Does Medical Properties Trust’s 2025 Rebound Signal a Valuation Opportunity?

- If you are wondering whether Medical Properties Trust is finally a bargain or still a value trap at a lower price, this article will walk you through what the numbers indicate about its valuation.

- After a painful multi year slide, the stock has started to claw back some ground, rising 0.8% over the last week, 2.0% over the past month, and 27.9% year to date, although it still trades well below where it was 3 and 5 years ago.

- Recent moves have been driven less by hype and more by shifting sentiment around the REIT's balance sheet, asset sales, and perceived landlord risk. Investors are reassessing how sustainable its rental income and liquidity position are. Together, these developments have nudged the market from pricing in a worst case scenario toward a more cautiously optimistic outlook.

- Under our framework, Medical Properties Trust scores a 5/6 valuation check. This suggests it screens as undervalued on most of the metrics we track, though not all. Next, we will unpack those methods and, at the end, explore an additional way to think about what the stock may be worth.

Approach 1: Medical Properties Trust Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model projects Medical Properties Trust's adjusted funds from operations into the future and then discounts those cash flows back to today to estimate what the shares are worth now.

On a trailing basis, the trust reported free cash flow of roughly $1.4 billion in the red, reflecting the pressure from asset sales and balance sheet repair. Analysts and internal estimates, however, point to a recovery, with free cash flow expected to improve to about $388 million by 2029 and continuing to grow through 2035 as the portfolio stabilizes.

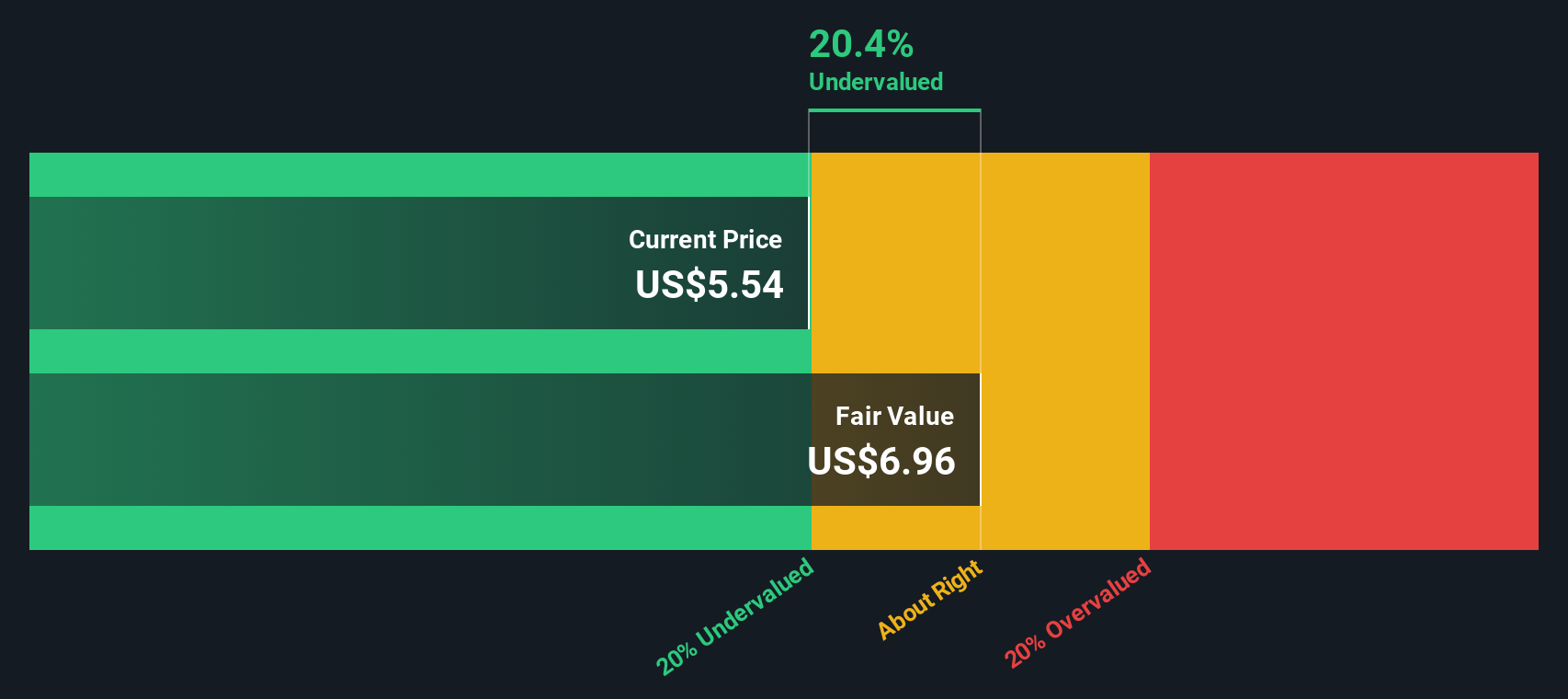

Simply Wall St uses a two stage Free Cash Flow to Equity approach, combining analyst forecasts for the next few years with longer term extrapolations to arrive at an intrinsic value of about $6.99 per share. Compared with the current market price, this implies the stock is trading at roughly a 26.5% discount to its estimated fair value. This indicates the market is still pricing in a more pessimistic scenario than the cash flow projections would justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Medical Properties Trust is undervalued by 26.5%. Track this in your watchlist or portfolio, or discover 914 more undervalued stocks based on cash flows.

Approach 2: Medical Properties Trust Price vs Sales

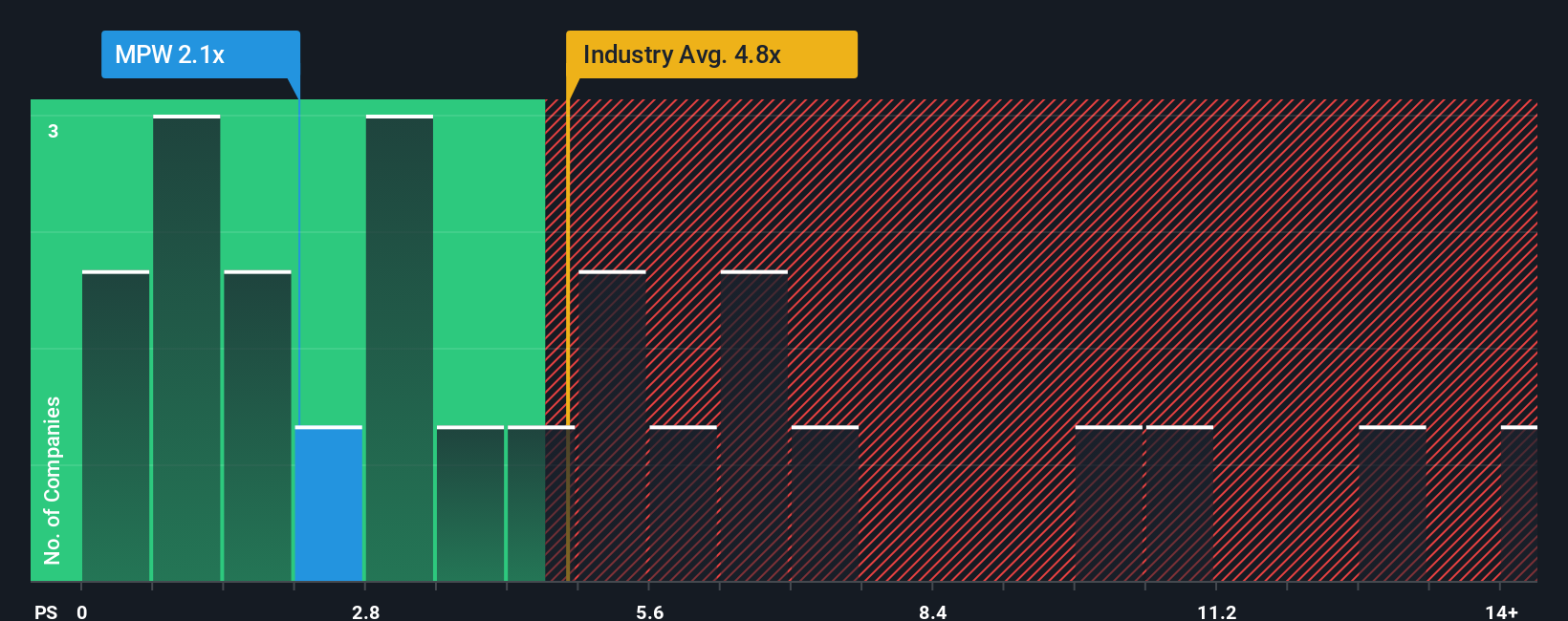

For companies where profitability is volatile or depressed, the price to sales ratio is often a useful way to gauge valuation because it focuses on the stability of revenue rather than short term earnings swings. Investors typically assign higher or lower price to sales multiples based on how quickly they expect revenue to grow and how risky that growth appears, so faster growing, lower risk businesses usually justify higher ratios.

Medical Properties Trust currently trades on a price to sales multiple of 3.06x, which is well below both the Health Care REITs industry average of about 6.61x and the broader peer group average of roughly 7.18x. Simply Wall St also calculates a Fair Ratio of 5.55x, which is the price to sales multiple inferred from Medical Properties Trust's specific mix of growth prospects, risk profile, profit margins, size, and industry positioning. This Fair Ratio can be more informative than a simple comparison with peers because it adjusts for what makes the company different rather than assuming all REITs deserve the same multiple. Since the current 3.06x multiple sits notably below the 5.55x Fair Ratio, the shares appear undervalued on this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Medical Properties Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St's Community page that lets you turn your view of Medical Properties Trust into a simple story linked to a concrete forecast and fair value. You spell out what you think will happen to its future revenue, earnings and margins. The platform converts that story into a financial model and fair value estimate, and then helps you decide whether to buy or sell by comparing that fair value with the current price. It updates dynamically as new news or earnings arrive. One investor might build a more optimistic MPW Narrative around improving rent coverage, international growth and a fair value near the higher end of recent targets. Another might focus on tenant risk, leverage and slower recovery and arrive at a fair value closer to the lower end. Both can clearly see how their assumptions drive the numbers and how the valuation gap changes over time.

Do you think there's more to the story for Medical Properties Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报