Does Western Union’s 13.1% Rally Signal a Fresh Opportunity in 2025?

- Wondering if Western Union at around $9.56 is a cheap cash cow or a value trap? Let us unpack whether the current price really reflects the underlying business.

- Over the last month the stock has climbed 13.1%, even though it is still down 8.4% year to date and 38.4% over 5 years, a mix that often signals shifting expectations rather than quiet stagnation.

- Recently, investors have been digesting Western Union's ongoing push into digital remittances and partnerships with fintech platforms, a strategic pivot that aims to protect its strong brand in a rapidly changing payments landscape. At the same time, regulatory scrutiny of cross border money flows and competition from low fee online rivals continue to shape the risk and reward profile the market is trying to price in.

- On our numbers Western Union scores a solid 5/6 valuation check, suggesting it screens as undervalued on most traditional metrics. Next, we will walk through those methods and then finish with a more complete way to think about what the stock is really worth.

Find out why Western Union's -1.3% return over the last year is lagging behind its peers.

Approach 1: Western Union Excess Returns Analysis

The Excess Returns model looks at how much profit a company generates above the return that equity investors reasonably demand, then projects how long that value add can continue.

For Western Union, the model starts with a Book Value of $2.91 per share and a Stable Book Value of $3.37 per share, based on weighted future book value estimates from 5 analysts. On that equity base, the company is expected to earn Stable EPS of $1.69 per share, driven by an Average Return on Equity of 50.05%, according to 6 analyst estimates.

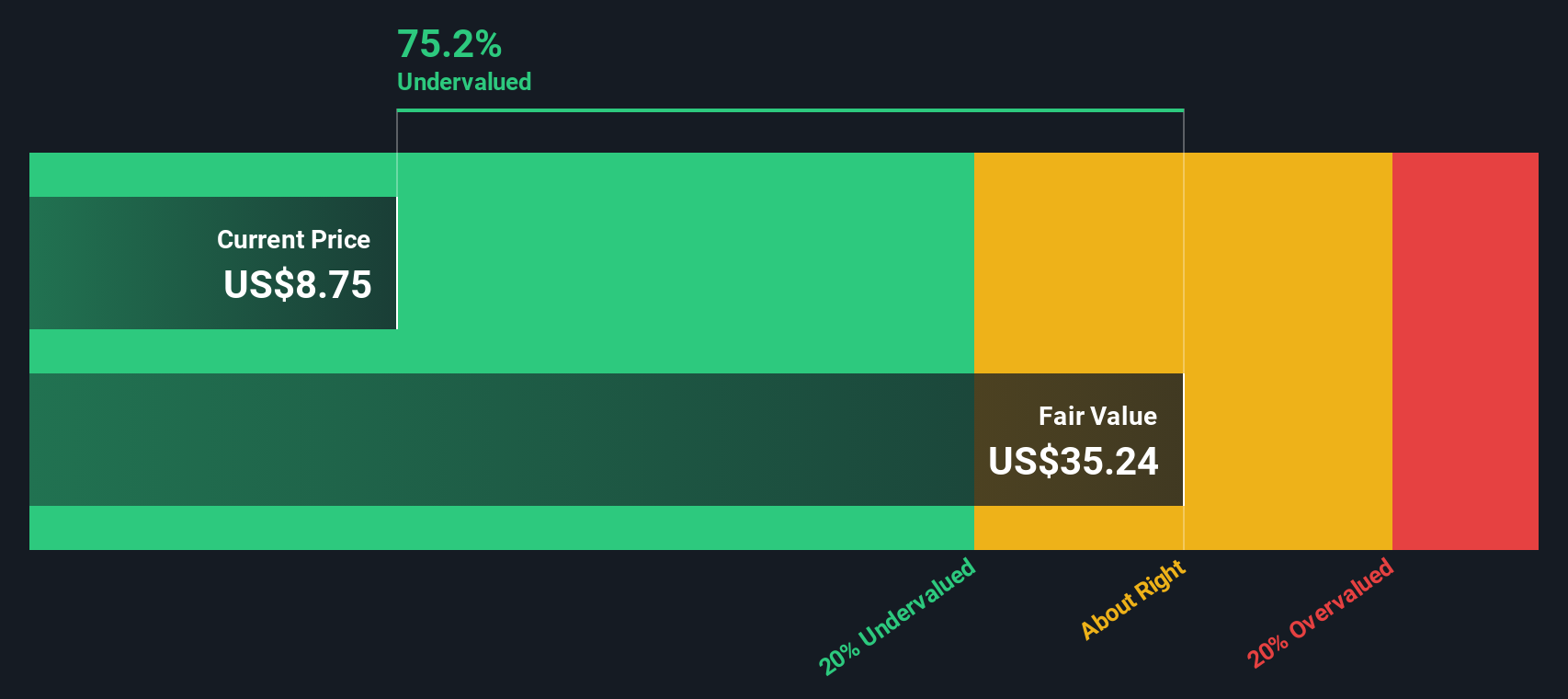

With a Cost of Equity of $0.25 per share, Western Union is projected to generate an Excess Return of $1.43 per share. This suggests it may continue compounding value above its funding cost. When these excess returns are capitalized, the model arrives at an intrinsic value of about $36.93 per share, compared with a recent price near $9.56. This indicates the stock is estimated to be roughly 74.1% undervalued within this framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Western Union is undervalued by 74.1%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Western Union Price vs Earnings

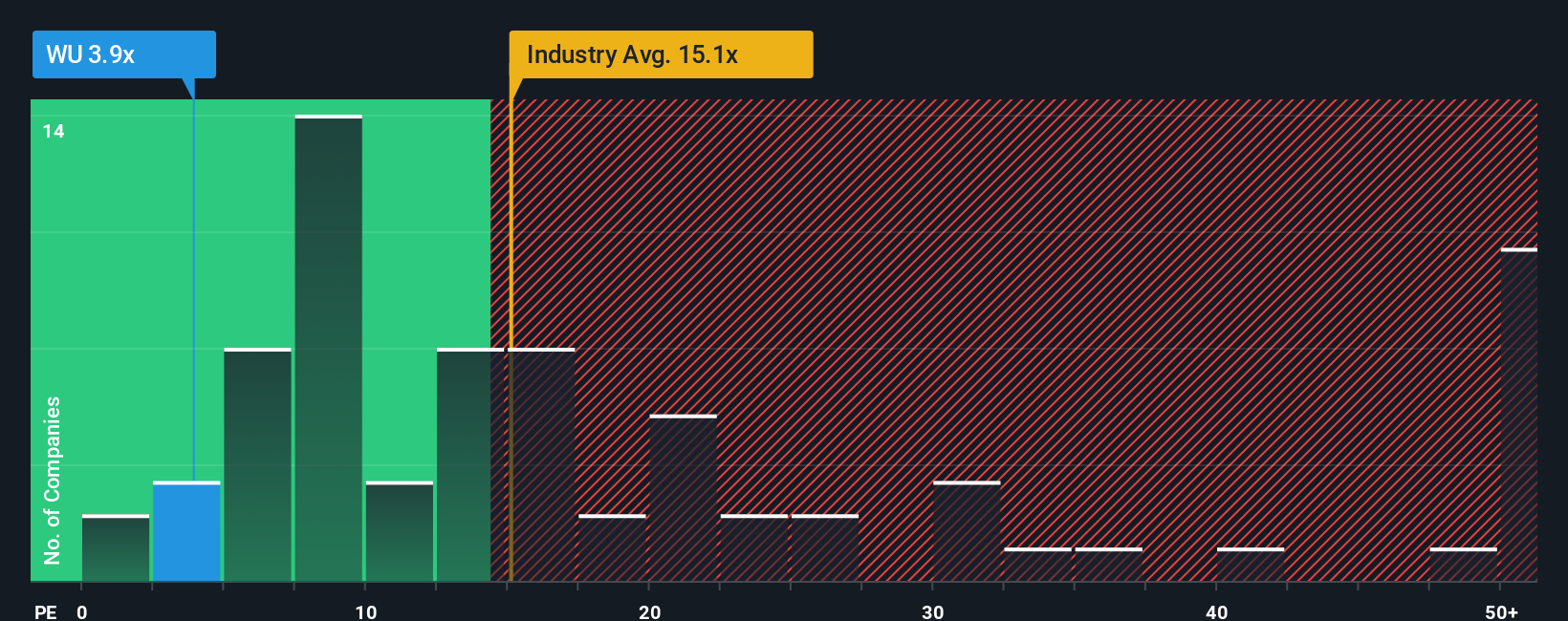

For a mature, profitable business like Western Union, the price to earnings, or PE, ratio is a straightforward way to gauge how much investors are willing to pay for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher, or more generous, PE multiple, while slower growth or higher uncertainty usually cap how far that multiple can stretch.

Western Union currently trades at about 3.94x earnings, which is far below the Diversified Financial industry average of roughly 13.76x and also well under the broader peer group average of around 14.46x. To go beyond these broad comparisons, Simply Wall St estimates a Fair Ratio of 11.39x. This is a proprietary view of what a reasonable PE should be once you factor in Western Union's earnings growth profile, profitability, risk characteristics, industry positioning and market cap.

This Fair Ratio is more tailored than a simple peer or industry comparison because it adjusts for the specific strengths and weaknesses of Western Union rather than assuming all financial stocks deserve the same multiple. Comparing that 11.39x Fair Ratio to the current 3.94x suggests the market is pricing Western Union at a steep discount to what its fundamentals would typically warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Union Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach a clear story to your numbers by tying your view of Western Union's future revenues, earnings and margins to a financial forecast and then to a Fair Value estimate. On Simply Wall St's Community page, used by millions of investors, Narratives let you spell out why you think Western Union's digital transformation, regulatory risks and remittance trends will play out a certain way. The platform then turns that story into a dynamic valuation you can compare against today's share price to decide whether it looks like a buy, a hold or a sell. Because Narratives automatically refresh when new earnings, news or guidance arrives, your fair value view stays current rather than frozen at the moment you built it. For example, one optimistic Western Union Narrative might lean into growth from digital services and stablecoin initiatives and land near a $17 fair value. A more cautious Narrative might stress policy headwinds and competition to justify a value closer to $7. Seeing where your own view sits on that spectrum can clarify your next move.

Do you think there's more to the story for Western Union? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报