Etsy (ETSY): Valuation Check After New $750 Million Buyback and Leadership Overhaul

Etsy (ETSY) shares climbed after the board approved a fresh 750 million dollar buyback, lifting total potential repurchases to nearly 1 billion dollars and announcing a revamped leadership lineup.

See our latest analysis for Etsy.

The new buyback plan and leadership refresh land at a delicate moment, with Etsy’s roughly 2 percent year to date share price return contrasting sharply with a five year total shareholder return of about negative 71 percent. This suggests today’s pop could be early momentum rather than a confirmed turnaround.

If this kind of strategic reset has you rethinking your watchlist, it might be worth scanning for other ecommerce and platform names using fast growing stocks with high insider ownership as potential next wave candidates.

With shares still trading at a steep discount to analyst targets and intrinsic value estimates even after the buyback bounce, the key debate now is clear: is Etsy a mispriced recovery story, or are markets already baking in its next leg of growth?

Most Popular Narrative Narrative: 20.8% Undervalued

With the narrative fair value sitting meaningfully above Etsy’s last close at 54.33 dollars, the story hinges on whether future profits can catch up.

Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

Curious how modest top line growth can still support a richer valuation profile? The narrative leans on powerful margin expansion and shrinking share count. Want to see how those assumptions combine into a punchy earnings outlook and a lower future multiple than today, which fuels that fair value? Dive in to unpack the full playbook.

Result: Fair Value of $68.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking active buyers and rising marketing costs could still derail the AI led recovery, undermining both growth expectations and the undervaluation thesis.

Find out about the key risks to this Etsy narrative.

Another Lens on Value

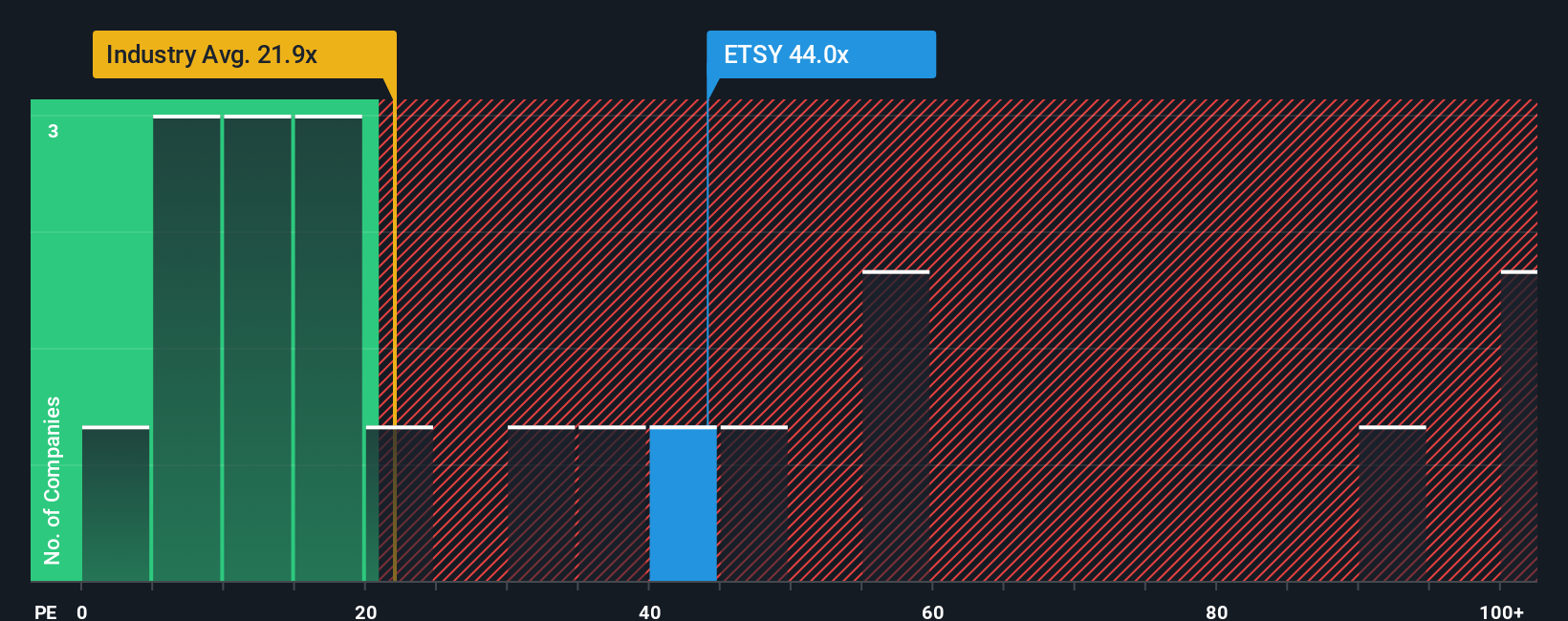

While the narrative framework points to around 21 percent upside, the earnings multiple tells a tougher story. Etsy trades on 29.4 times earnings versus 18 times for peers and a fair ratio of 22.9 times. This suggests investors are already paying up for the recovery. Is this premium really as cheap as it looks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Etsy Narrative

If you see the numbers differently or want to stress test your own thesis, you can build a full narrative in just minutes: Do it your way.

A great starting point for your Etsy research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall Street’s Screener, so the next big winner does not pass you by.

- Capture potential mispricings by running through these 913 undervalued stocks based on cash flows that combine strong fundamentals with attractive cash flow based value.

- Ride powerful technological shifts by zeroing in on these 24 AI penny stocks that could benefit most from rapid advances in artificial intelligence.

- Strengthen your income stream by targeting these 13 dividend stocks with yields > 3% that aim to balance reliable payouts with solid business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报