How Samsung’s 105% Rally in 2024 Aligns With Its Cash Flow Potential

- If you are wondering whether Samsung Electronics is still a buy after its huge run, you are not alone. This article is going to unpack what the current price might really be telling us.

- The stock has pulled back slightly in the last week, down 2.4%, but it is still up 5.7% over the past month, 99.1% year to date, and an eye catching 105.3% over the last year.

- These moves have come as Samsung remains at the center of big themes in tech, from AI driven demand for advanced memory to ongoing competition in smartphones and semiconductors. Investors are also watching how the company navigates capital spending and global supply chain shifts, which can quickly change market expectations around future growth.

- On our checks, Samsung scores a 3 out of 6 valuation score, suggesting some areas of undervaluation but not across the board. We will walk through what that means under different valuation approaches before finishing with an even more powerful way to think about the stock's true worth.

Approach 1: Samsung Electronics Discounted Cash Flow (DCF) Analysis

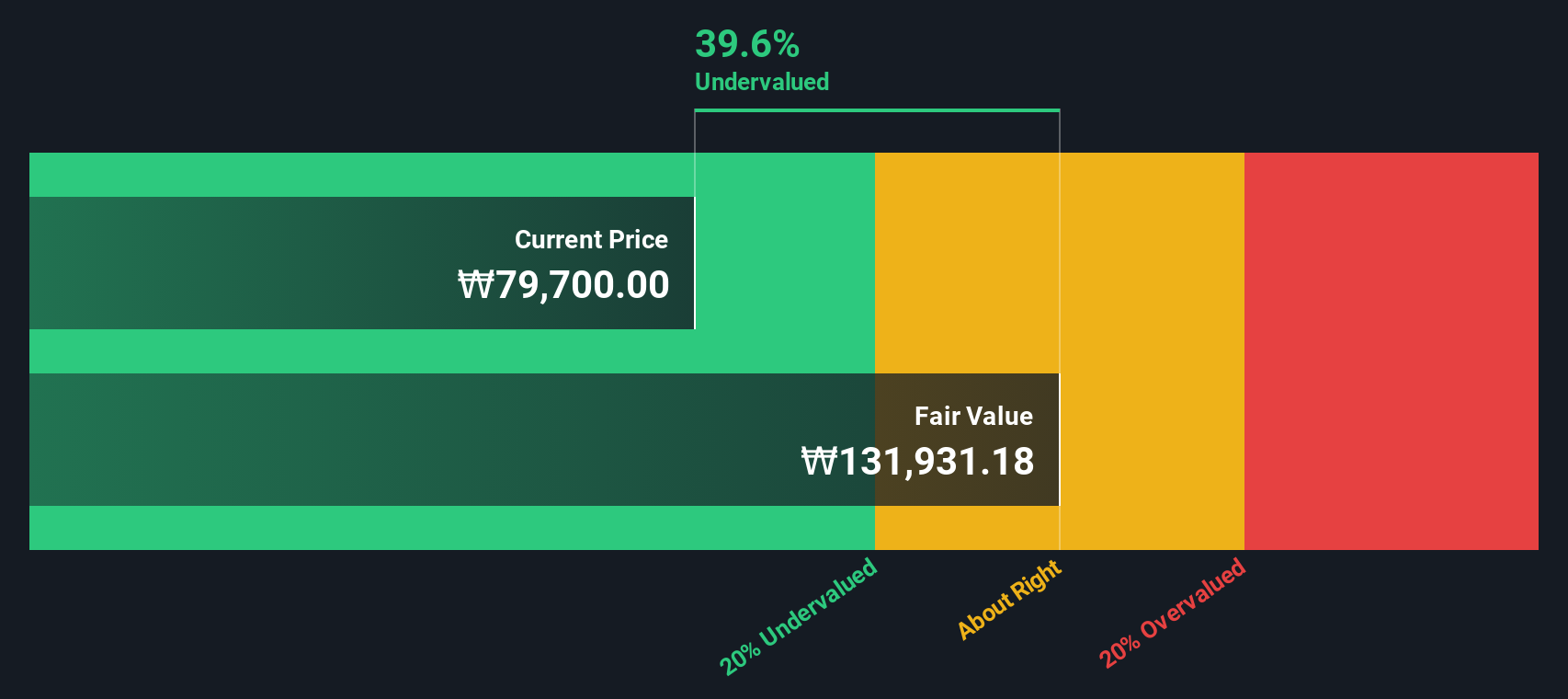

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Samsung Electronics, this involves taking expected Free Cash Flow in coming years and adjusting for the risk and time value of money.

Samsung’s latest twelve month Free Cash Flow is about ₩16.5 trillion. Analysts, together with Simply Wall St extrapolations, see this rising steadily over the next decade. By 2035, projected Free Cash Flow is around ₩120.5 trillion, based on expectations of growth as memory and semiconductor demand expand. These projected cash flows, when discounted back using a 2 Stage Free Cash Flow to Equity model, yield an estimated intrinsic value of roughly ₩241,022 per share.

Compared with the current share price, this implies the stock is trading at about a 55.9% discount to its calculated intrinsic value. This suggests the market is still pricing Samsung conservatively relative to its long term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Samsung Electronics is undervalued by 55.9%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Samsung Electronics Price vs Earnings

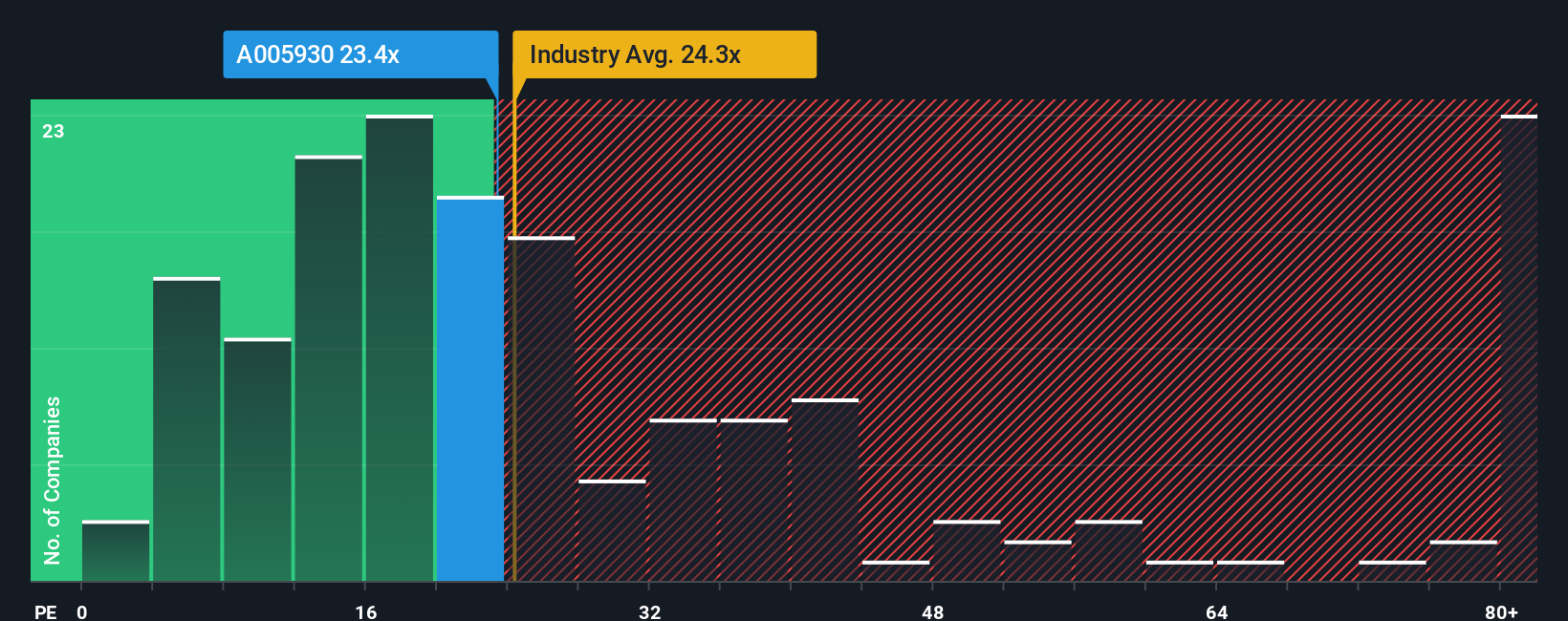

For a profitable business like Samsung Electronics, the price to earnings (PE) ratio is a straightforward way to gauge how much investors are willing to pay today for each unit of current earnings. A higher PE can be justified when investors expect stronger growth or see the earnings stream as relatively low risk, while slower or more volatile growth usually warrants a lower, more conservative multiple.

Samsung currently trades on a PE of about 24.3x, a premium to both the broader Tech industry average of roughly 22.6x and the peer group average of around 14.7x. On the surface, that might suggest the stock is a bit expensive compared to many of its competitors.

However, Simply Wall St’s Fair Ratio framework goes a step further. It estimates what a reasonable PE should be, given Samsung’s specific earnings growth outlook, profitability, industry, market cap, and risk profile. For Samsung, this Fair Ratio comes out at about 47.9x, far above the current 24.3x, implying the market is assigning a discount rather than an aggressive premium based on its fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Samsung Electronics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple stories you create about Samsung that connect your view of its future revenue, earnings and margins to a financial forecast and, ultimately, to a fair value estimate you can compare with the current share price on Simply Wall St’s Community page. Narratives turn the numbers into something intuitive, by letting you say, for example, that you believe AI driven chip demand will push Samsung’s earnings toward the higher end of analyst expectations and justify a fair value closer to the most bullish price target of around ₩100,000, or, alternatively, that rising competition and geopolitical risks mean earnings will land nearer the lowest estimate and support a more cautious fair value near ₩58,500. These Narratives are dynamic and automatically refresh as new news, earnings and forecasts arrive, helping you quickly see whether your story still holds up and whether the gap between your Fair Value and the current market price suggests it is time to buy, hold or sell.

Do you think there's more to the story for Samsung Electronics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报