Chewy (CHWY) Valuation Check After Q3 Beat and Expanding Autoship, Membership, and Health Initiatives

Chewy (CHWY) just cleared a modest hurdle with third quarter earnings that edged past expectations. The story behind that beat matters more than the headline numbers for anyone watching the stock.

See our latest analysis for Chewy.

The latest guidance tweak, calling for around 8% adjusted full year net sales growth, comes as Chewy’s share price has slid, with a 90 day share price return of minus 15.67% and a five year total shareholder return of minus 68.79%. This suggests long term holders remain cautious even as revenue keeps climbing.

If Chewy’s mixed momentum has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other growth names backed by committed insiders.

With shares trading at a steep discount to analyst targets even as sales and profits rise, the key question now is whether Chewy is quietly undervalued or whether the market is already pricing in the next leg of growth.

Most Popular Narrative Narrative: 27.8% Undervalued

With Chewy shares last closing at $32.46 against a narrative fair value near $44.95, the spread hinges on how its new growth engines deliver.

The migration to a 1P ad platform allows for enhanced advertising capabilities, including off site ads and new content formats like video, which could grow the sponsored ads business up to 3% of total enterprise net sales, positively impacting gross margins.

Curious how a subscription uplift, richer ad economics, and a long term margin goal all stack into that higher value? Want to see the exact growth and profitability path this narrative is baking in, and the punchy earnings multiple it assumes Chewy can command several years from now? Dive in to unpack the full set of projections behind that gap between price and fair value.

Result: Fair Value of $44.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Autoship growth stalls or new Vet Care and ad initiatives underdeliver, the case for premium margins and a higher multiple weakens.

Find out about the key risks to this Chewy narrative.

Another View: Rich On Earnings

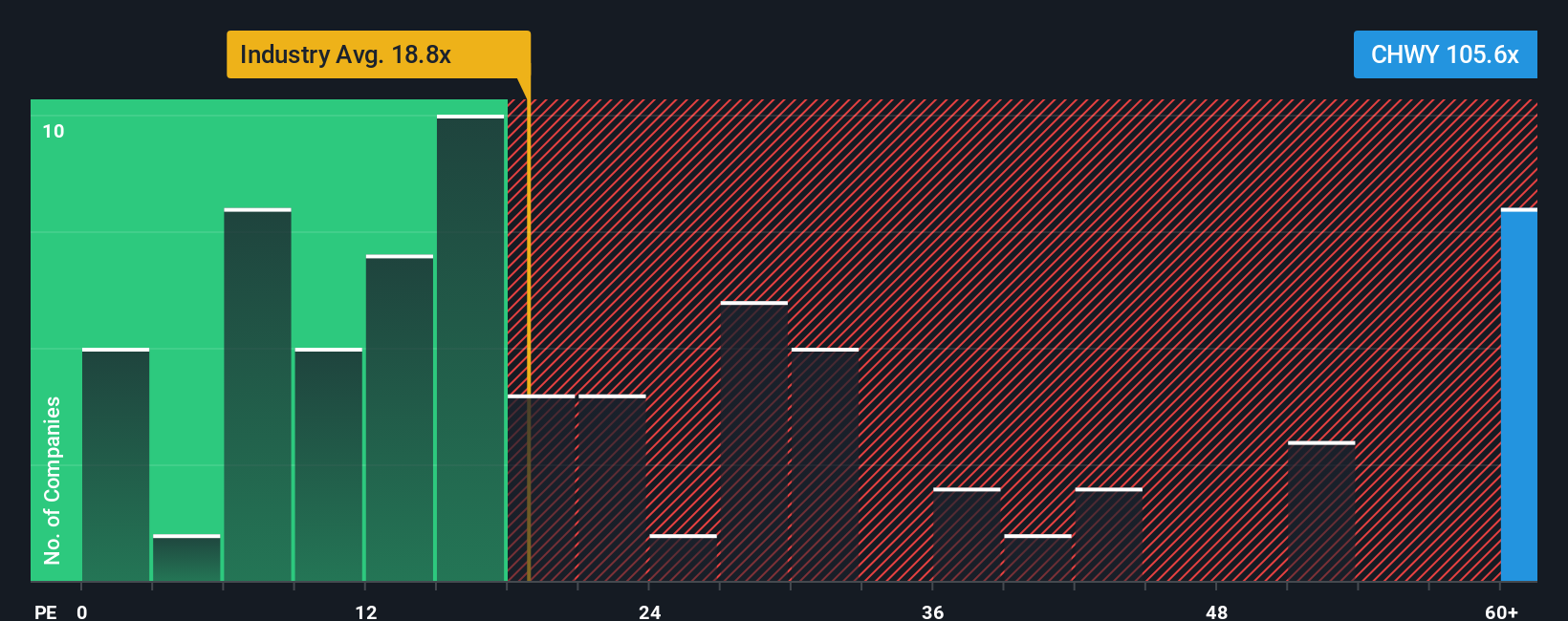

While the narrative fair value suggests Chewy is 27.8% undervalued, its current price implies a steep 65.3 times earnings. That is far above the US Specialty Retail average of 20.3 times and our fair ratio of 28.4 times, which points to real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chewy Narrative

If you see Chewy’s story differently or want to stress test the assumptions yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Chewy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to surface focused, data driven stock ideas tailored to your strategy.

- Target resilient income by scanning these 13 dividend stocks with yields > 3% that can help anchor your portfolio with steadier cash flows.

- Ride powerful innovation trends by reviewing these 24 AI penny stocks that are shaping the future of intelligent technology.

- Seize mispriced opportunities by filtering for these 910 undervalued stocks based on cash flows where market pessimism may have gone too far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报