Is It Too Late To Consider NVIDIA After Its AI Infrastructure Boom?

- If you are wondering whether NVIDIA is still worth buying after its massive run, you are not alone. This breakdown is designed to give you a clear, no nonsense view of the stock's value.

- Despite a blockbuster long term performance, with the share price up 1091.4% over 3 years and 1296.8% over 5 years, more recent moves have been mixed, up 3.4% over the last week but down 3.0% over the last month, while still sitting on a 30.9% gain year to date and 34.4% over the past year.

- Recent headlines have continued to highlight NVIDIA's dominance in AI infrastructure, with major cloud providers and tech giants expanding their use of its GPUs for training and inference workloads. At the same time, ongoing discussions around AI regulation and competition in high performance chips have added nuance to how investors think about the durability of that growth.

- On our checks, NVIDIA currently scores a 2/6 valuation score, suggesting it screens as undervalued on some metrics but not most. That is why we will walk through multiple valuation approaches next and, later in the article, explore an even more powerful way to make sense of what the market is pricing in.

NVIDIA scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NVIDIA Discounted Cash Flow (DCF) Analysis

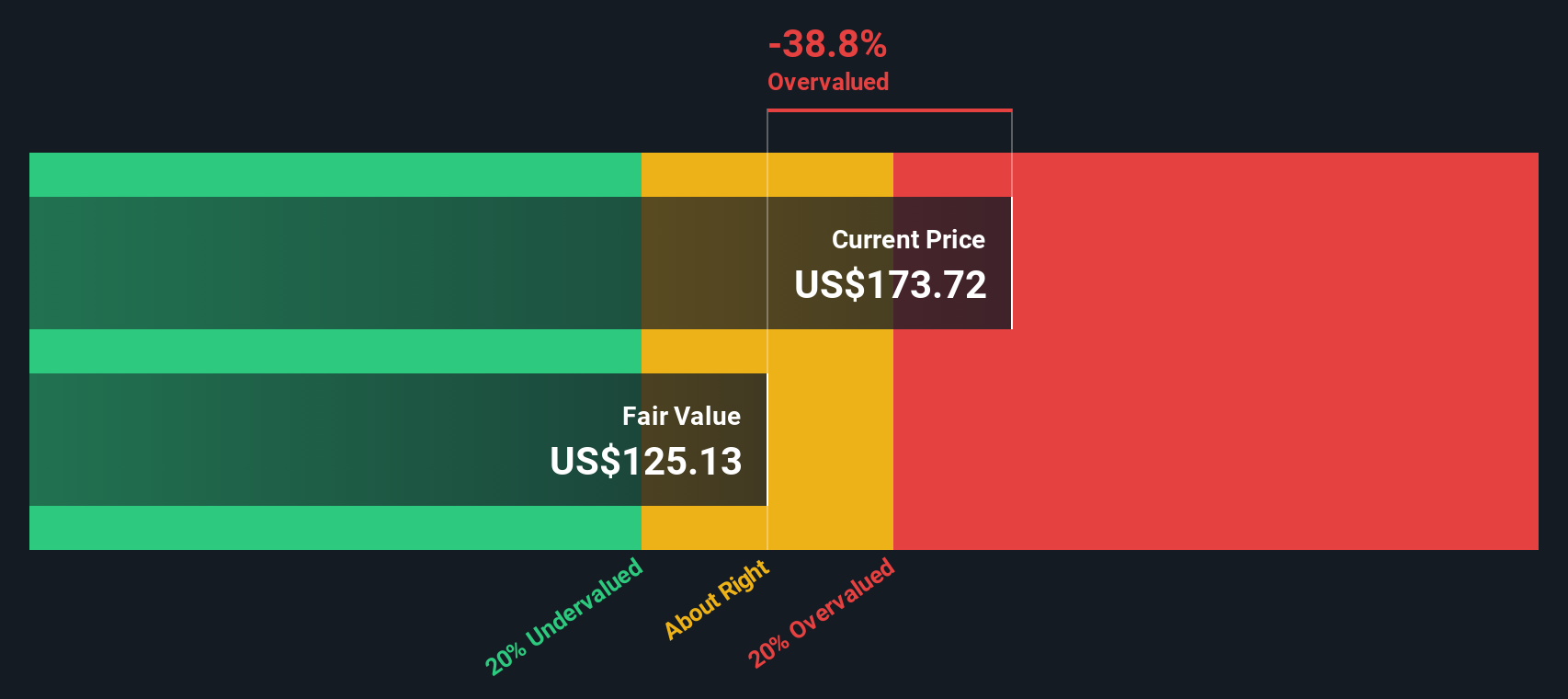

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in dollar terms. For NVIDIA, the model starts with last twelve month Free Cash Flow of about $78.0 billion and uses analyst forecasts and extrapolations to map how that figure could grow over time.

Based on a 2 Stage Free Cash Flow to Equity approach, Simply Wall St combines analyst estimates for the next few years with longer term growth assumptions, reaching projected Free Cash Flow of roughly $287.5 billion by 2030. These future cash flows are then discounted back to arrive at an estimated intrinsic value of $163.38 per share.

Compared to the current share price, this DCF suggests NVIDIA is about 10.8% overvalued, so the market is already pricing in very strong growth and cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests NVIDIA may be overvalued by 10.8%. Discover 910 undervalued stocks or create your own screener to find better value opportunities.

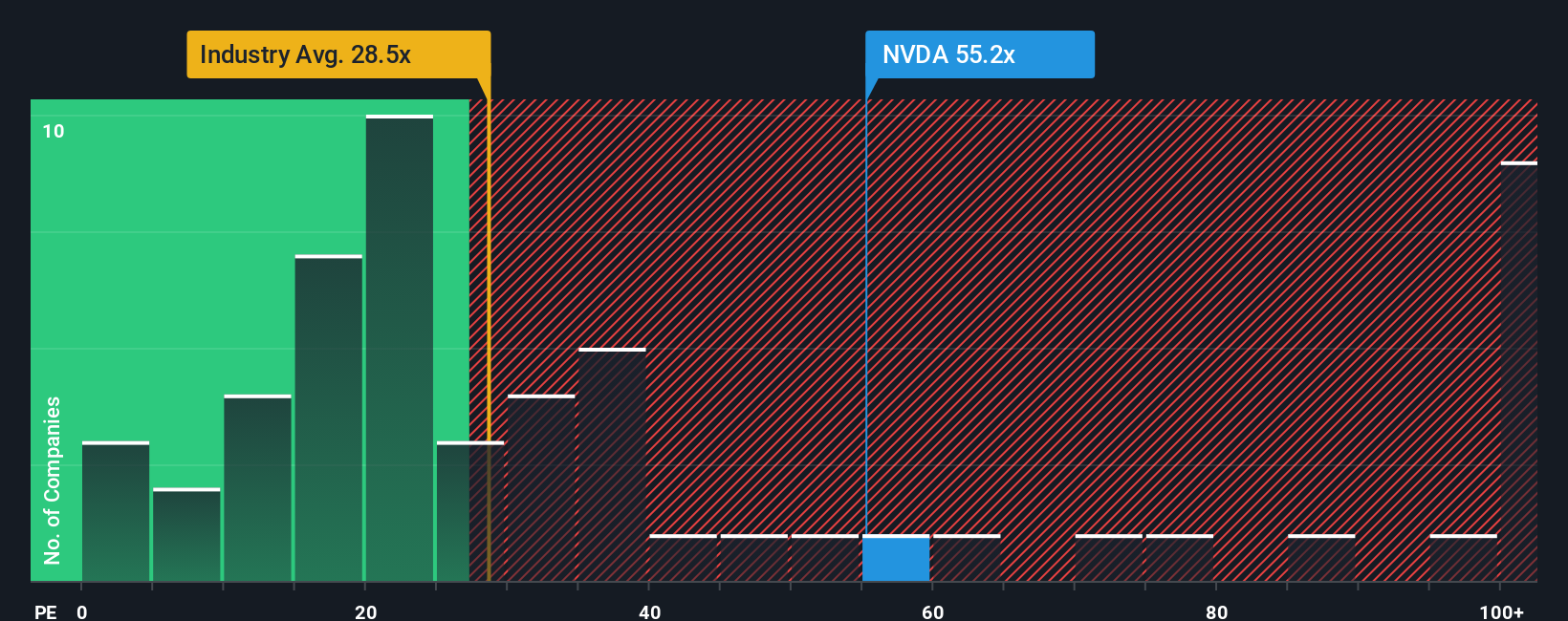

Approach 2: NVIDIA Price vs Earnings

For profitable, mature businesses like NVIDIA, the price to earnings (PE) ratio is a useful lens because it ties what investors pay today directly to the profits the company is generating now and is expected to generate in the future. Higher growth and lower perceived risk usually justify a higher, or more expensive, PE ratio, while slower growth or higher uncertainty typically call for a lower, more conservative multiple.

NVIDIA currently trades on a PE of about 44.33x, which is above the broader Semiconductor industry average of roughly 36.79x but below the peer group average of around 59.88x. Simply Wall St also calculates a proprietary Fair Ratio of 58.21x for NVIDIA, which is the PE level that would be consistent with its earnings growth outlook, profitability, risk profile, industry and market cap.

This Fair Ratio is more informative than a simple comparison to peers or the industry because it adjusts for NVIDIA specific drivers, such as its earnings growth from AI demand, its margins and the risks around regulation and competition. With the current PE sitting below the 58.21x Fair Ratio, the stock appears undervalued on this earnings based view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NVIDIA Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about NVIDIA with the numbers behind your forecast and the fair value you think is reasonable today.

A Narrative on Simply Wall St is your own, structured view of a company, where you spell out how you expect revenue, earnings and margins to develop, and the platform automatically turns that story into a financial forecast and an updated fair value that you can compare to the current share price to decide whether NVIDIA looks like a buy, a hold or a sell.

These Narratives live inside the Community page, are easy to set up and adjust, and are used by millions of investors, with the models recalculating dynamically whenever new information, like earnings or major news, comes in so your fair value view stays current without you needing to rebuild the whole analysis.

For example, one NVIDIA Narrative on the platform currently assumes a fair value near $70 per share based on slower growth and rising competition. Another sees fair value around $345 per share backed by sustained AI leadership and very high profitability, neatly illustrating how different yet data driven perspectives can coexist and help you anchor your own decision.

For NVIDIA however we will make it really easy for you with previews of two leading NVIDIA Narratives:

Fair value: $250.39 per share

Implied discount vs last close: approximately 27.7% undervalued

Forecast revenue growth: 30.75%

- This view assumes sustained, multi year AI infrastructure demand across hyperscalers, sovereign buyers and enterprise customers, supporting compounding data center revenue.

- It also expects NVIDIA to deepen its full stack advantage, from GPUs and networking to CUDA and software, preserving high margins and pricing power as platforms such as Blackwell and Rubin roll out.

- It builds in geopolitical, supply chain and regulatory risks, but concludes that analyst consensus, with a fair value above $250 and a future PE in the mid 30s, still leaves potential upside from current levels.

Fair value: $90.15 per share

Implied premium vs last close: approximately 50.7% overvalued

Forecast revenue growth: 15.93%

- This view argues NVIDIA is priced for AI perfection, with today’s valuation assuming its current dominance in AI hardware and software will persist despite rising competitive and efficiency pressures.

- It highlights emerging threats from custom chips at hyperscalers, alternative accelerators, open source software and efficiency focused players like DeepSeek that could reduce NVIDIA’s share and margins over time.

- It uses a more conservative long term DCF, with slower revenue growth, margin compression and a future PE below 20x, to arrive at a fair value near $90, far below the current share price.

Do you think there's more to the story for NVIDIA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报