Pinnacle Financial Partners (PNFP): Valuation Check After Fresh Target Hikes from JP Morgan and Barclays

Recent upbeat calls from JP Morgan and Barclays have put Pinnacle Financial Partners (PNFP) back on traders’ radar, with the stock grinding higher after a choppy year for regional banks.

See our latest analysis for Pinnacle Financial Partners.

The upbeat calls are landing at a moment when PNFP has quietly rebuilt some momentum, with an 11.67% 30 day share price return helping offset a negative year to date move. Its 3 year total shareholder return of 41.40% and 5 year total shareholder return of 62.49% still point to a franchise that has rewarded patient holders.

If you like the story around renewed confidence in regional banks, it is also worth exploring fast growing stocks with high insider ownership as a way to spot other under the radar opportunities with aligned management.

Yet with the stock already near twelve month highs and trading at a modest discount to analyst targets despite punchy growth, investors face a familiar dilemma: is this still a genuine buying opportunity or is future upside already priced in?

Most Popular Narrative Narrative: 8.7% Undervalued

With the narrative fair value sitting around 10% above Pinnacle Financial Partners' last close, the story leans toward patient upside rather than a quick trade.

The analysts have a consensus price target of $112.083 for Pinnacle Financial Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $130.0, and the most bearish reporting a price target of just $95.0.

Want to see what kind of rapid top line expansion, shifting margins, and future earnings multiple could justify this path? The narrative lays out the full playbook.

Result: Fair Value of $110.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on smooth Synovus integration and resilient Southeast conditions, as any merger missteps or regional slowdown could quickly pressure margins and credit quality.

Find out about the key risks to this Pinnacle Financial Partners narrative.

Another View: Earnings Multiple Sends a Different Signal

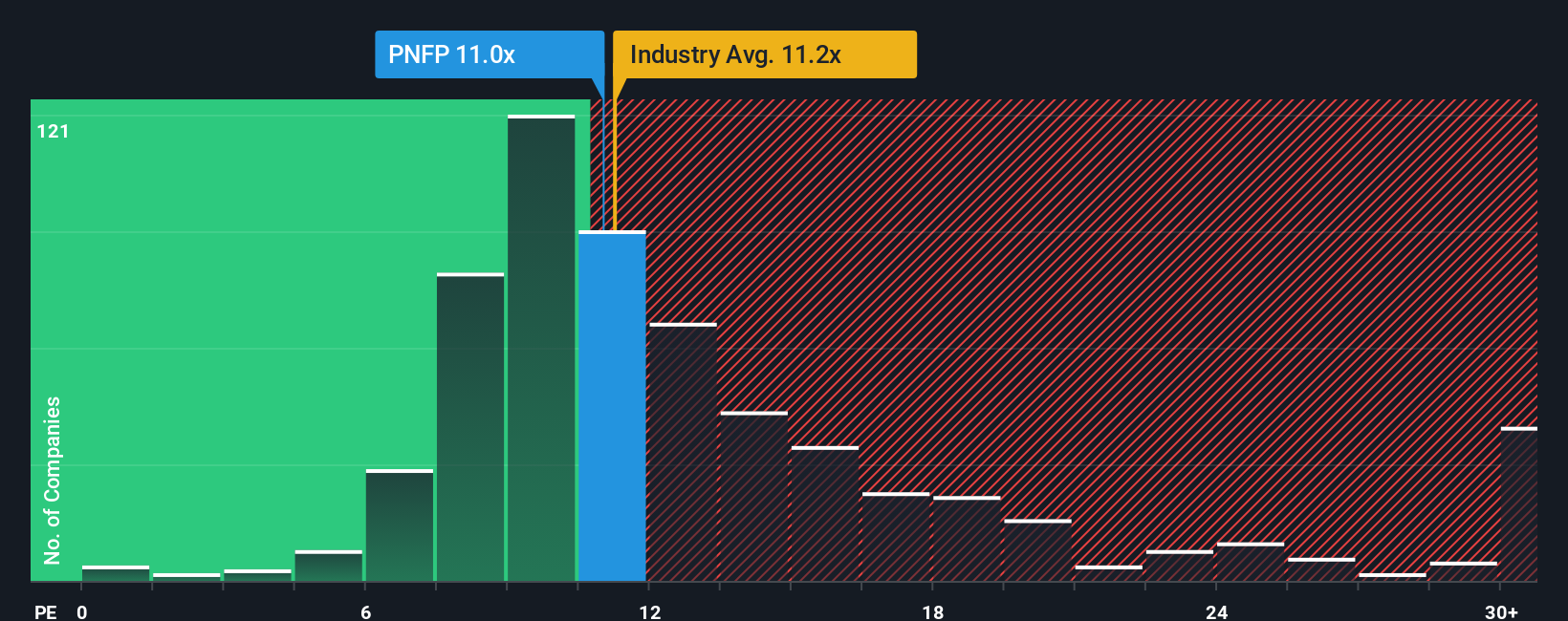

While the narrative fair value suggests upside, the market is assigning Pinnacle Financial Partners a price-to-earnings ratio of about 12.7 times, slightly richer than the US banks average of 11.9 times but well below a fair ratio closer to 25.1 times. This hints at meaningful upside if sentiment normalizes. Is this a value story the market is still slow to trust?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pinnacle Financial Partners Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Pinnacle Financial Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Turn today’s insight into a smarter portfolio move by acting now on fresh opportunities our screeners surface before they become obvious to everyone else.

- Capture overlooked value by scanning these 914 undervalued stocks based on cash flows that strong cash flows suggest the market has mispriced.

- Ride powerful structural trends by targeting these 29 healthcare AI stocks reshaping diagnostics, drug discovery, and patient care.

- Position early for potential breakouts with these 79 cryptocurrency and blockchain stocks harnessing blockchain, tokenization, and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报