FDA Review Of Veli For Thyroid Eye Disease Might Change The Case For Investing In Viridian Therapeutics (VRDN)

- In recent days, analysts at firms including Goldman Sachs and Needham reiterated positive views on Viridian Therapeutics after the company submitted a Biologics License Application to the FDA for its lead thyroid eye disease therapy, veli.

- These endorsements highlight how Viridian’s plan to convert existing Tepezza prescribers and potentially broaden veli’s label with Phase 3 data could reshape expectations for its rare disease portfolio.

- With FDA review of veli’s application now underway, we’ll examine how this potential launch opportunity influences Viridian’s investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Viridian Therapeutics' Investment Narrative?

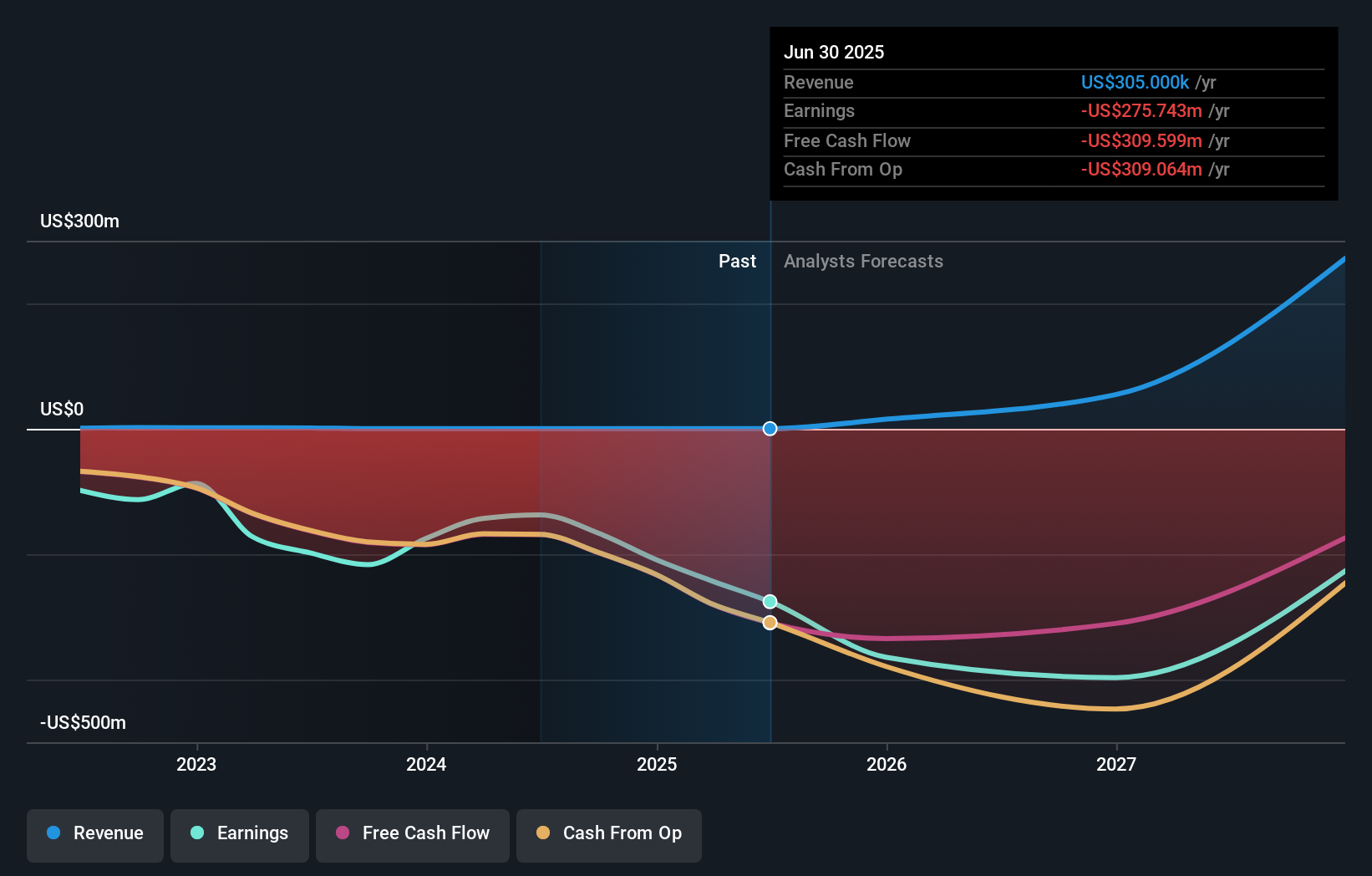

For Viridian, the core “big picture” is straightforward: you have to believe that veli can secure approval in thyroid eye disease and become a meaningful alternative to Tepezza, while VRDN-003 follows as a second, possibly more convenient, option. The recent BLA submission and the follow-up boost from Goldman Sachs and Needham reinforce that the key near term catalyst is now the FDA review itself, rather than new data. A 5% share price move suggests the market sees this as incrementally positive, but not thesis changing. The business still lives with classic biotech risks: regulatory outcomes, the timing and shape of any veli label, and the need to fund a pipeline while losses remain large and the stock trades on a rich sales multiple.

However, investors also need to consider how much dilution and cash burn may still lie ahead. Despite retreating, Viridian Therapeutics' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on Viridian Therapeutics - why the stock might be worth over 9x more than the current price!

Build Your Own Viridian Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viridian Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Viridian Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viridian Therapeutics' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报