Bank of New York Mellon (BK): Valuation Check as AI Investments and Earnings Expectations Draw Fresh Attention

Bank of New York Mellon (BK) is back on traders dashboards ahead of its upcoming fourth quarter report, as the market weighs upbeat profit expectations against the bank ongoing push into AI driven operations.

See our latest analysis for Bank of New York Mellon.

The stock has quietly built strong momentum, with an 8.84% 1 month share price return contributing to a 49.64% year to date share price gain and a 5 year total shareholder return of 226.07%. This suggests investors are steadily repricing its AI led strategy and recent boardroom changes.

If BNY's AI push has caught your eye, this could be a good moment to see what other financial names are doing with technology, starting with fast growing stocks with high insider ownership.

With shares sitting just below analyst price targets after a nearly 50% year to date rally, the key question now is whether BNY still trades at a discount to its AI powered future, or if markets are already pricing in that growth.

Most Popular Narrative Narrative: 1.9% Undervalued

With Bank of New York Mellon last closing at $115.84 against a narrative fair value near $118.03, the story points to modest upside grounded in long term digital growth and disciplined capital returns.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years, as scalable technology reduces costs and increases cross-selling opportunities. The ongoing rollout of the platform operating model and dynamic process automation is expected to drive further efficiency gains, unlocking margin improvement and scalable earnings growth through expense control and faster product delivery.

Curious how steady, low double digit style growth, expanding margins and a richer future earnings multiple combine to justify this near fair value call? The full narrative reveals the exact revenue runway, profitability uplift and share count shifts behind that calculation, plus the precise assumptions about how far efficiency and digital asset leadership can push long term earnings power.

Result: Fair Value of $118.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this constructive view still hinges on BNY delivering promised efficiency gains and navigating potential fee pressure if passive investing and digital disruption accelerate.

Find out about the key risks to this Bank of New York Mellon narrative.

Another View: Cash Flows Paint A Tougher Picture

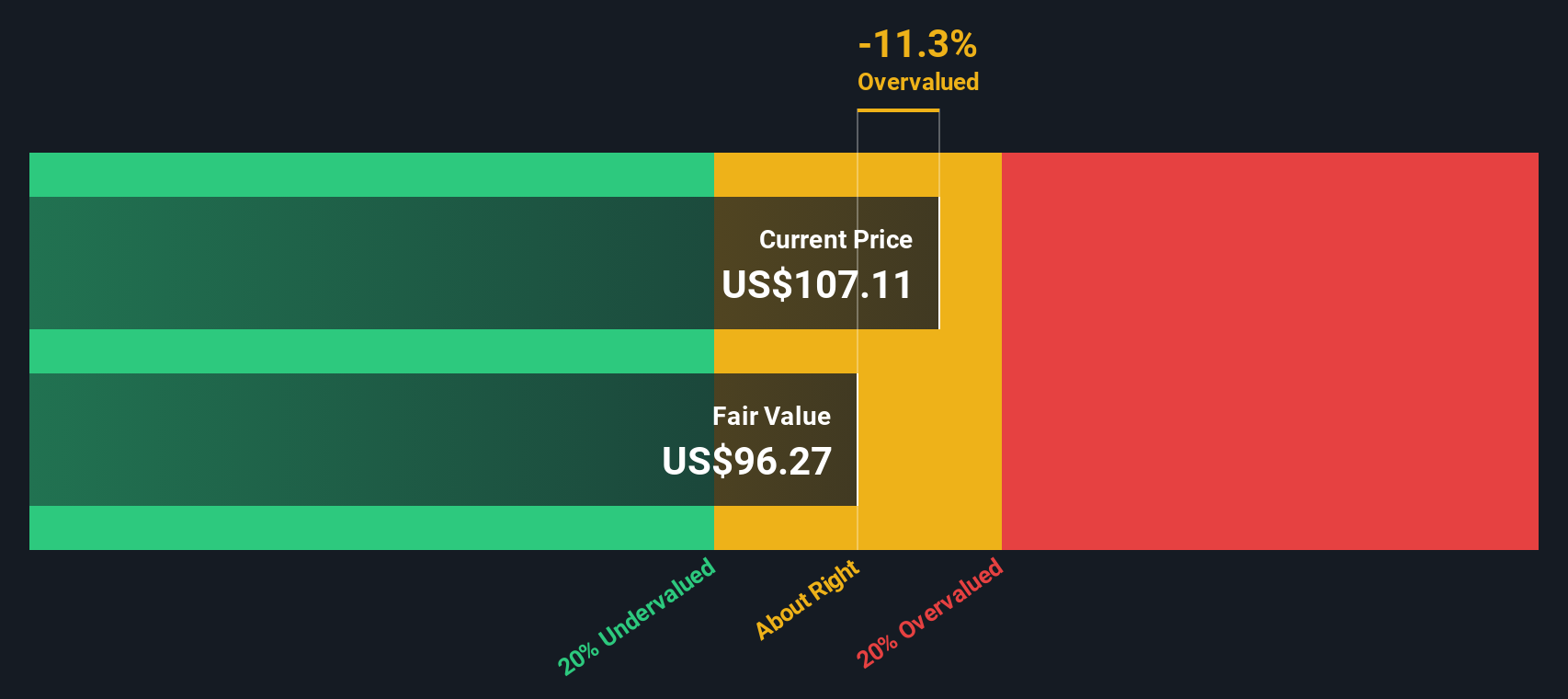

While the narrative fair value suggests about 1.9% upside, our DCF model points the other way and indicates BK is trading above its estimated fair value of roughly $101.73. If cash flow reality diverges from the growth story, which signal should investors trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 911 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If you see the setup differently or want to test your own assumptions against the numbers, you can build a tailored view in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Bank of New York Mellon.

Ready for more smart investment ideas?

Do not stop with one opportunity when a wider field of high potential stocks is waiting. Let the Simply Wall St Screener help you identify your next move today.

- Explore these 3631 penny stocks with strong financials with solid balance sheets and improving fundamentals.

- Identify these 24 AI penny stocks that use artificial intelligence in ways that may reshape industries.

- Review these 12 dividend stocks with yields > 3% with yields above 3% supported by resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报