Does Simply Good Foods’ Slumping Share Price Signal a Long Term Opportunity in 2025?

- If you are wondering whether Simply Good Foods is a bargain or a value trap at today’s price, you are not alone. This piece will walk through what the numbers are really saying about the stock.

- The share price has nudged up 4.1% over the last week and 1.3% over the last month, but it is still down 49.7% year to date and 48.8% over the past year, which naturally raises questions about both risk and recovery potential.

- Recent headlines have focused on how shifting consumer preferences in the nutrition and snack space, plus competition from both legacy food brands and newer wellness players, are forcing companies like Simply Good Foods to sharpen their strategy. Investors are watching closely as the company leans into brand positioning and distribution initiatives to defend its niche and potentially reignite growth.

- Our valuation framework gives Simply Good Foods a 4 out of 6 value score, suggesting it screens as undervalued on most of our checks. Next we will unpack how different valuation methods arrive at that view, before finishing with a more intuitive way to make sense of what the stock may be worth.

Find out why Simply Good Foods's -48.8% return over the last year is lagging behind its peers.

Approach 1: Simply Good Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today, using a required rate of return. For Simply Good Foods, the model starts with last twelve month Free Cash Flow of about $163.6 million and then applies analyst forecasts and longer term assumptions to map out how that figure could evolve.

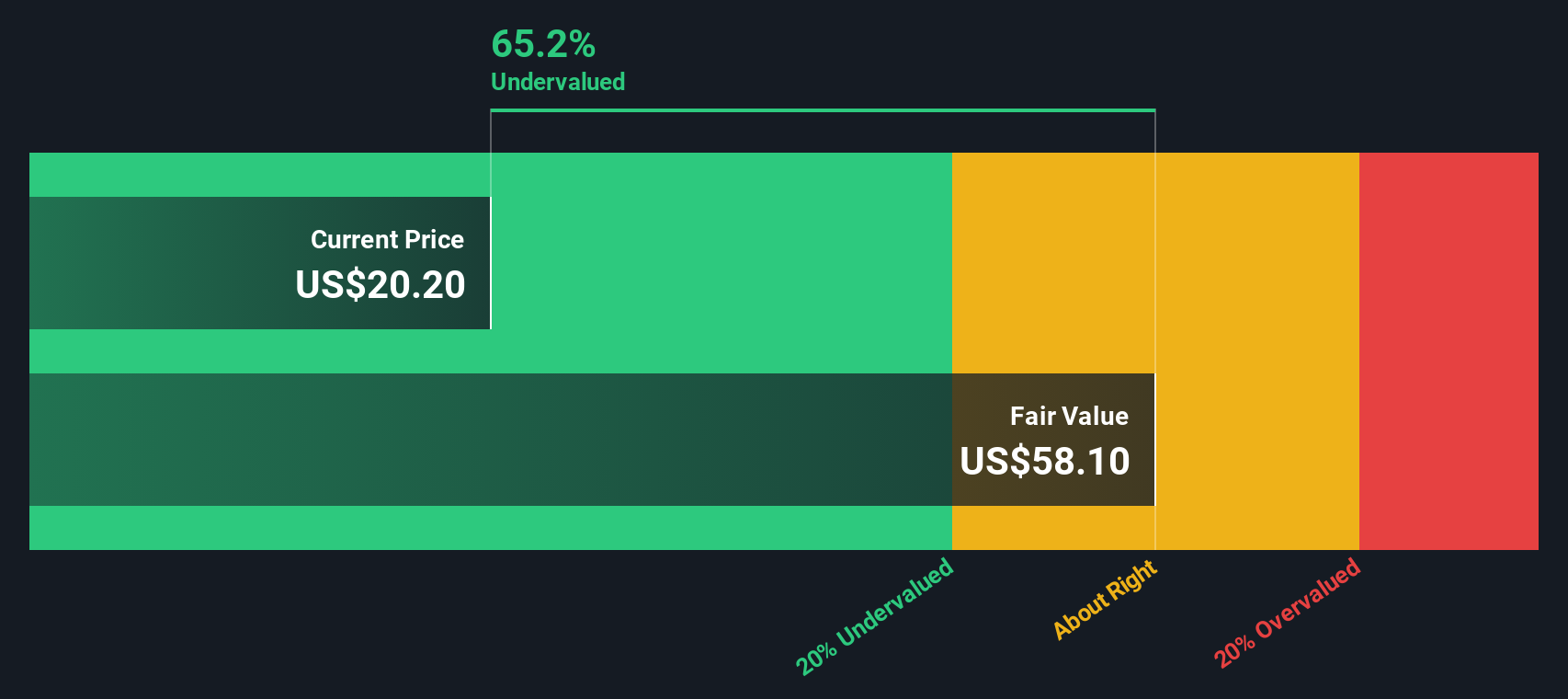

Analysts expect Free Cash Flow to rise to around $177.2 million by 2026 and $213.3 million by 2027, with further growth and modest tapering beyond that, reaching a projected $240 million by 2030. Simply Wall St extrapolates the later years once explicit analyst estimates run out, then discounts each of those projected cash flows back to today using its 2 Stage Free Cash Flow to Equity framework. On this basis, the intrinsic value comes out at roughly $52.12 per share.

Compared with the current share price, this implies the stock is about 62.3% undervalued according to the DCF model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Simply Good Foods is undervalued by 62.3%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Simply Good Foods Price vs Earnings

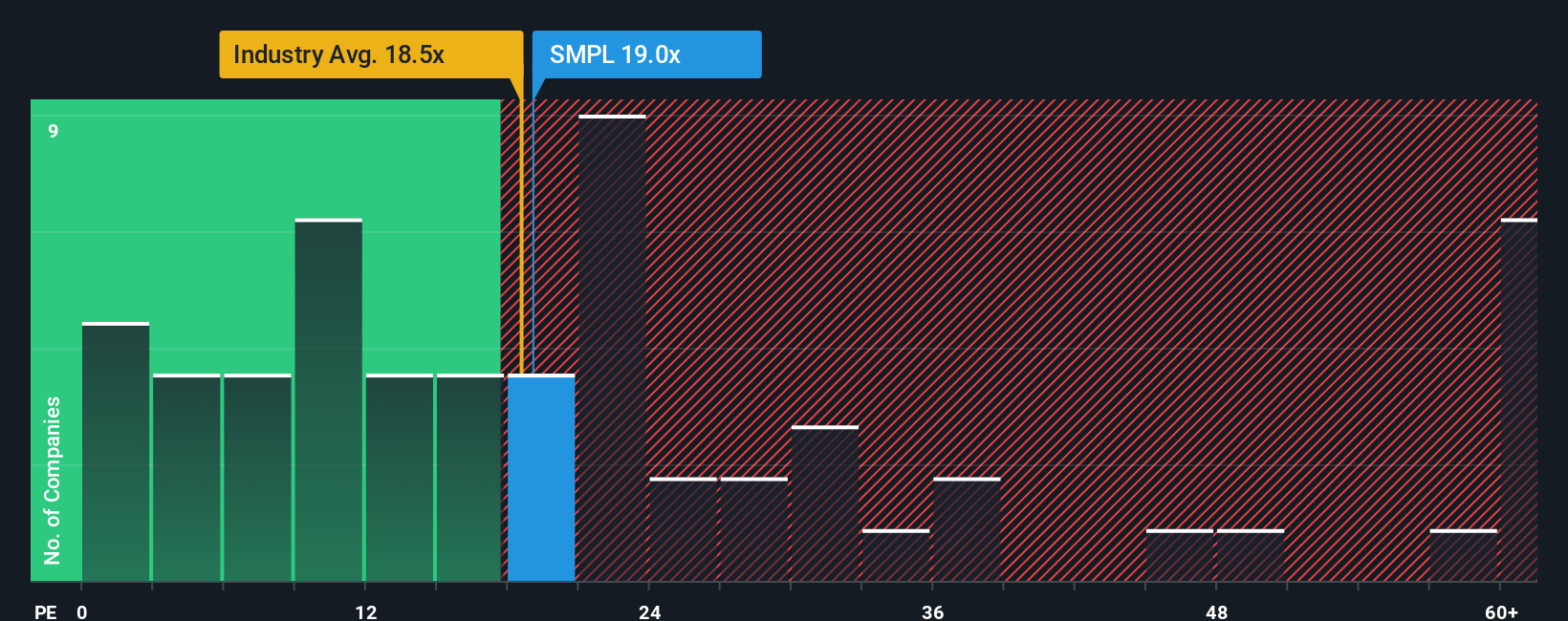

For a consistently profitable business like Simply Good Foods, the price to earnings ratio is a useful way to judge valuation because it links what investors pay today directly to the profits the company is generating. In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE multiple, while slower growing or riskier firms usually deserve a discount.

Simply Good Foods currently trades on a PE of about 18.9x, slightly below the broader Food industry average of roughly 19.4x and above the peer group average of around 11.4x. While these simple comparisons are helpful, they do not fully capture company specific drivers such as earnings growth outlook, margins, size and balance sheet strength.

This is where Simply Wall St’s Fair Ratio comes in. Its proprietary model estimates that a PE of about 20.2x would be reasonable for Simply Good Foods given its growth profile, profitability, industry positioning, market cap and risk factors. Because this Fair Ratio is tailored to the company, it provides a more nuanced anchor than raw peer or industry multiples. With the current PE of 18.9x sitting below the 20.2x Fair Ratio, the shares screen as modestly undervalued on this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Simply Good Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page that lets you turn your view of a company into a simple story linked to a financial forecast and a fair value. With Narratives, you can describe what you think will happen to revenue, earnings and margins, see what that implies for fair value and compare it to today’s price to decide whether to buy, hold or sell. The platform keeps your Narrative updated as fresh news or earnings arrive. For example, one investor might build a bullish Simply Good Foods Narrative around Quest and OWYN driving faster growth and a fair value closer to 43 dollars, while another takes a more cautious view that Atkins weakness and integration risks justify a fair value nearer 32 dollars. This shows how different perspectives on the same facts can lead to very different but clearly quantified decisions.

Do you think there's more to the story for Simply Good Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报