Has Synopsys Rally on AI Chip Design Left Limited Upside in 2025?

- If you are wondering whether Synopsys is still worth buying at these levels or if the best gains are already in the rearview mirror, this article will walk you through what the current price really implies.

- The stock has bounced about 2.4% over the last week and roughly 20.0% over the past month, even though it is still down around 3.9% year to date and about 5.8% over the last year. Longer term holders remain well ahead with 44.8% and 80.9% returns over 3 and 5 years.

- Behind those swings, Synopsys has stayed in the spotlight thanks to its central role in enabling chip design for AI and advanced semiconductors, as well as continued industry commentary that positions it as a key picks and shovels player in the ongoing AI buildout. Together, these themes have kept investor expectations high and helped explain why the market reacts so quickly to any shift in sentiment around chip demand or design complexity.

- Despite all that excitement, Synopsys currently scores just 0/6 on our basic valuation checks, which suggests the market may already be pricing in a lot of the good news. Next, we will break down what different valuation methods say about the stock, and finish by looking at a smarter way to think about its long term value story.

Synopsys scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Synopsys Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today in $ terms. For Synopsys, the model starts with last twelve month free cash flow of about $1.33 billion and uses analyst forecasts for the next few years before extrapolating longer term trends.

On this basis, Simply Wall St projects Synopsys could be generating around $4.87 billion in free cash flow by 2030, with further gains implied through 2035 as the business scales with AI driven chip design demand. All these future cash flows are discounted using a 2 stage Free Cash Flow to Equity approach to arrive at an estimated intrinsic value of roughly $461.94 per share.

Compared to the current share price, this implies the stock is about 0.4% overvalued, which is effectively a rounding error in valuation terms. In other words, the DCF suggests Synopsys is trading very close to its modeled fair value and that most of the expected growth is already reflected in the price.

Result: ABOUT RIGHT

Synopsys is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Synopsys Price vs Earnings

For profitable, established companies like Synopsys, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. Higher growth and lower perceived risk typically justify a higher PE, while slower or more uncertain growth tends to pull a fair PE ratio lower.

Synopsys currently trades on a PE of about 66.2x, which is roughly double the broader Software industry average of 32.4x and above the peer group average of around 62.1x. That premium suggests the market is pricing in strong, durable growth and relatively low risk compared to typical software names.

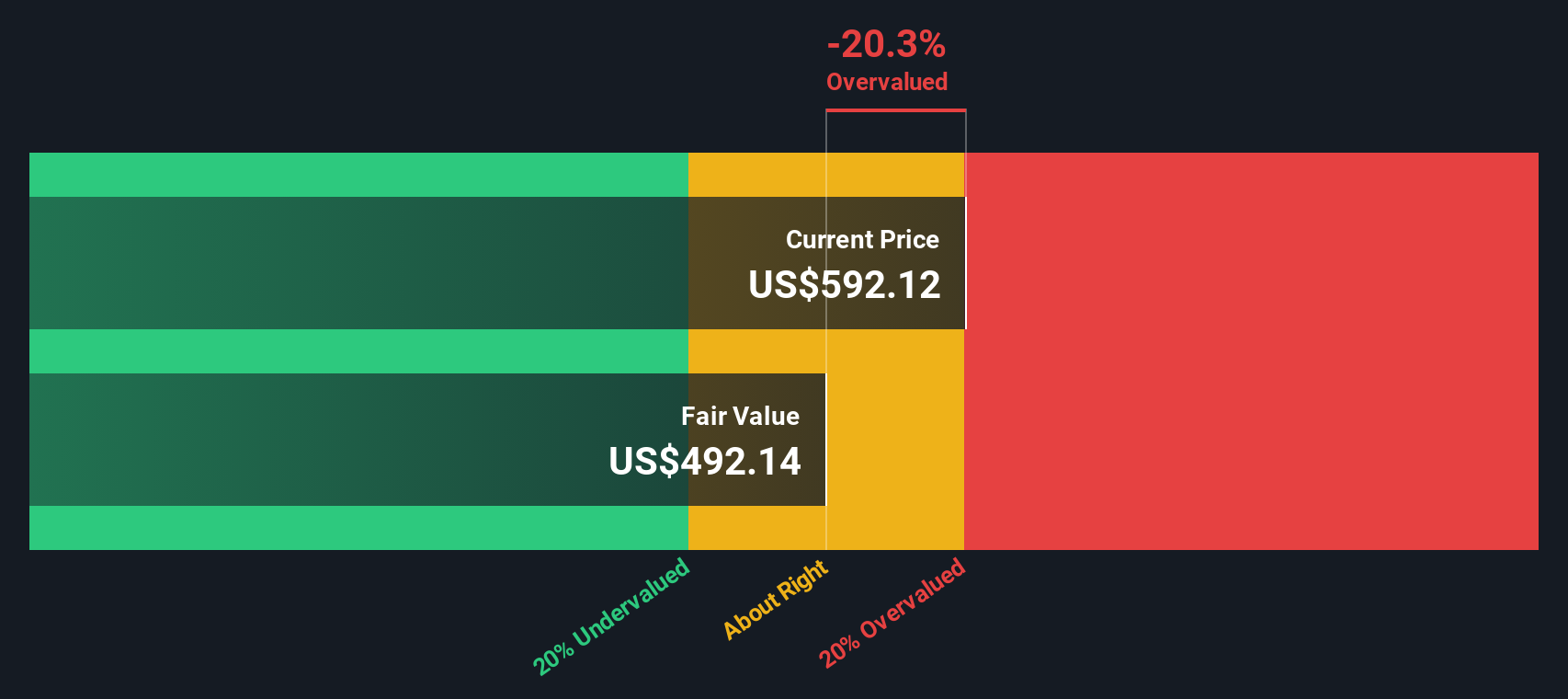

Simply Wall St’s proprietary Fair Ratio framework goes a step further by estimating what PE multiple would be reasonable given Synopsys specific earnings growth outlook, profitability, industry positioning, market cap and risk profile. On this basis, the Fair Ratio for Synopsys is 41.2x, well below the current 66.2x, indicating that the market is paying a hefty premium even after accounting for its strengths.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synopsys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply the stories investors tell about a company that link its business drivers to a financial forecast and then to a fair value estimate.

On Simply Wall St’s Community page, Narratives let you spell out your view on Synopsys future revenue, earnings and margins, and then connect those assumptions to a calculated Fair Value that you can compare with today’s share price to decide whether it looks like a buy, a hold, or a sell.

Narratives are dynamic, updating as new information like earnings, guidance, lawsuits, or major partnerships comes in. This means your fair value view evolves automatically instead of sitting frozen in an old model.

For Synopsys, for example, one investor might build a bullish Narrative that leans heavily on AI driven design demand, the NVIDIA alliance and margin expansion to support a Fair Value closer to the top end of recent analyst targets. Another might focus on export risks, integration challenges and profit pressure to anchor a more cautious Fair Value nearer the low end. Both perspectives can coexist and be compared side by side on the platform.

Do you think there's more to the story for Synopsys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报