Axon Enterprise (AXON) Is Up 5.3% After New AI Safety Deals And 911 Platform Acquisition

- Axon Enterprise recently secured multi-million dollar contracts for its AI-powered body cameras and drones, advanced plans to redeem its 0.50% convertible senior notes due 2027, and expanded its public-safety footprint through the acquisition of Prepared, an AI platform for 911 call centers.

- Together, these moves highlight how Axon is widening its role across public safety workflows while actively reshaping its balance sheet and long-term technology platform.

- Next, we’ll examine how Axon’s new AI-powered contracts and 911 acquisition may influence its long-term investment narrative and growth assumptions.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Axon Enterprise Investment Narrative Recap

To own Axon, you generally have to believe that demand for modern, integrated public safety technology will keep expanding, and that Axon can preserve its edge in AI-enabled hardware and cloud software. The latest AI-focused contracts and the Prepared acquisition reinforce that narrative, but the biggest near term swing factor still looks like how budgets and sentiment toward law enforcement technology evolve, while ongoing regulatory and privacy scrutiny around AI and surveillance remains a key risk.

Among the recent updates, Axon’s move to redeem its 0.50% convertible senior notes due 2027 and allow conversion into cash and stock by early February 2026 stands out as particularly relevant. This step could influence Axon’s capital structure and potential dilution at a time when investors are focused on funding AI, drone, and software growth, and it sits alongside the new AI-powered contracts as part of the near term setup for the stock.

Yet for investors, the real question is how increased regulatory and privacy scrutiny around AI-powered policing tools could affect Axon’s growth and valuation over time...

Read the full narrative on Axon Enterprise (it's free!)

Axon Enterprise's narrative projects $4.6 billion revenue and $476.0 million earnings by 2028.

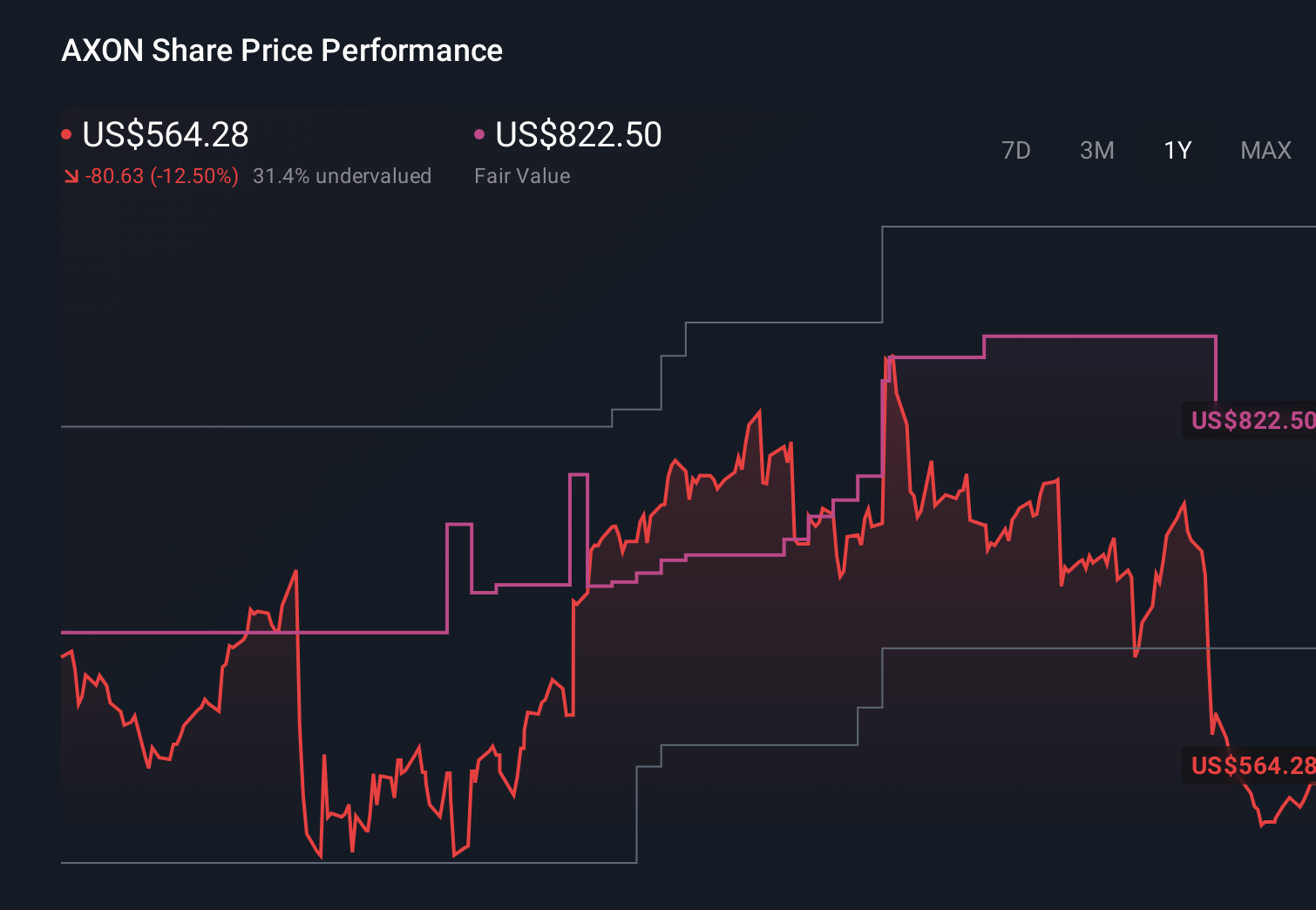

Uncover how Axon Enterprise's forecasts yield a $822.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$397 to US$835, underscoring how far apart individual views on Axon can be. As you weigh those perspectives, it is worth setting them against Axon’s reliance on government contracts and budgets, which can swing with politics and policy choices and may meaningfully influence how the business performs over time.

Explore 9 other fair value estimates on Axon Enterprise - why the stock might be worth 33% less than the current price!

Build Your Own Axon Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Axon Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axon Enterprise's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报