NEC (TSE:6701) Valuation Check After ClimateAi Partnership and New Digital Infrastructure Wins

NEC (TSE:6701) has been busy, from securing CDP A List status on climate and water to teaming up with ClimateAi and rolling out high precision timing systems for aviation and banking clients.

See our latest analysis for NEC.

Against that backdrop, NEC's 16.0 percent 3 month share price return and triple digit year to date gain suggest momentum is still building, while a 3 year total shareholder return above 500 percent underlines how firmly the long term story has shifted.

If NEC's climate tech and digital infrastructure push has your attention, it could be a good moment to explore high growth tech and AI stocks as potential next generation beneficiaries of the same themes.

With earnings rising, a value score at the top end and the share price already more than doubling this year, the key question is whether NEC still trades below its true worth or whether markets now fully price in its future growth.

Most Popular Narrative Narrative: 10.1% Undervalued

With NEC closing at ¥5,436 against a fair value estimate of ¥6,050, the most followed narrative sees more upside baked into its long range projections.

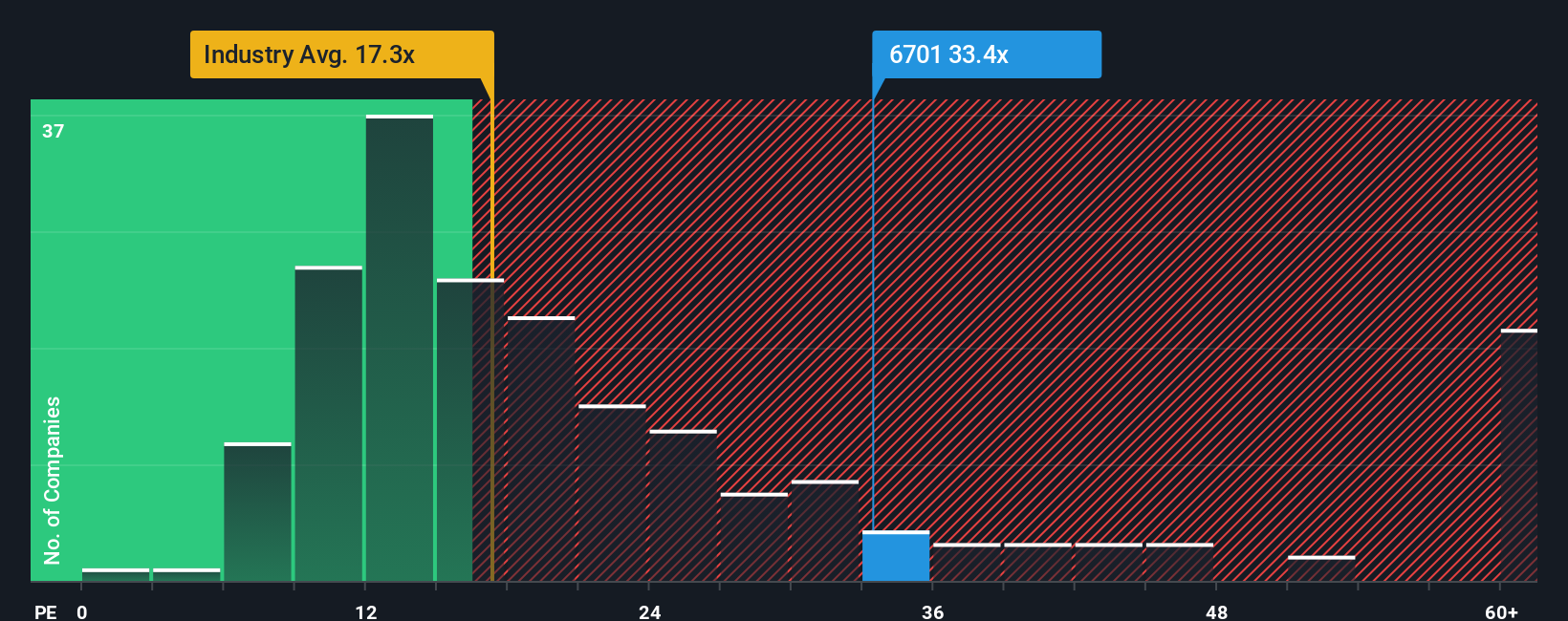

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.5x on those 2028 earnings, down from 28.8x today. This future PE is greater than the current PE for the JP IT industry at 17.4x.

Want to know what kind of earnings climb could support that premium multiple, and how margins are expected to evolve to get there? The full narrative unpacks a detailed path for revenue expansion, profit upgrades, and a valuation reset that assumes NEC keeps stepping up as a higher quality, higher margin platform player. Curious which of those assumptions does the heavy lifting in the fair value math? Read on to see what the narrative is really pricing in.

Result: Fair Value of ¥6,050 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent domestic IT softness and rising investment needs could easily cap near term growth and undermine the premium multiple implied by this narrative.

Find out about the key risks to this NEC narrative.

Another View: Market Ratios Flag a Richer Price

While the narrative suggests NEC is 10.1 percent undervalued, its current price to earnings ratio of 30.9 times sits above both peers at 30.6 times and the JP IT industry at 17.1 times. This tilts the balance toward valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NEC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NEC Narrative

If this take does not quite match your view, or you would rather dig into the numbers yourself, you can build a personalised narrative in just a few minutes, starting with Do it your way.

A great starting point for your NEC research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one idea; use the Simply Wall Street Screener to quickly surface fresh opportunities that match your style before other investors get there.

- Capitalize on mispriced potential by scanning these 914 undervalued stocks based on cash flows where robust cash flows are not yet fully reflected in market prices.

- Amplify your growth focus by targeting these 25 AI penny stocks positioned at the intersection of powerful algorithms and surging enterprise adoption.

- Secure steadier income streams by reviewing these 13 dividend stocks with yields > 3% offering attractive yields above 3 percent with room for long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报