Cooper Companies (COO): Valuation Check After Continued Insider Buying by CooperVision CEO

Cooper Companies (COO) just drew fresh attention after White Albert G III, head of its CooperVision unit, bought another 10,000 shares, extending a year long pattern of insider purchases without any sales.

See our latest analysis for Cooper Companies.

That confidence has coincided with improving sentiment, with a roughly 21% 3 month share price return helping to offset weaker year to date and 1 year total shareholder returns that remain in negative territory. This suggests momentum may be rebuilding after a tougher stretch.

If Cooper Companies has you rethinking healthcare exposure, it could be worth scanning other opportunities across healthcare stocks to see which names the market is starting to reward next.

With shares still trading below both analyst targets and some estimates of intrinsic value, despite a recent rebound, are investors getting a mispriced turnaround in vision and women’s health, or is the market already baking in the next leg of growth?

Most Popular Narrative: 8.6% Undervalued

With Cooper Companies last closing at $82.75 against a fair value of $90.50, the prevailing narrative frames today's price as a discounted entry into its long term earnings story.

Free cash flow is poised to inflect higher as a multi year capital expenditure cycle winds down following the ramp up of MyDAY capacity, with management guiding for approximately $2 billion in free cash flow over the next three years. This improved cash generation, tied to strong cost discipline and revenue momentum, will further benefit shareholders via debt reduction and share repurchases.

Want to see what powers that cash flow surge? This narrative quietly leans on rising margins, steady revenue compounding, and a richer earnings multiple. Curious which assumptions really move the dial?

Result: Fair Value of $90.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft fertility and IUD demand, or a slower than expected MyDAY ramp, could undercut those margin gains and delay the expected cash flow inflection.

Find out about the key risks to this Cooper Companies narrative.

Another View: Expensive on Earnings

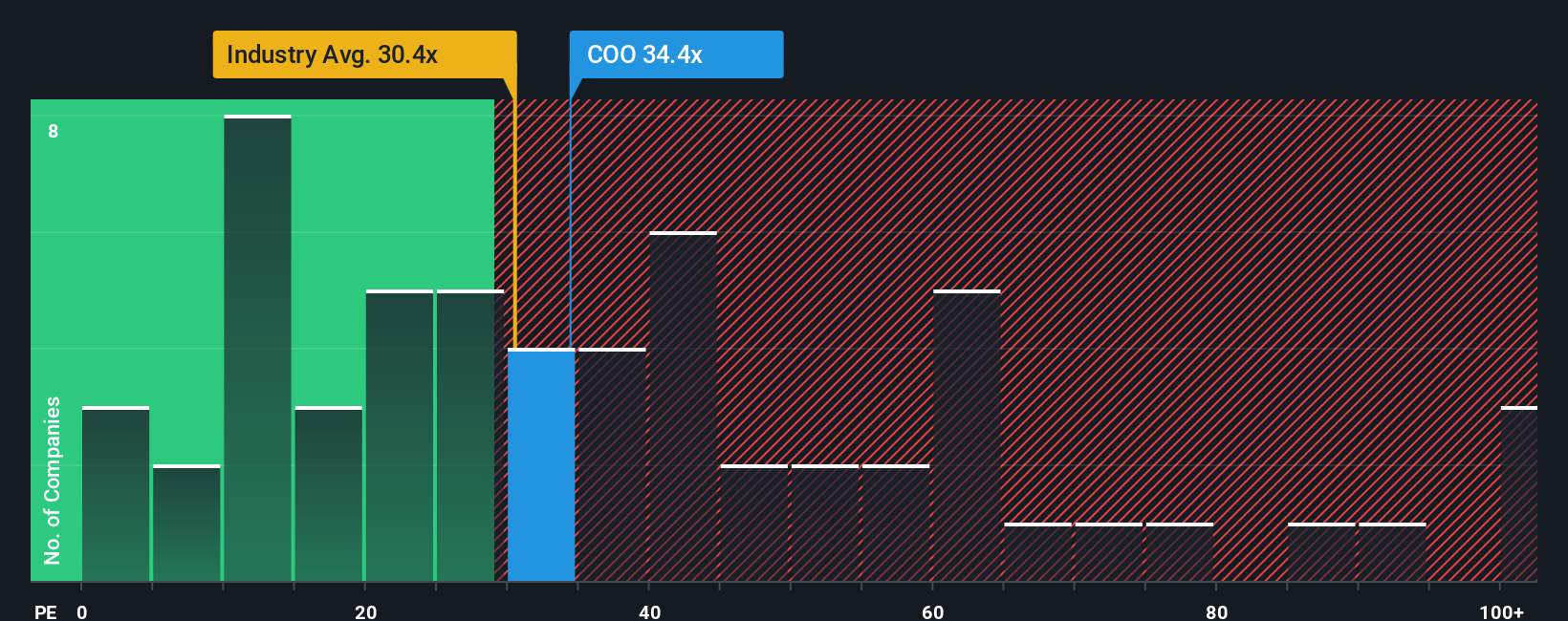

Step away from fair value models and the earnings multiple tells a tougher story. Cooper Companies trades on 43.3 times earnings, well above both the medical equipment industry at 30.6 times and peers at 26.4 times, and even its 29.7 times fair ratio. Is sentiment running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cooper Companies Narrative

If this perspective does not quite resonate, or if you would prefer to review the numbers yourself, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cooper Companies.

Ready for more high conviction ideas?

Before you move on, lock in fresh opportunities by using the Simply Wall Street Screener to surface focused ideas that match your return and risk preferences.

- Capture underappreciated opportunities by targeting companies trading below their estimated cash flow potential with these 914 undervalued stocks based on cash flows.

- Ride the next wave of innovation by scanning cutting edge names powering intelligent software and automation through these 25 AI penny stocks.

- Strengthen your income stream by targeting reliable payouts and healthier yields using these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报