Dutch Bros (BROS) Valuation Check as KeyBanc’s Overweight Call and LA Expansion Fuel Fresh Investor Optimism

KeyBanc’s fresh coverage of Dutch Bros (BROS) with an Overweight rating, landing right as the chain opens its first Los Angeles shop, has given the stock a clear sentiment jolt.

See our latest analysis for Dutch Bros.

The KeyBanc call lands on top of a strong run, with Dutch Bros posting a 29.09% 1 month share price return and a 19.92% 1 year total shareholder return, suggesting momentum is still building as new markets like Los Angeles, North Carolina, Illinois and Ohio come online.

If this kind of expansion story has your attention, it could be a good moment to see what else is brewing in the market and explore fast growing stocks with high insider ownership.

With Dutch Bros shares up sharply and analysts still seeing upside to targets, the real question now is whether the current price underestimates its long runway or if the market is already baking in years of growth.

Most Popular Narrative Narrative: 15.2% Undervalued

With Dutch Bros last closing at $64.83 against a narrative fair value in the mid $70s, the story leans toward an optimistic long term path.

The evolving menu, featuring specialty beverages, energy drinks, and an expanded food pilot, taps into the consumer trend toward premiumization and customization in beverages; these higher margin offerings and incremental morning daypart food sales support higher average ticket sizes and future margin or earnings growth.

Curious how ambitious revenue ramps, rising margins, and a lofty future earnings multiple can still argue for upside from here? The full narrative lays out the bold math.

Result: Fair Value of $76.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor cost inflation and softer industry traffic could pressure margins and comps, which may force analysts to reassess the premium multiple on Dutch Bros.

Find out about the key risks to this Dutch Bros narrative.

Another Lens on Valuation

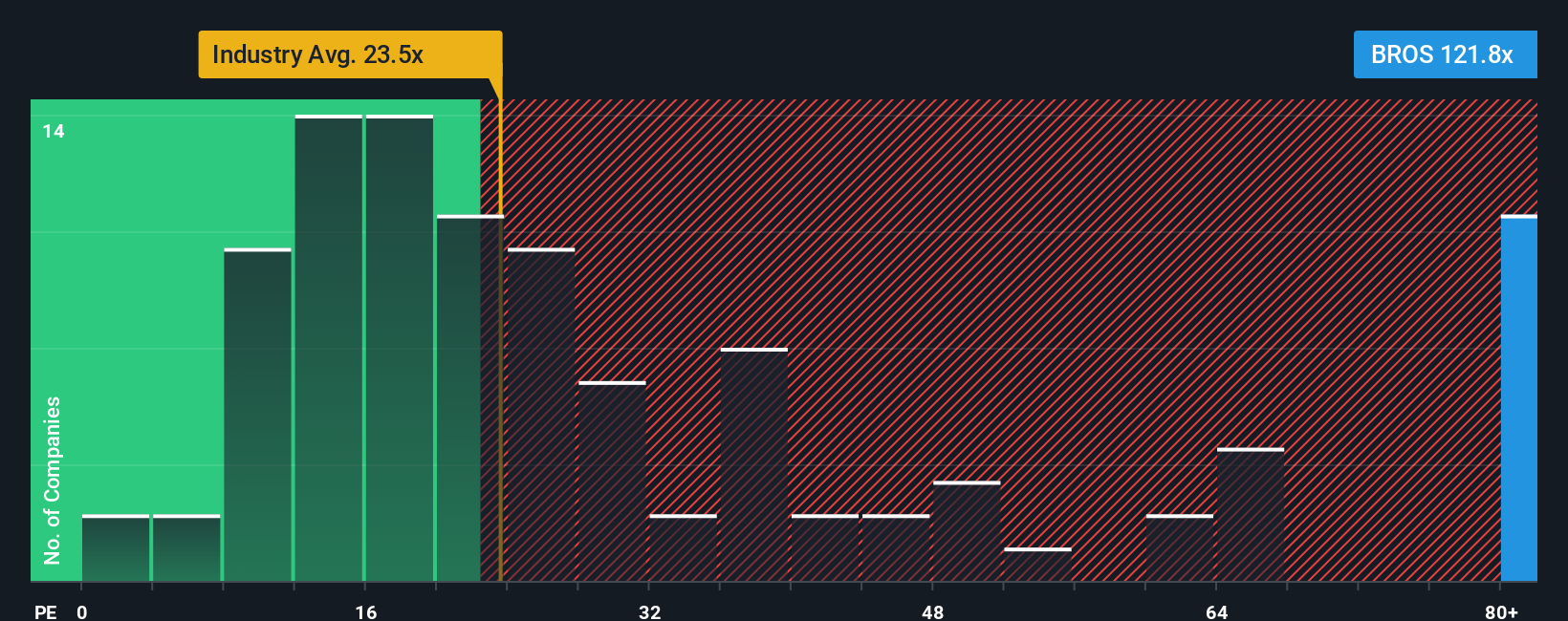

While the narrative fair value points to upside, classic valuation checks tell a tougher story. Dutch Bros trades on a P/E of about 132.6 times, versus 29.6 times for peers and a fair ratio of 35.9 times, which flags meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Dutch Bros Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a personalized Dutch Bros view in minutes: Do it your way.

A great starting point for your Dutch Bros research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before the next opportunity runs away from you, put your strategy to work with fresh stock ideas from our powerful Simply Wall St screener tools.

- Capture overlooked value by targeting quality companies trading below intrinsic worth using these 912 undervalued stocks based on cash flows.

- Ride the next wave of intelligent automation by focusing on businesses at the forefront of machine learning and neural networks through these 24 AI penny stocks.

- Lock in potential income streams by filtering for stable businesses offering robust payouts with these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报