SentinelOne (S): Reassessing Valuation After Strong Results, Softer Guidance and CFO Exit

SentinelOne (S) just delivered a quarter with double digit revenue growth and a clean move into positive margins, yet the stock is under pressure after softer guidance and a surprise CFO departure.

See our latest analysis for SentinelOne.

Those mixed signals help explain why, even with operational wins and high profile threat discoveries, SentinelOne’s share price return is still negative over the last year while the three year total shareholder return remains in positive territory. This suggests that momentum has cooled but not disappeared.

If this kind of volatility has you scanning the rest of cybersecurity, it may be worth exploring high growth tech and AI stocks as potential peers and alternatives to SentinelOne.

With shares down sharply from recent highs and trading at a sizable discount to analyst targets despite improving profitability, investors face a key question: Is SentinelOne a misunderstood value in cybersecurity, or is the market correctly discounting future growth?

Most Popular Narrative: 31.6% Undervalued

With SentinelOne last closing at 14.73 dollars against a most popular narrative fair value of about 21.55 dollars, the gap hinges on ambitious growth, margin, and multiple assumptions.

Expansion beyond endpoint security into high demand adjacent markets such as cloud security, identity, and data protection including the Prompt Security acquisition for GenAI risk unlocks significant cross sell opportunities and is expected to elevate average contract value and diversify revenue streams, laying the groundwork for outsized multi year revenue growth.

Curious how this platform expansion translates into that higher fair value, and why the assumed future earnings multiple stretches beyond typical software peers, yet still underpins this growth story? Dive in to see the exact revenue runway, margin lift, and valuation bridge that connect today’s losses with that future earnings power.

Result: Fair Value of $21.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors also need to weigh deal timing volatility and rising partner dependence, both of which could derail the long term growth and margin improvement assumptions.

Find out about the key risks to this SentinelOne narrative.

Another Look Through Multiples

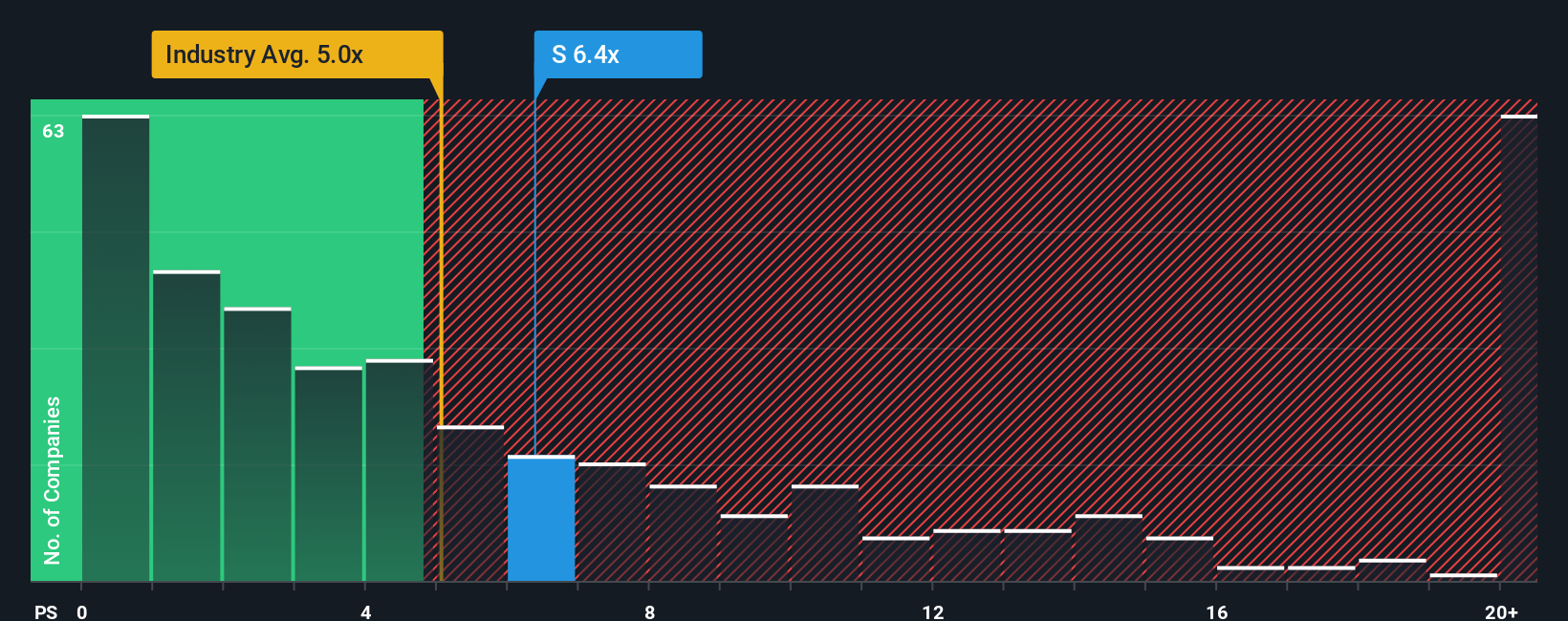

While the narrative suggests upside, the current price to sales ratio of 5.2 times is slightly richer than the broader US software sector at 4.9 times, yet cheaper than close peers at 6.2 times and below a fair ratio of 6 times. This raises the question of whether sentiment or fundamentals will drive the next move.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SentinelOne Narrative

If you see the story differently or want to stress test the assumptions using your own inputs, you can craft a custom view in just minutes: Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities using the Simply Wall St Screener so you are not left watching others capture the upside first.

- Target long term wealth by focusing on consistent income streams through these 12 dividend stocks with yields > 3%, where payouts and fundamentals work together for compounding potential.

- Ride structural shifts in technology and automation with these 24 AI penny stocks, zeroing in on companies building real products rather than just hype.

- Position yourself early in transformative market themes by scanning these 79 cryptocurrency and blockchain stocks that stand to benefit if blockchain adoption accelerates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报