Advance Auto Parts (AAP): Revisiting Valuation After a Steep Three‑Month Share Price Slide

Advance Auto Parts (AAP) has quietly slid again, with the stock down about 2 % on the day and roughly 31 % over the past 3 months, putting its turnaround story back under the microscope for investors.

See our latest analysis for Advance Auto Parts.

Zooming out, the recent slide adds to a tough stretch, with a roughly 19 percent 1 month share price return and a year to date share price decline suggesting momentum is still fading despite some operational progress, while the 3 year total shareholder return near minus 70 percent underlines how deep the rebuild challenge remains.

If this kind of reset has you rethinking your watchlist, it might be a good moment to explore auto manufacturers as a different way to play the broader automotive theme.

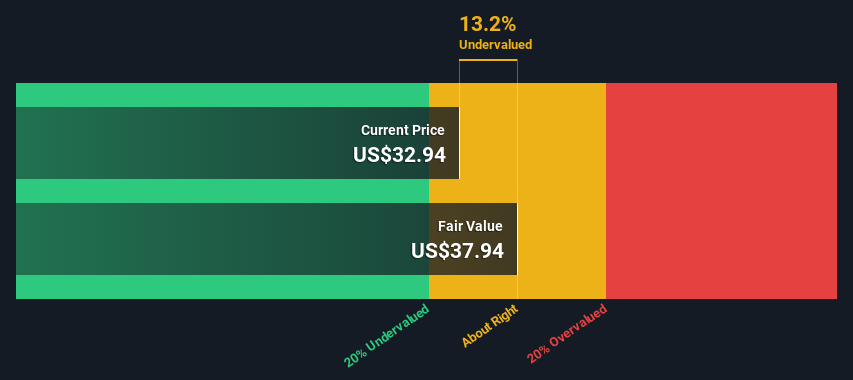

With shares now trading at a steep discount to analyst targets but still weighed down by losses and a bruising multi year track record, is Advance Auto Parts a contrarian value play, or is the market rightly skeptical about future growth?

Most Popular Narrative Narrative: 25.6% Undervalued

With shares at $40.40 versus a narrative fair value near the mid 50s, the upside case leans heavily on a multi year margin rebuild.

The consolidation of distribution centers (DCs) from 38 to 12 by 2026 aims to enhance supply chain efficiency. This reorganization, along with new market hub stores, is projected to reduce supply chain costs and improve gross margins, impacting earnings positively.

Curious how flat revenue expectations can still back a higher valuation? The narrative leans on a sharp earnings swing and a future profit multiple that might surprise you. Want to see the exact trajectory behind that margin turnaround and the valuation it is meant to support? Read on to unpack the full story.

Result: Fair Value of $54.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent store closure costs and weaker than expected sales trends could delay the margin rebuild and undermine the case for a sustained earnings turnaround.

Find out about the key risks to this Advance Auto Parts narrative.

Another View on Valuation

Not everyone sees Advance Auto Parts as a bargain. Our DCF model suggests the shares, at $40.40, sit well above an estimated fair value of about $6.94, implying the stock screens as sharply overvalued if future cash flows fall short of the turnaround script.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advance Auto Parts for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advance Auto Parts Narrative

If you are not fully convinced by this view, or simply prefer digging into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Advance Auto Parts research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at a single turnaround story. Sharpen your edge by scanning fresh opportunities other investors may overlook using targeted stock screeners right now.

- Capture potential multi baggers early by reviewing these 3625 penny stocks with strong financials with resilient balance sheets and financials that back up the growth story.

- Capitalize on structural tech shifts by focusing on these 25 AI penny stocks positioned at the heart of intelligent automation and data driven decision making.

- Lock in quality at compelling prices through these 914 undervalued stocks based on cash flows that appear mispriced relative to their cash flow strength and future prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报