Reassessing Kioxia Holdings (TSE:285A) Valuation After a Sharp Multi‑Month Rally and Recent Pullback

Recent Performance and Market Context

Kioxia Holdings (TSE:285A) has slipped about 2% on the day and roughly 18% over the past month, even after more than doubling over the past 3 months. This has left investors reassessing near term expectations.

See our latest analysis for Kioxia Holdings.

That backdrop makes the latest pullback look more like cooling momentum than a broken story. The share price is at ¥9,340 after a year-to-date share price return of 437.71% and a 1 year total shareholder return of 447.80%, suggesting investors are still pricing in strong growth but reassessing near term risk.

If Kioxia’s sharp run up has you thinking about what else is moving in chips and data infrastructure, it might be worth scanning high growth tech and AI stocks for other fast changing opportunities.

With the stock still trading at a notable discount to analyst targets but boasting explosive recent gains, is Kioxia a misunderstood value in high growth memory, or have investors already priced in its next leg of expansion?

Price-to-Earnings of 32.5x: Is it justified?

On a headline basis, Kioxia’s last close of ¥9,340 equates to a price-to-earnings ratio of 32.5x, placing it at a clear premium to peers.

The price-to-earnings multiple compares what investors pay today for each unit of current earnings, a key yardstick in semiconductors where profit cycles and capital intensity can be extreme. For Kioxia, the market is effectively assigning a growth stock label, paying well above average for its profit base.

That premium looks stretched when stacked against both the JP Semiconductor industry average of 19.9x and a peer average of 24.3x, signaling that buyers are accepting a much richer tag for Kioxia’s earnings power. However, our fair price-to-earnings estimate of 73.2x implies the market could still be underestimating the level at which the multiple might eventually settle if forecast earnings growth and returns materialize as expected.

Explore the SWS fair ratio for Kioxia Holdings

Result: Price-to-Earnings of 32.5x (OVERVALUED)

However, sustained multiple expansion still hinges on resilient chip demand and flawless execution, with any downturn or manufacturing setback quickly undermining the growth narrative.

Find out about the key risks to this Kioxia Holdings narrative.

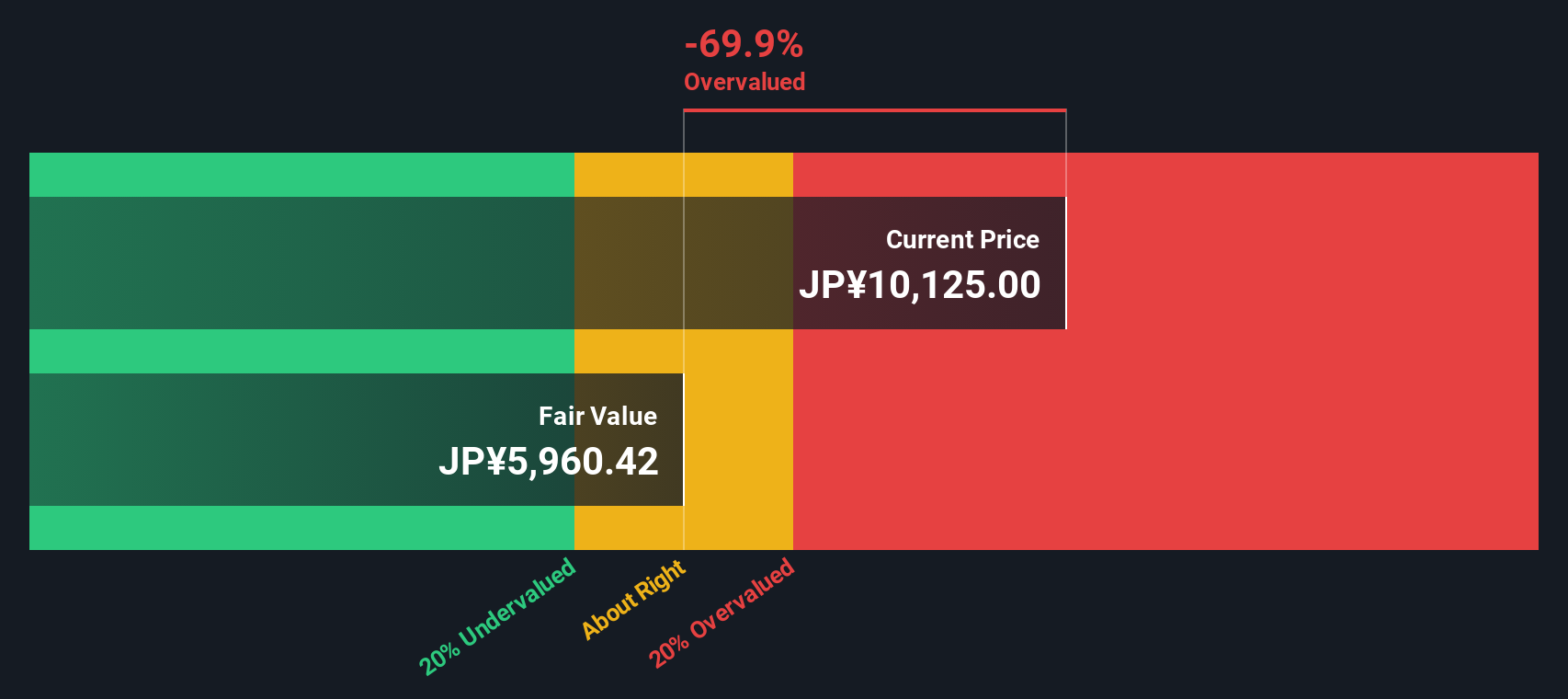

Another View: Cash Flows Tell a Different Story

While earnings multiples hint Kioxia could have room to rerate higher, our DCF model points the other way. The shares are trading above an estimated fair value of ¥5,910.57. If cash flows are closer to the truth than today’s profit snapshot, is the market getting ahead of itself?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kioxia Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kioxia Holdings Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Kioxia Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Stay ahead of the crowd and lock in your next opportunity now by using targeted screeners that spotlight quality, momentum, and long term upside.

- Capture potential multi baggers early by scanning these 3634 penny stocks with strong financials, which pair small size with surprisingly robust financial foundations and room to grow.

- Capitalize on secular tailwinds by focusing on these 24 AI penny stocks, positioned at the heart of the AI and automation boom reshaping global markets.

- Strengthen your portfolio’s value core by targeting these 914 undervalued stocks based on cash flows, where current prices appear out of sync with their long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报