Energy Transfer (ET) valuation after pivot from Lake Charles LNG to Transwestern Pipeline expansion

Energy Transfer (ET) just made a clear trade off, shelving its Lake Charles LNG export project to pour more capital into expanding the Transwestern Pipeline, a pivot toward demand driven growth in the Desert Southwest.

See our latest analysis for Energy Transfer.

That pivot comes after a choppy stretch, with the share price at $16.39 and a weak year to date share price return contrasting with a still impressive five year total shareholder return of nearly threefold. This suggests long term momentum is intact even if near term sentiment is cautious.

If this kind of infrastructure shift has you rethinking your watchlist, it could be a good moment to discover fast growing stocks with high insider ownership.

With the pivot toward higher return pipeline growth, a near 8 percent yield, and the stock trading roughly 30 percent below consensus targets, is Energy Transfer quietly undervalued, or is the market already discounting that future growth?

Most Popular Narrative Narrative: 23.9% Undervalued

With the most followed narrative putting fair value near $21.55 against Energy Transfer's $16.39 close, the implied upside rests on very specific growth math.

Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

To value all of this in today's terms, we will use a discount rate of 8.57%, as per the Simply Wall St company report.

Curious how modest volume growth, richer margins, and a higher future earnings multiple can still add up to a double digit upside case? See how this narrative connects the dots and what has to go right, in lockstep, to justify that target.

Result: Fair Value of $21.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer Bakken and Permian volumes, along with potential regulatory delays on big-ticket pipeline projects, could quickly erode the assumed earnings and valuation upside.

Find out about the key risks to this Energy Transfer narrative.

Another Lens on Value

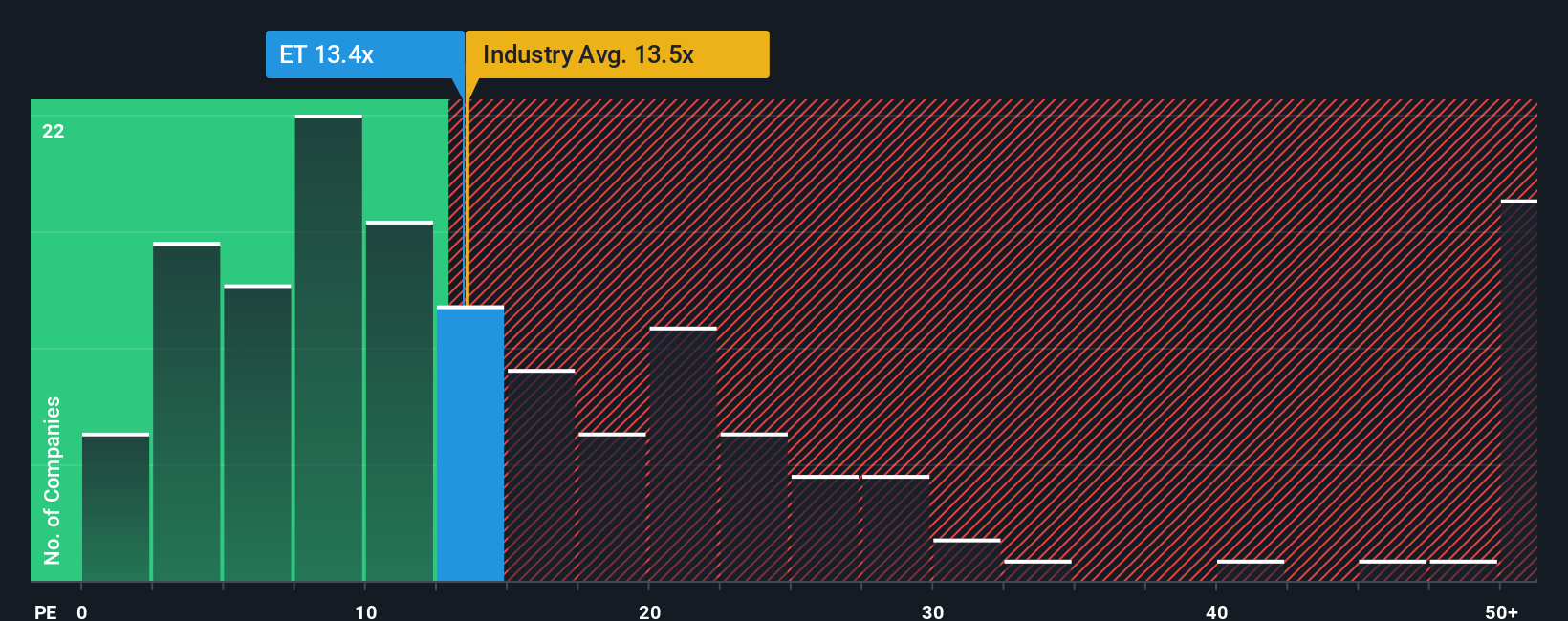

Step away from fair value models and Energy Transfer looks far less obviously cheap. At 13 times earnings, it trades slightly above the US oil and gas average of 12.8 times and well below a fair ratio of 21.9 times, leaving investors to judge whether that discount signals opportunity or a warning about growth and balance sheet risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Energy Transfer Narrative

If this view does not quite match your own, or you prefer to dig into the numbers yourself, you can build a custom narrative in under three minutes: Do it your way.

A great starting point for your Energy Transfer research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next smart idea?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover focused stock ideas that match your strategy.

- Capture high potential turnaround stories by scanning these 3625 penny stocks with strong financials that pair tiny market caps with surprisingly resilient fundamentals.

- Ride structural tailwinds in automation, data, and machine learning by targeting these 24 AI penny stocks positioned to benefit from accelerating AI adoption.

- Lock in quality at a discount by filtering for these 13 dividend stocks with yields > 3% that combine reliable income with room for capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报