Is Domino's Still Attractive After Strong Three Year Gains And Digital Growth Initiatives?

- If you have ever wondered whether Domino's Pizza at around $431 a share is still a buy, or if the best slices of upside have already been eaten, this breakdown is for you.

- The stock has been a bit choppy recently, slipping about 0.1% over the last week but still up 5.9% over the past month, while longer term returns of 2.9% over 1 year and 27.6% over 3 years hint at a business that has rewarded patient holders despite a slightly softer 0.8% year to date move.

- Investors have been reacting to Domino's ongoing digital and delivery initiatives, including its continued push into more efficient ordering channels and partnerships that aim to keep it front of mind for convenience focused customers. At the same time, the company has stayed active on store growth and franchise support, which helps explain why sentiment has remained reasonably constructive even when the share price pauses.

- Despite that backdrop, Domino's currently scores just 0/6 on our valuation checks, so we will walk through what that means using multiple valuation approaches, and then finish by looking at a more complete way to think about what the stock is really worth.

Domino's Pizza scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Domino's Pizza Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today, so everything is expressed in present dollar terms. For Domino's Pizza, the latest twelve months Free Cash Flow sits at about $622 million, which analysts and the model expect to grow steadily over time.

According to the projections used, annual Free Cash Flow could reach roughly $787 million by 2028, with further growth extrapolated out to around $927 million by 2035 based on modest long term assumptions. These forecasts combine analyst estimates for the nearer years with Simply Wall St extrapolations for the outer years, and all are discounted back to reflect risk and the time value of money.

Putting those cash flows together, the DCF points to an estimated intrinsic value of about $345 per share. With the stock trading around $431, the model implies the shares are approximately 25.0% above this estimate at current levels, which indicates the valuation may already reflect optimistic expectations.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Domino's Pizza may be overvalued by 25.0%. Discover 912 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Domino's Pizza Price vs Earnings

For profitable, established businesses like Domino's Pizza, the Price to Earnings ratio is a useful shorthand for how much investors are willing to pay today for each dollar of current earnings. It tends to work well where earnings are relatively stable and the market already has a long track record of how the business performs through different cycles.

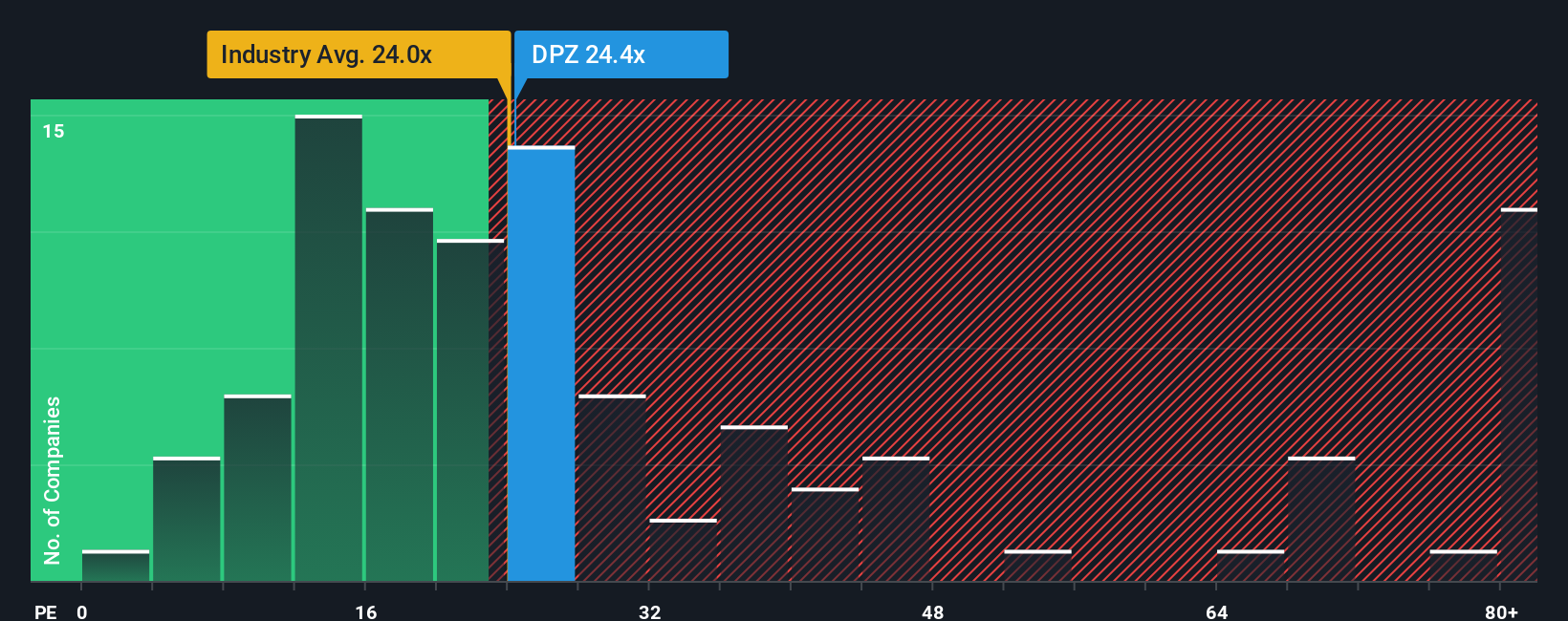

In broad terms, higher growth and lower perceived risk justify a higher PE ratio, while slower or more uncertain growth usually deserves a lower multiple. Domino's currently trades on about 24.7x earnings, which is a touch above both the Hospitality industry average of roughly 23.4x and the peer group average of about 24.0x. This suggests the market is already paying a modest premium for its growth and resilience.

Simply Wall St's Fair Ratio is a proprietary estimate of what a reasonable PE for Domino's should be, once factors like earnings growth, profit margins, industry characteristics, market cap and specific risks are taken into account. For Domino's, this Fair Ratio sits lower at around 20.7x, which indicates the shares are priced ahead of what those fundamentals alone would support.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Domino's Pizza Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St's Community page that lets you connect your view of Domino's Pizza, from its delivery partnerships to its store expansion, to a concrete financial forecast and Fair Value estimate, then compare that Fair Value to today’s share price to consider whether to buy, hold or sell. Every Narrative is kept up to date as new news or earnings arrive, and you can see how different investors look at the same company. For example, one bullish Domino's Narrative might see the national rollout on delivery apps, digital upgrades and urban densification justifying a Fair Value close to the most optimistic analyst target of about $594 per share. A more cautious Narrative might focus on flat pizza category traffic, tougher international growth and fading cost tailwinds to anchor Fair Value nearer the most bearish view of around $340. This gives you a transparent range of stories and numbers you can compare with your own.

Do you think there's more to the story for Domino's Pizza? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报