Trend Micro (TSE:4704) Valuation After Board Weighs Share Buyback Plan

Trend Micro (TSE:4704) has set investors talking after its November 12 board meeting, where directors weighed a plan to repurchase common stock, a move that often hints at management’s underlying confidence.

See our latest analysis for Trend Micro.

That confidence comes after a choppy year, with the latest share price at ¥6,921 and a roughly 15 percent year to date share price decline, even as the three year total shareholder return sits near 27 percent. This suggests longer term momentum has been solid even if sentiment has cooled recently.

If this potential buyback has you rethinking your tech exposure, it might be a good time to scout other opportunities among high growth tech and AI stocks.

With shares down this year yet still trading only modestly below analyst targets despite steady revenue and profit growth, the key question is whether Trend Micro is quietly undervalued or if the market already sees its future upside.

Most Popular Narrative: 18% Undervalued

Compared with Trend Micro's last close at ¥6,921, the most followed narrative pegs fair value closer to ¥8,417, implying notable upside if its assumptions play out.

The company’s strategic focus on its enterprise segment, with plans to leverage Vision One and managed security service provider (MSP) partners, suggests potential for increased annual recurring revenue (ARR) and operating income as they expand their market share and offer comprehensive security solutions.

Curious why a relatively modest growth outlook still supports a richer future earnings multiple than many software peers, even after a higher discount rate? The narrative leans heavily on expanding margins and scaling subscription style revenues to justify that stance. If you want to see how those moving parts fit together in the valuation model, read on to uncover the assumptions driving this fair value call.

Result: Fair Value of ¥8,417 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, recent setbacks in online settlement outsourcing and weaker consumer renewals outside Japan could delay the expected uplift in growth and margins.

Find out about the key risks to this Trend Micro narrative.

Another Angle On Value

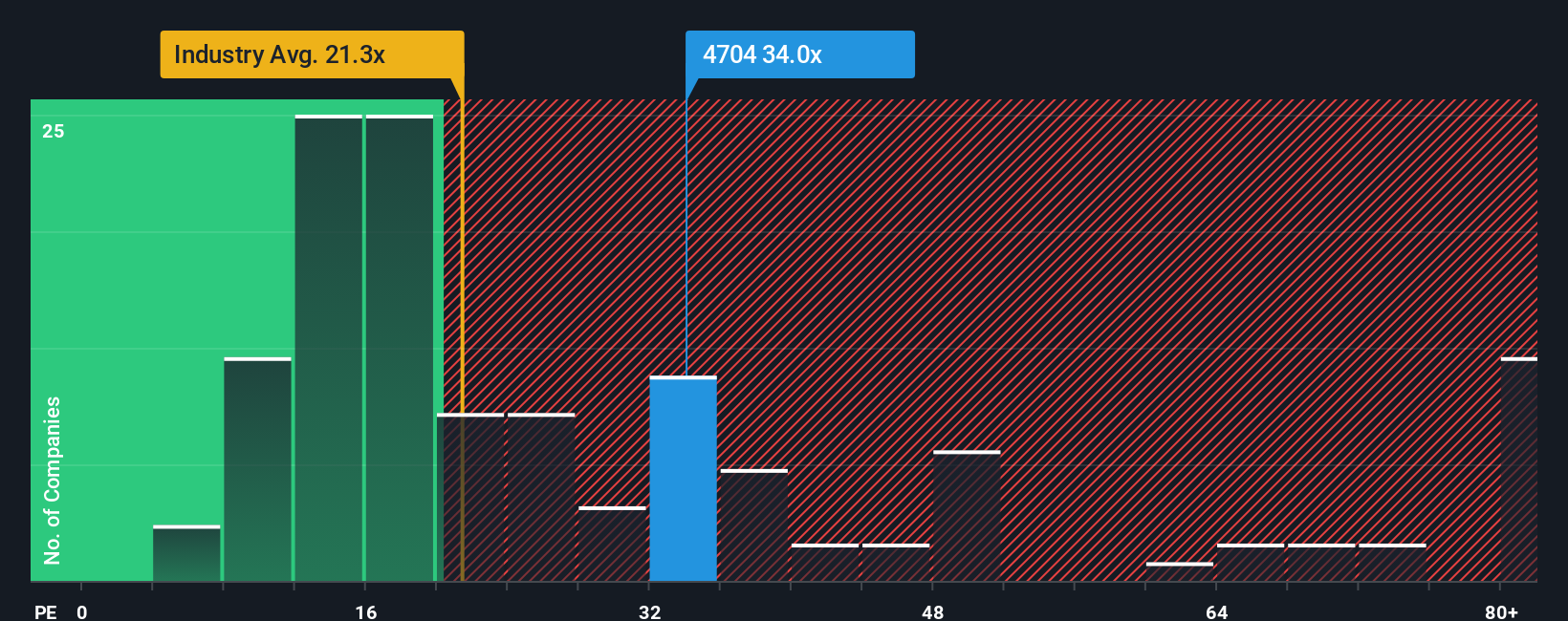

While the narrative points to upside, a simple earnings multiple tells a tighter story. Trend Micro trades on 26.2x earnings, richer than both the JP Software industry at 19.9x and peers at 22.6x, yet only slightly below its 28.8x fair ratio, hinting at limited margin of safety. Is investors’ optimism already in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trend Micro Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Trend Micro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single stock. Use the Simply Wall St Screener to uncover fresh opportunities that match your style before the market catches on.

- Capture potential value early by scanning these 914 undervalued stocks based on cash flows that strong cash flow models suggest the market has not fully appreciated yet.

- Ride powerful technology tailwinds by targeting these 24 AI penny stocks positioned to benefit from accelerating demand for automation and intelligent software.

- Strengthen your income strategy by zeroing in on these 12 dividend stocks with yields > 3% that can support reliable cash returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报