Dekon Food and Agriculture Group (SEHK:2419): Valuation Check After Strong November Trading Update and Sales Growth

Dekon Food and Agriculture Group (SEHK:2419) just released its unaudited November trading update, showing over 1 million pigs sold and RMB 1.59 billion in monthly revenue, plus RMB 17.52 billion year to date.

See our latest analysis for Dekon Food and Agriculture Group.

The strong operational update arrives after a powerful year to date, with a 146.7% year to date share price return and a 155.9% one year total shareholder return suggesting momentum is still very much on Dekon’s side.

If Dekon’s surge has you thinking about what else might be gathering steam in the market, now is a good moment to explore fast growing stocks with high insider ownership.

With Dekon trading at a steep discount to analyst targets and strong earnings growth on display, investors now face a key question: is this still an undervalued growth story, or has the market already priced in its next leg higher?

Price-to-Earnings of 7.3x: Is it justified?

Dekon Food and Agriculture Group trades on a 7.3x price to earnings multiple against a last close of HK$75, which may indicate a modest valuation relative to peers and certain intrinsic estimates.

The price to earnings ratio compares what investors pay for each unit of current earnings, a key yardstick for profitable, steadily growing businesses like Dekon in the livestock and poultry sector.

With Dekon expected to grow earnings faster than the broader Hong Kong market and sector, a low earnings multiple suggests the market may not be fully pricing in that profit expansion or its current and forecast return on equity.

Set against the Hong Kong Food industry average of 12.4x and a peer average of 13.1x, Dekon’s 7.3x multiple appears compressed, and even more so when compared to an estimated fair price to earnings of 22.4x, a level the market could eventually move toward if similar growth and profitability trends were to continue.

Explore the SWS fair ratio for Dekon Food and Agriculture Group

Result: Price-to-Earnings of 7.3x (UNDERVALUED)

However, elevated cyclicality in pig and poultry prices, alongside execution risk in rapidly scaling operations, could easily derail today’s optimistic valuation narrative.

Find out about the key risks to this Dekon Food and Agriculture Group narrative.

Another View: SWS DCF Signals Deeper Value

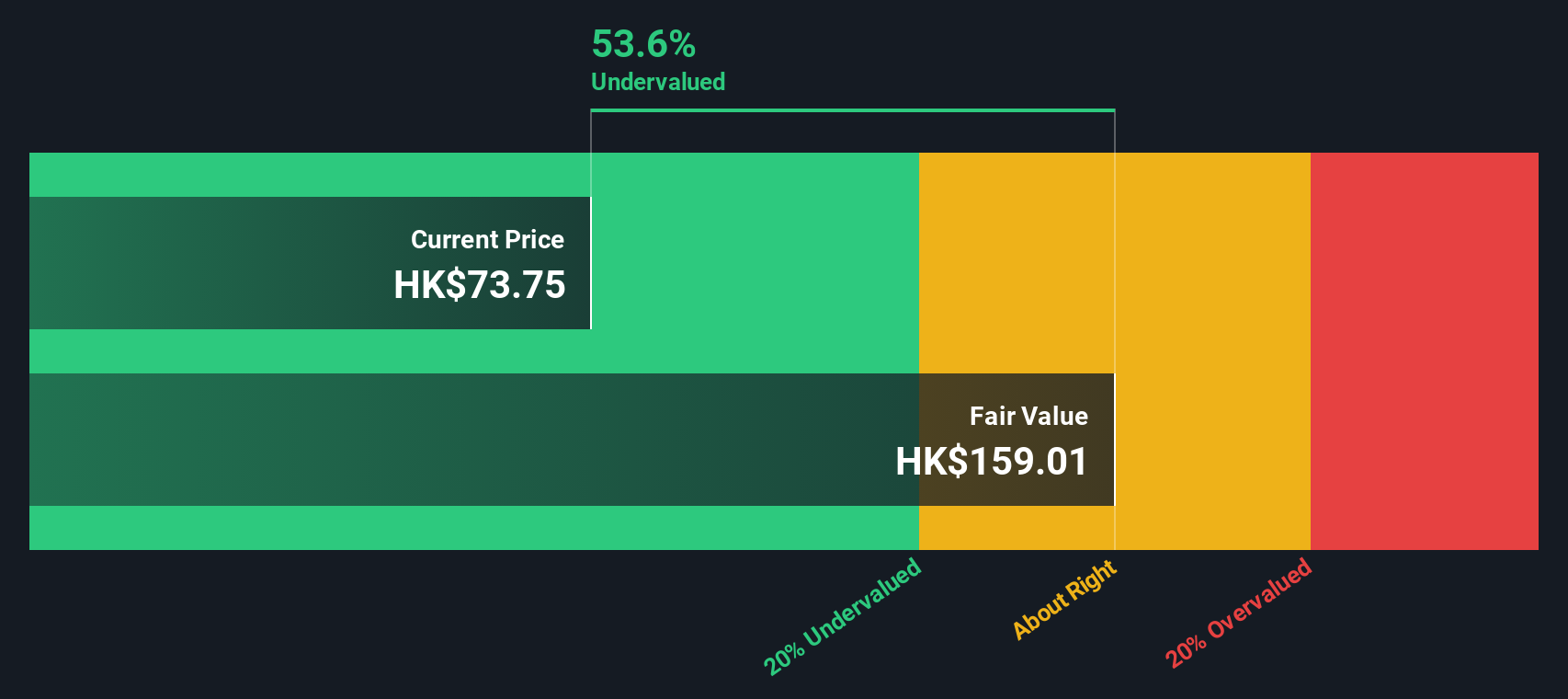

While the earnings multiple points to value, our DCF model indicates fair value at roughly HK$161.12, about 53.5% above the current HK$75 price. If both earnings and cash flows suggest it is cheap, is the market underestimating Dekon’s risks or its runway?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dekon Food and Agriculture Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dekon Food and Agriculture Group Narrative

If you see the story differently, or would rather dive into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dekon Food and Agriculture Group.

Ready for your next investing move?

Put this momentum to work. Use the Simply Wall St Screener to uncover targeted stock ideas that match your strategy before the crowd rushes in.

- Capture early-stage growth potential by screening for these 3625 penny stocks with strong financials that pair tiny market caps with robust financial underpinnings.

- Position yourself at the heart of technological transformation by focusing on these 25 AI penny stocks shaping automation, data intelligence, and next generation platforms.

- Lock in better risk reward profiles by zeroing in on these 914 undervalued stocks based on cash flows that still trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报