Assessing China Ruyi Holdings (SEHK:136) Valuation After Its HK$2.21b Follow-On Share Offering

China Ruyi Holdings (SEHK:136) just wrapped up a HK$2.21 billion follow on share sale via a subsequent direct listing, a material move that reshapes its capital base and raises fresh funds for expansion.

See our latest analysis for China Ruyi Holdings.

The follow on deal lands after a volatile stretch, with the latest HK$2.27 quote sitting below recent levels. The 90 day share price return of negative 21.72 percent contrasts with a still positive three year total shareholder return of 26.82 percent, a sign that near term momentum has cooled even though the longer term story has not fully broken down.

If this capital raise has you rethinking where growth might come from next, it could be worth scanning fast growing stocks with high insider ownership to spot other potentially overlooked compounders.

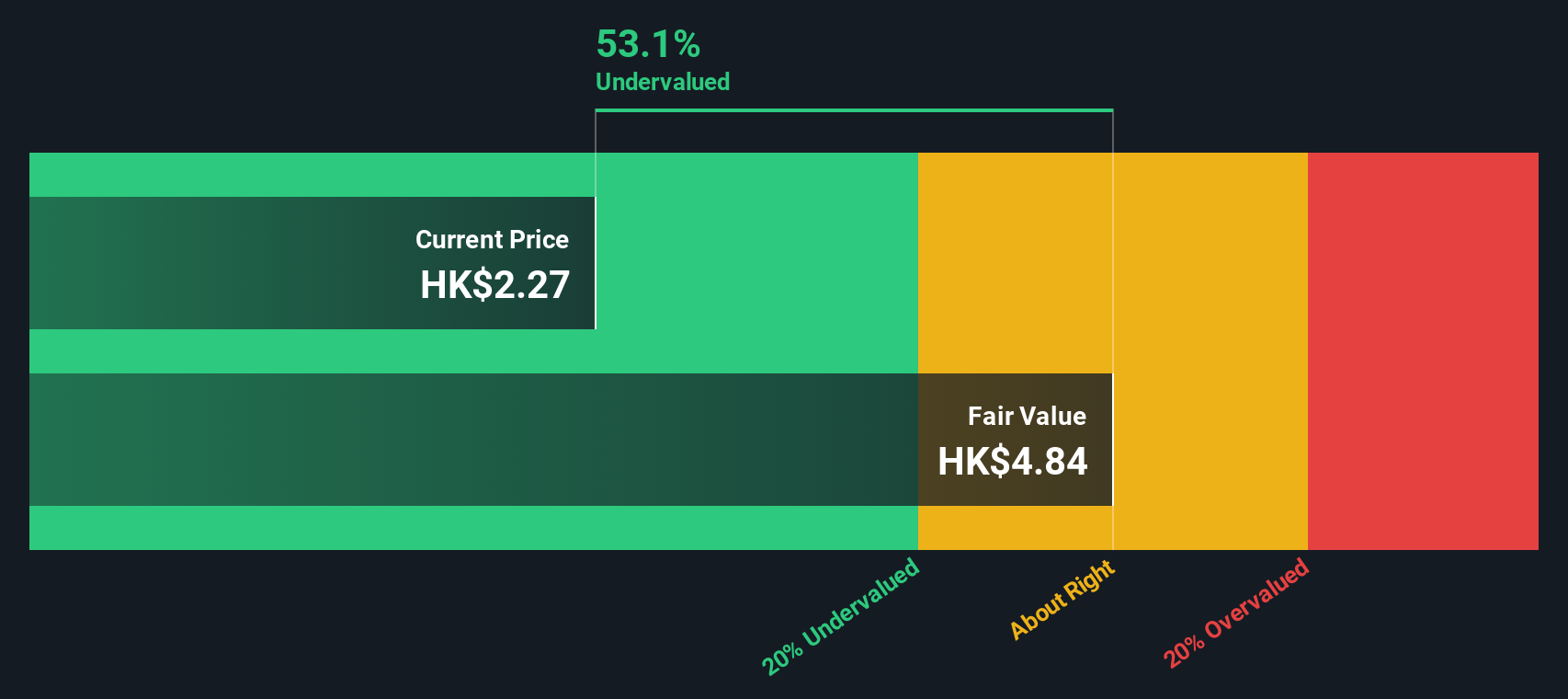

With shares still down over the past year but trading at a steep discount to analyst targets and intrinsic value estimates, is China Ruyi quietly undervalued, or is the market already factoring in its future growth?

Price-to-Earnings of 29.1x: Is it justified?

China Ruyi is trading on a 29.1x price to earnings ratio at HK$2.27, a premium that puts clear expectations on future profitability relative to peers.

The price to earnings multiple compares what investors are currently willing to pay for each dollar of the company’s profits, and it is a common way to value media and entertainment businesses with meaningful earnings. For China Ruyi, this lens is especially relevant because the company has transitioned into stronger profitability with high quality earnings and expanding margins rather than relying purely on top line growth.

Against its own fundamentals, that 29.1x multiple looks demanding, since our analysis suggests a fair price to earnings ratio would be closer to 22.1x. This is a level the market could eventually gravitate toward as expectations normalise. The premium also implies investors are paying up in advance for the company’s forecast earnings growth and margin trajectory, even though its return on equity is currently low and only expected to improve to still modest levels in a few years.

Set beside the wider Hong Kong Entertainment industry, the contrast is stark. China Ruyi’s 29.1x price to earnings is more than double the sector average of 13.9x, underscoring how richly the market currently values its profit outlook compared to most competitors.

Explore the SWS fair ratio for China Ruyi Holdings

Result: Price-to-Earnings of 29.1x (OVERVALUED)

However, persistent share price weakness, despite robust earnings growth and analyst upside, suggests that sentiment and execution risks could still derail the bullish valuation narrative.

Find out about the key risks to this China Ruyi Holdings narrative.

Another View: DCF Points the Other Way

Our DCF model paints a very different picture. At HK$2.27, China Ruyi trades about 53% below our fair value estimate of HK$4.84, suggesting meaningful upside if cash flows materialise as forecast. Is the market overly cautious, or is the model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Ruyi Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Ruyi Holdings Narrative

If you see the story differently, or simply prefer to dig into the numbers yourself, you can craft a personalised view in just minutes: Do it your way.

A great starting point for your China Ruyi Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want more potential winners on your radar, use the Simply Wall Street Screener now so you do not miss the next big opportunity.

- Capitalize on overlooked value by targeting these 913 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has mispriced.

- Ride powerful technology tailwinds by focusing on these 24 AI penny stocks positioned at the front line of artificial intelligence innovation.

- Secure growing income streams by zeroing in on these 13 dividend stocks with yields > 3% that can strengthen your portfolio’s long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报