Broadridge Financial Solutions (BR): Has Recent Share Price Consolidation Created a Valuation Opportunity?

Broadridge Financial Solutions (BR) has been quietly treading water, with the stock roughly flat over the past month but down about 6% in the past 3 months, despite steady earnings growth.

See our latest analysis for Broadridge Financial Solutions.

That sideways share price over the past few months sits against a far stronger backdrop, with a modestly positive 1 year total shareholder return and a powerful 3 year total shareholder return of 76.63%. This suggests that momentum is cooling rather than reversing.

If Broadridge’s steady profile has you thinking about where growth and conviction might be stronger, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings still climbing, analyst targets sitting well above today’s price, and a solid long term track record, the question now is simple: is Broadridge a buy at a discount, or is future growth already priced in?

Most Popular Narrative Narrative: 16.1% Undervalued

With Broadridge closing at 225.96 dollars against a most popular narrative fair value near 269.38 dollars, the story leans toward underappreciated compounding.

The company's increasing share of SaaS and recurring subscription models, combined with consistently high client retention rates (97–98%), is enhancing the predictability and resilience of revenues and earnings, and positioning Broadridge for sustainable EPS growth and ongoing dividend increases.

Curious how modest growth assumptions can still justify a premium style valuation multiple and a higher fair value than today, without any heroics in margins or discounts? The narrative breaks down the earnings runway step by step. Want to see which forecasts really carry the valuation load, and how sensitive that target is to even small changes in profitability and growth expectations? Dive in to see the full chain of assumptions behind that fair value call.

Result: Fair Value of $269.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the normalization of event driven revenue and longer sales cycles in key technology segments could easily dull that optimistic earnings and valuation trajectory.

Find out about the key risks to this Broadridge Financial Solutions narrative.

Another Lens on Valuation

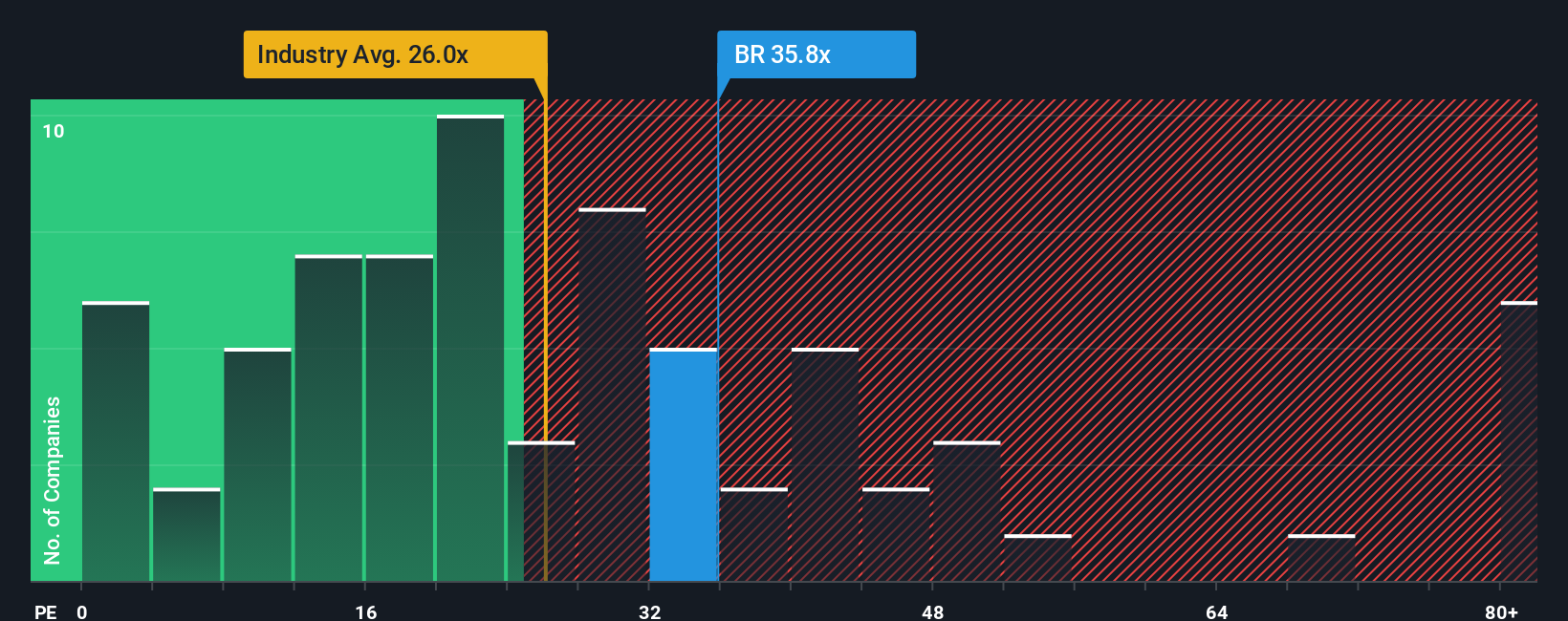

While narratives and analyst targets point to upside, our look at Broadridge’s price to earnings ratio says something different. At 28.5 times earnings, the stock trades richer than the US Professional Services industry at 24.2 times and peers at 20.9 times, and even sits above its own fair ratio of 27.9 times. That kind of premium can reward you if growth stays strong, but it also leaves less room for disappointment if the story cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Broadridge Financial Solutions Narrative

If this view does not quite fit your thinking, or you prefer to lean on your own analysis, you can build a fresh perspective in under three minutes, Do it your way.

A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about sharpening your edge beyond Broadridge, use the Simply Wall St Screener now so you do not miss high quality opportunities.

- Capture potential multi baggers early by scanning these 3625 penny stocks with strong financials that already show stronger fundamentals than the typical speculative name.

- Position ahead of the next productivity boom by targeting these 24 AI penny stocks that pair real revenue growth with credible technology moats.

- Lock in value opportunities before the crowd notices by filtering for these 912 undervalued stocks based on cash flows that still trade at meaningful discounts to their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报