Braze (BRZE): Reassessing Valuation After Earnings Beat, Raised Guidance and New BTIG Buy Coverage

Braze (BRZE) has had a busy stretch, with revenue beating expectations, guidance nudged higher, and fresh Buy coverage from BTIG all landing within days. Naturally, investors are asking what comes next.

See our latest analysis for Braze.

Those upbeat results and new coverage have lit a fire under sentiment, with the 30 day share price return of 30.31 percent standing out against a still negative year to date share price performance. This suggests momentum is rebuilding after a choppy stretch and a 3 year total shareholder return of 38.83 percent.

If Braze’s rebound has you rethinking where growth could come from next, this is a good moment to explore high growth tech and AI stocks that might be riding similar digital adoption tailwinds.

With the stock still down roughly 20 percent over the past year and trading about 32 percent below consensus targets, investors now face a key question: Is this renewed optimism an entry point, or is future growth already priced in?

Most Popular Narrative Narrative: 24.6% Undervalued

With Braze last closing at 35.47 dollars versus a narrative fair value of about 47.06 dollars, the valuation case leans heavily on AI driven upside and scaling economics.

Bullish analysts view Braze as a top pick within application software, arguing that customer engagement and marketing platforms are among the best positioned to translate Gen AI functionality into incremental revenue growth and margin expansion.

Curious how a still unprofitable business earns such a premium future multiple? The narrative leans on accelerating revenue, rising margins, and a bold earnings ramp. Want to see how those moving pieces line up to support that higher fair value and long term price target path? Read the full narrative to see the projections behind the call.

Result: Fair Value of $47.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, integrating OfferFit and navigating evolving data sovereignty laws could pressure margins and delay the scale of Gen AI monetization that investors are betting on.

Find out about the key risks to this Braze narrative.

Another Angle on Valuation

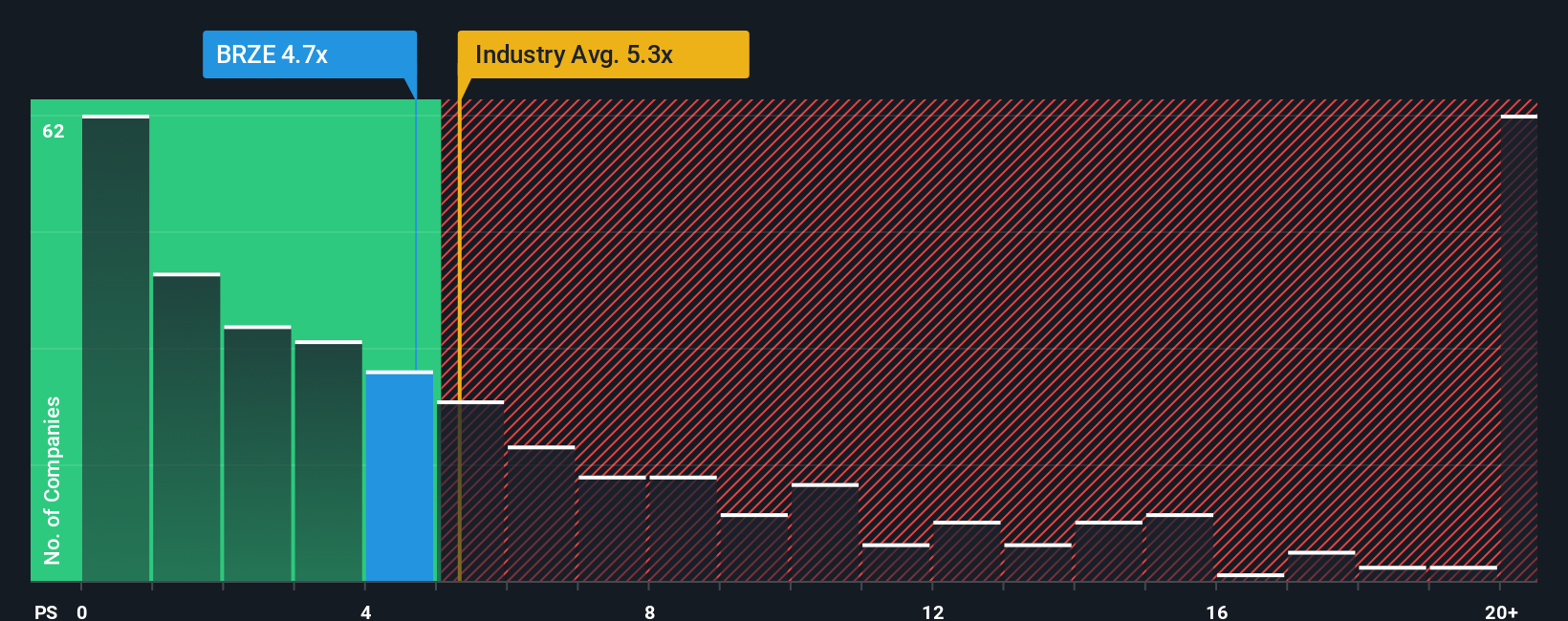

While the narrative suggests Braze is 24.6 percent undervalued, our ratio based view points the other way. The stock trades at 5.7 times sales versus 4.9 times for the US software sector and a 5.0 times fair ratio, which hints at richer expectations rather than a clear bargain. Could that premium narrow if growth disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Braze Narrative

If you are not fully aligned with this view, or prefer to analyze the numbers on your own, you can build a custom narrative in under three minutes, Do it your way.

A great starting point for your Braze research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Braze, you risk missing out on other powerful setups, so let Simply Wall Street’s screener surface the next wave of opportunities for you.

- Secure potentially overlooked value by scanning these 914 undervalued stocks based on cash flows that the market may be underpricing based on future cash flows.

- Ride structural growth trends by targeting these 29 healthcare AI stocks transforming patient outcomes with smarter diagnostics and treatment tools.

- Tap into disruptive innovation by reviewing these 79 cryptocurrency and blockchain stocks building real world applications on blockchain and digital asset infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报