TJX (TJX) Valuation Check After Strong 3‑Month and 1‑Year Share Price Performance

TJX Companies (TJX) has quietly kept rewarding patient shareholders, with the stock up about 11% over the past 3 months and nearly 28% over the past year, handily beating many retail peers.

See our latest analysis for TJX Companies.

With the share price now around $154.6 and a strong year to date share price return alongside a robust three year total shareholder return, the recent pullback looks more like a pause in a broader uptrend as investors reassess how much of TJX Companies steady growth is already reflected in the valuation.

If TJX Companies momentum has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other ideas with strong alignment between management and shareholders.

With shares now trading close to analyst targets after a powerful multi year run, the key question is whether TJX still offers mispriced upside or if the market is already baking in years of steady growth.

Most Popular Narrative: 2.9% Undervalued

With TJX Companies last closing at $154.60 versus a narrative fair value of about $159.16, the most popular view sees only a modest upside priced in.

The Fair Value Estimate has increased from $151.84 to $159.16 per share, reflecting a moderate reassessment upward. The Revenue Growth Projection is up, increasing from 5.51% to 5.71%.

Curious why a value focused retailer is being priced with growth style expectations? The narrative leans on rising margins and richer future earnings multiples. Want to see what assumptions power that jump?

Result: Fair Value of $159.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bullish narrative could unwind if e commerce continues siphoning traffic from stores or brands tighten inventory, limiting attractive off price sourcing.

Find out about the key risks to this TJX Companies narrative.

Another Angle on Valuation

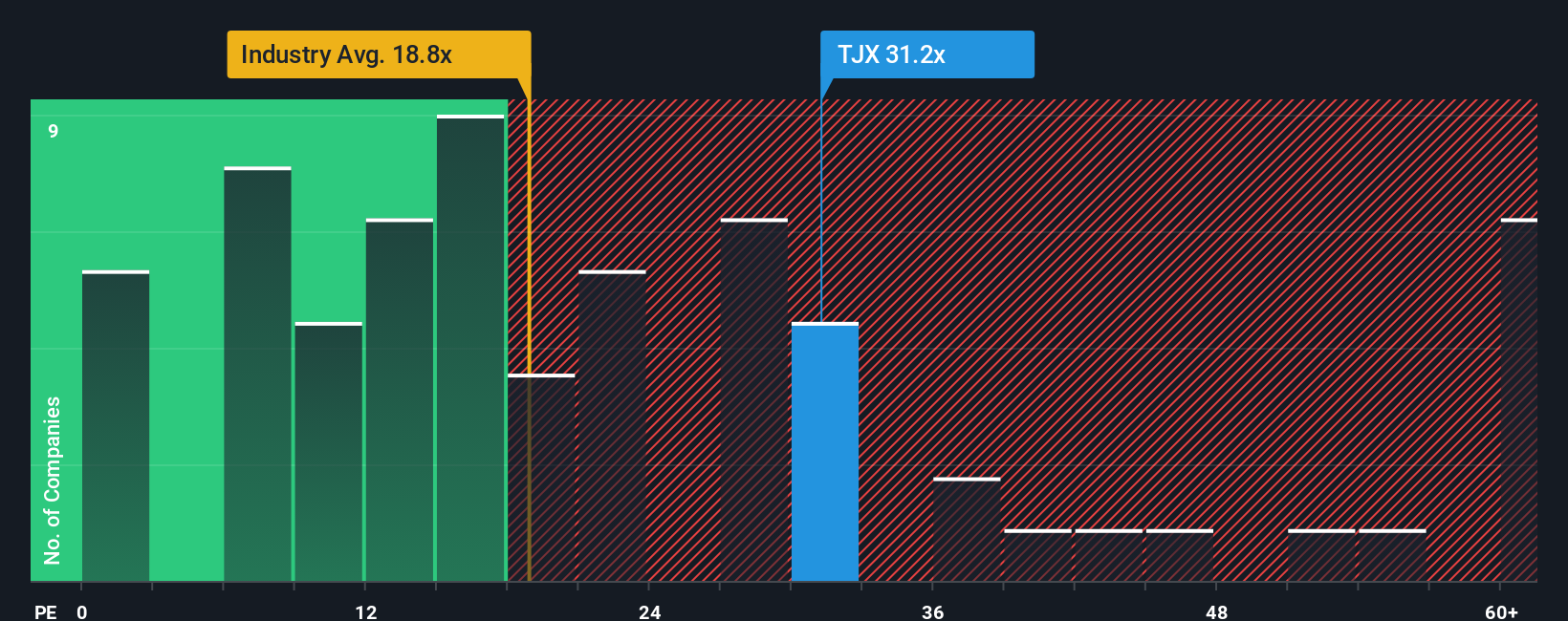

While the narrative fair value suggests TJX Companies is modestly undervalued, the earnings multiple tells a tougher story. At about 33.5 times earnings versus an industry 20.3 times and a fair ratio of 22.1 times, the stock looks richly priced, leaving less margin for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TJX Companies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in minutes, Do it your way.

A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider giving yourself the chance to spot tomorrow’s potential winners today by tapping into powerful, data driven stock ideas built from our screeners.

- Explore overlooked growth potential by scanning these 913 undervalued stocks based on cash flows that the market has not fully appreciated yet, before sentiment and prices catch up.

- Focus on cutting edge innovation by targeting these 24 AI penny stocks positioned to benefit from increasing demand for intelligent software, automation, and data driven solutions.

- Support your cash flow with these 12 dividend stocks with yields > 3% that aim to combine income today with solid fundamentals for long term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报