Reassessing Vaisala Oyj’s Valuation After Recent Climate and Industrial Measurement Expansion

- If you are wondering whether Vaisala Oyj is quietly turning into a bargain after a choppy run on the Helsinki market, this piece will walk you through whether the current price really matches the quality of the business.

- The stock has inched up 0.5% over the last week and 5.0% over the last month, but is still down 12.1% year to date and 6.0% over the past year, despite delivering 15.1% and 23.2% returns over the last 3 and 5 years.

- Recent headlines have focused on how Vaisala continues to deepen its role in weather, environment and industrial measurement solutions, from advanced sensing technologies for climate and air-quality monitoring to reliable instruments used in critical industrial processes. These developments help explain why sentiment can swing as investors reassess the company as a long term compounder rather than just a cyclical tech name.

- Right now, Vaisala scores a modest 2 out of 6 on our undervaluation checks. We will break down what that means through discounted cash flow, multiples and other lenses, before finishing with a more nuanced way to think about valuation that goes beyond any single model.

Vaisala Oyj scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Vaisala Oyj Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes the cash that a business is expected to generate in the future and discounts those projections back into today’s euros, aiming to estimate what the company is worth right now.

For Vaisala Oyj, the latest twelve month Free Cash Flow is about €68.5 million. Analysts expect Free Cash Flow to rise to roughly €75.2 million by 2026 and €86.2 million by 2027, with further growth to about €116.0 million by 2035. Estimates beyond the next few years are extrapolated using Simply Wall St’s two stage Free Cash Flow to Equity model rather than direct analyst forecasts.

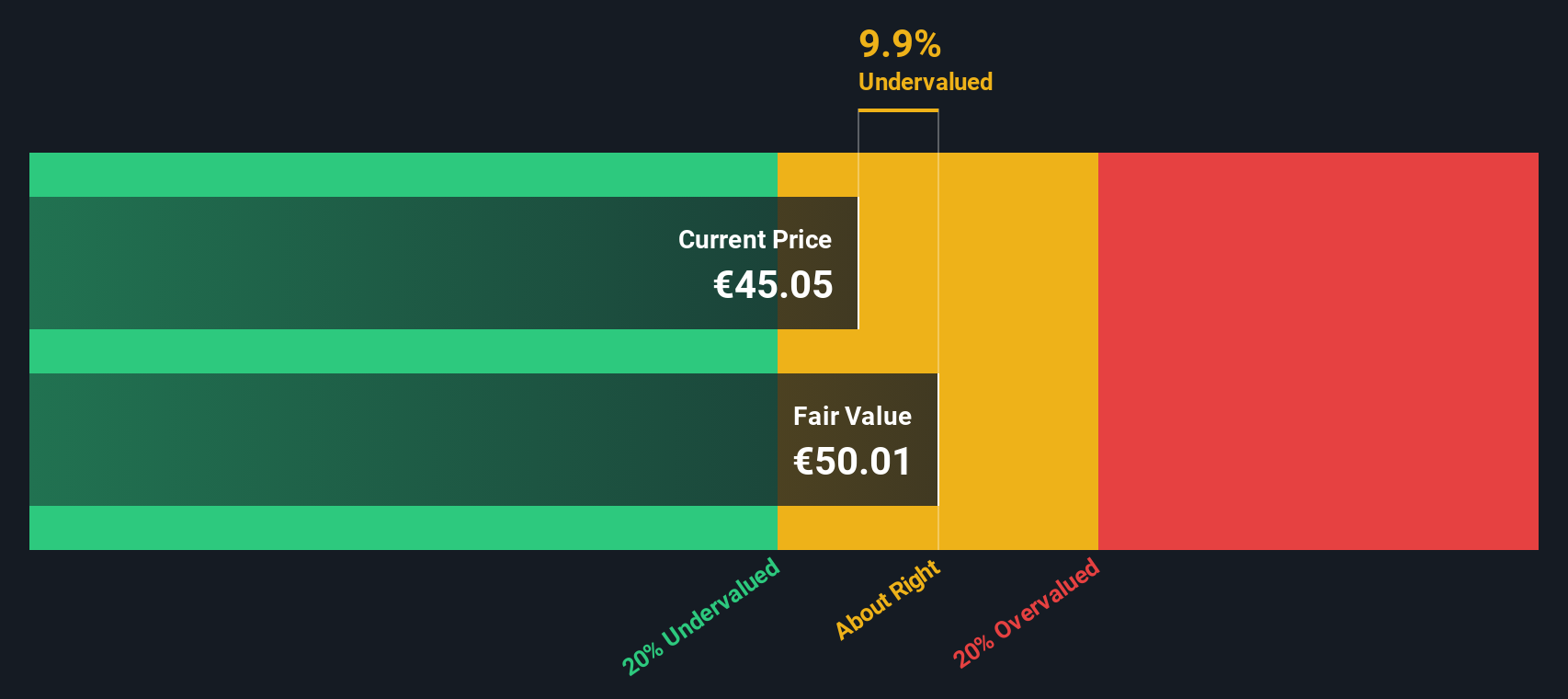

When all those projected cash flows are discounted back, the intrinsic value comes out at around €48.83 per share. This implies the stock is trading at an 11.1% discount to that estimate, suggesting the market is being somewhat cautious about Vaisala’s long term cash generation and growth durability.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vaisala Oyj is undervalued by 11.1%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Vaisala Oyj Price vs Earnings

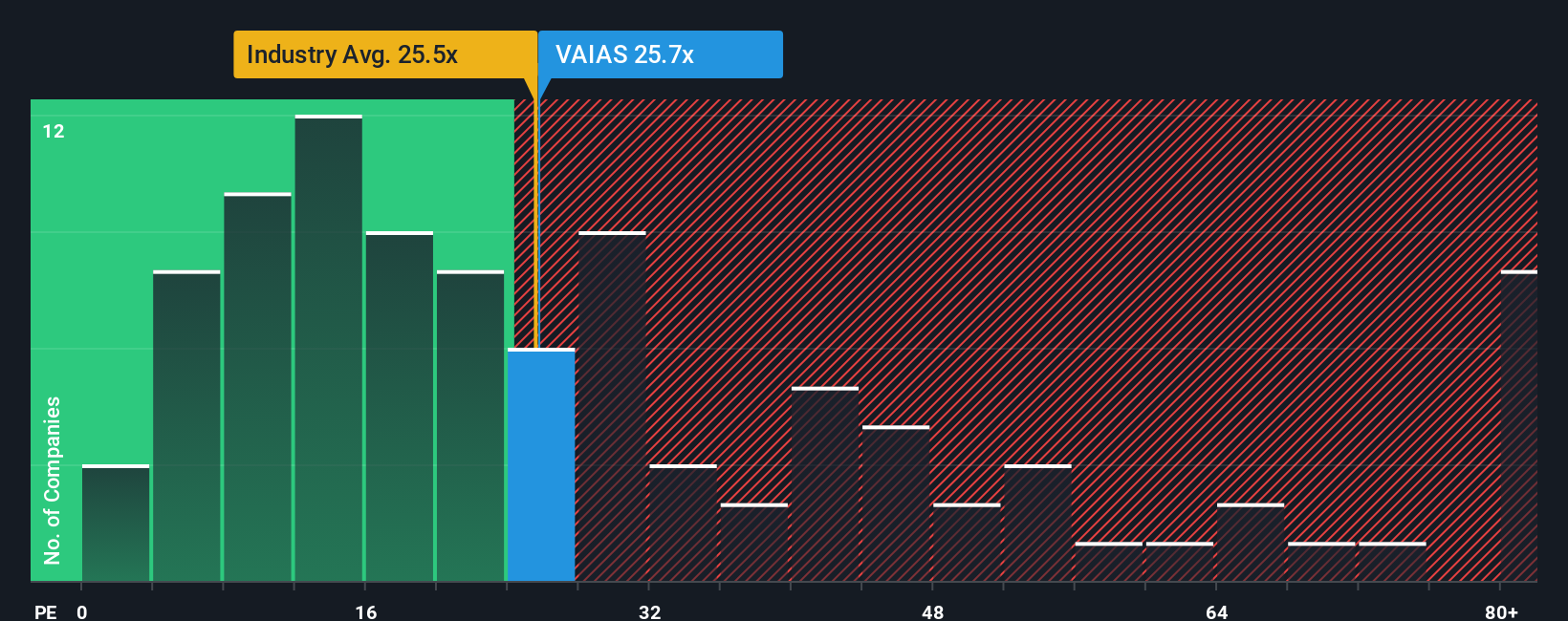

For profitable companies like Vaisala, the price to earnings (PE) ratio is a practical way to gauge whether investors are paying a reasonable price for each euro of profit. A higher PE can be justified if markets expect faster, more reliable growth and see lower risk in those future earnings. A lower PE usually reflects weaker growth, higher uncertainty, or both.

Vaisala currently trades at about 25.0x earnings, roughly in line with the broader Electronic industry average of 25.4x but meaningfully above the peer group average of 19.6x. To go a step further, Simply Wall St calculates a proprietary Fair Ratio of 20.3x for Vaisala, which reflects its specific mix of earnings growth, risk profile, profit margins, industry positioning and market capitalization. This Fair Ratio framework is more tailored than a simple comparison with peers or industry averages because it adjusts for the company’s own fundamentals rather than assuming all Electronic stocks deserve the same multiple. On this basis, Vaisala’s current 25.0x multiple sits notably above the 20.3x Fair Ratio, indicating the shares look somewhat expensive relative to what its fundamentals would usually warrant.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vaisala Oyj Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple framework that lets you attach a clear story and set of assumptions to the numbers behind a company’s fair value, from its future revenue, earnings and margins through to the price you think is justified today.

A Narrative on Simply Wall St links three things together: the business story you believe in, the financial forecast that flows from that story, and the fair value estimate that results from those forecasts, so you can easily see whether the current share price is above or below what your story implies.

These Narratives are available on the Community page of Simply Wall St, where millions of investors can browse, create and update them as new information, such as earnings releases or major news, changes the outlook and automatically refreshes the implied fair value.

For example, one Vaisala Narrative might assume climate and digitalization tailwinds drive revenue to about €692 million by 2028 and justify a fair value near €53.8 per share. A more cautious Narrative might expect slower growth, lower margins and a fair value below today’s price, helping each investor decide how Vaisala Oyj fits their own investment perspective.

Do you think there's more to the story for Vaisala Oyj? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报