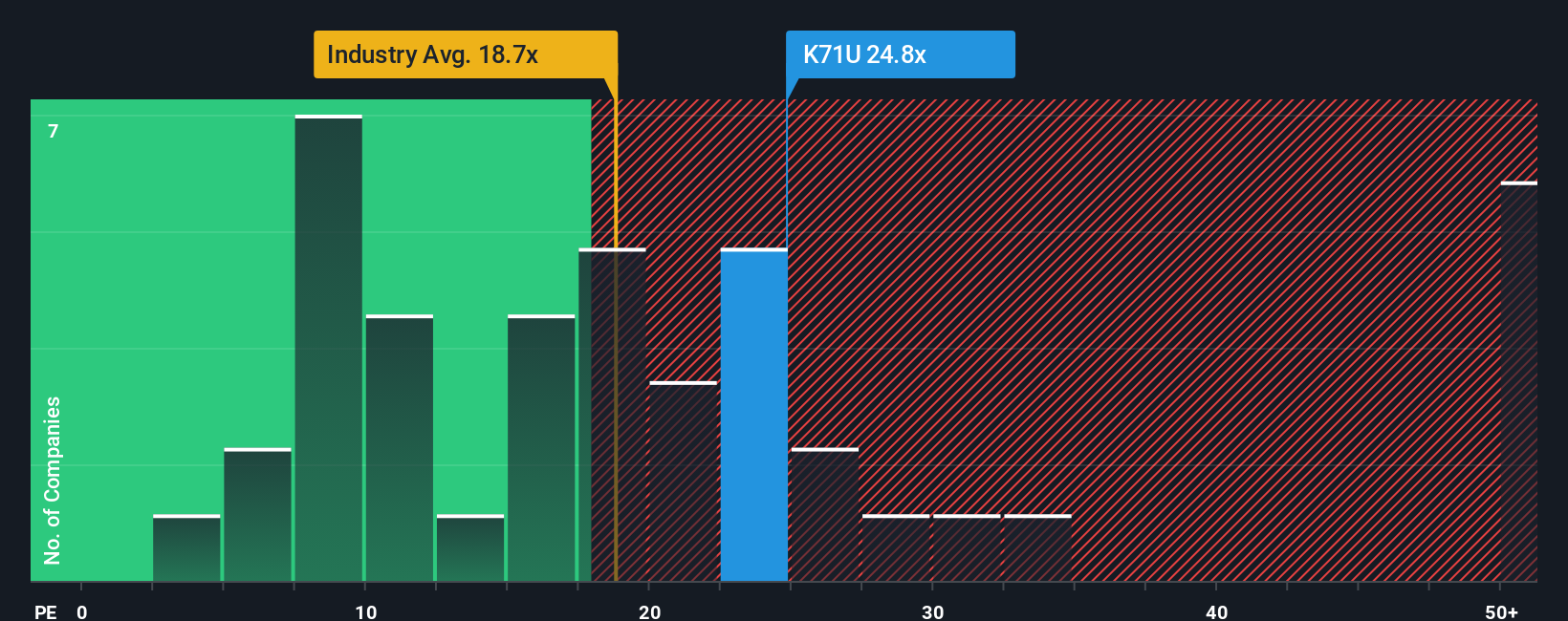

On earnings, Keppel REIT looks far from cheap, trading at about 25.2 times profit compared with an estimated fair ratio of 18.2 times and an Asian office REIT average of 18.7 times. That premium implies less margin for error, so what has to go right to justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keppel REIT Narrative

If you see the outlook differently, or simply want to stress test the numbers yourself, you can build a fresh storyline in minutes by using Do it your way.

A great starting point for your Keppel REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before you lock in any decision on Keppel REIT, widen your opportunity set with targeted ideas from the Simply Wall St Screener so you do not overlook compelling alternatives.

- Capitalize on potential mispricings by scanning these 914 undervalued stocks based on cash flows that could offer stronger upside than mature income names.

- Ride powerful structural themes by focusing on these 24 AI penny stocks positioned to benefit from long term adoption of intelligent automation.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that can complement or even surpass REIT yields in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报