Taking Stock of M/I Homes (MHO) Valuation After Its Recent Pullback

Valuation backdrop after mixed recent performance

M/I Homes (MHO) has slipped about 4% in the past day and roughly 6% over the past week, even though the stock is still modestly higher over the past month. This combination sets up an interesting reset in expectations.

See our latest analysis for M/I Homes.

Zooming out, the recent pullback comes after a strong multi year run, with the share price still near record territory and longer term total shareholder returns remaining very robust. This suggests momentum is pausing rather than breaking.

If you are reassessing housing names after this move, it can also be a good moment to broaden your search and discover fast growing stocks with high insider ownership.

With growth cooling and the share price still hovering near highs but below analyst targets, the key question now is whether M/I Homes trades at a genuine discount or if markets are already pricing in its next leg of growth.

Most Popular Narrative: 16.6% Undervalued

With M/I Homes last closing at 127.65 dollars versus a narrative fair value of 153 dollars, the valuation case leans supportive despite softer fundamentals.

The company is strategically expanding its community count, up 5 percent year over year, and planning continued growth in high demand regions (Midwest, Southeast, and especially Southern markets like Texas and Florida) where demographic trends (millennial and Gen Z buyers, household formation) and migration patterns support long term demand. This positions M/I Homes for potential future revenue growth. Despite short term headwinds from higher rates, the persistent U.S. single family home undersupply relative to demographic demand means many buyers are still on the sidelines, suggesting there is substantial pent up demand that could materialize as macro conditions change, which could support future sales and revenue trends.

Want to see how modest revenue contraction, slimmer margins, and a richer future earnings multiple can still be used to argue for upside from here, discover the full playbook driving that conclusion.

Result: Fair Value of $153 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained rate pressure, softer contracts, and rising inventory exposure could weigh further on margins and challenge the current undervaluation thesis.

Find out about the key risks to this M/I Homes narrative.

Another angle on value

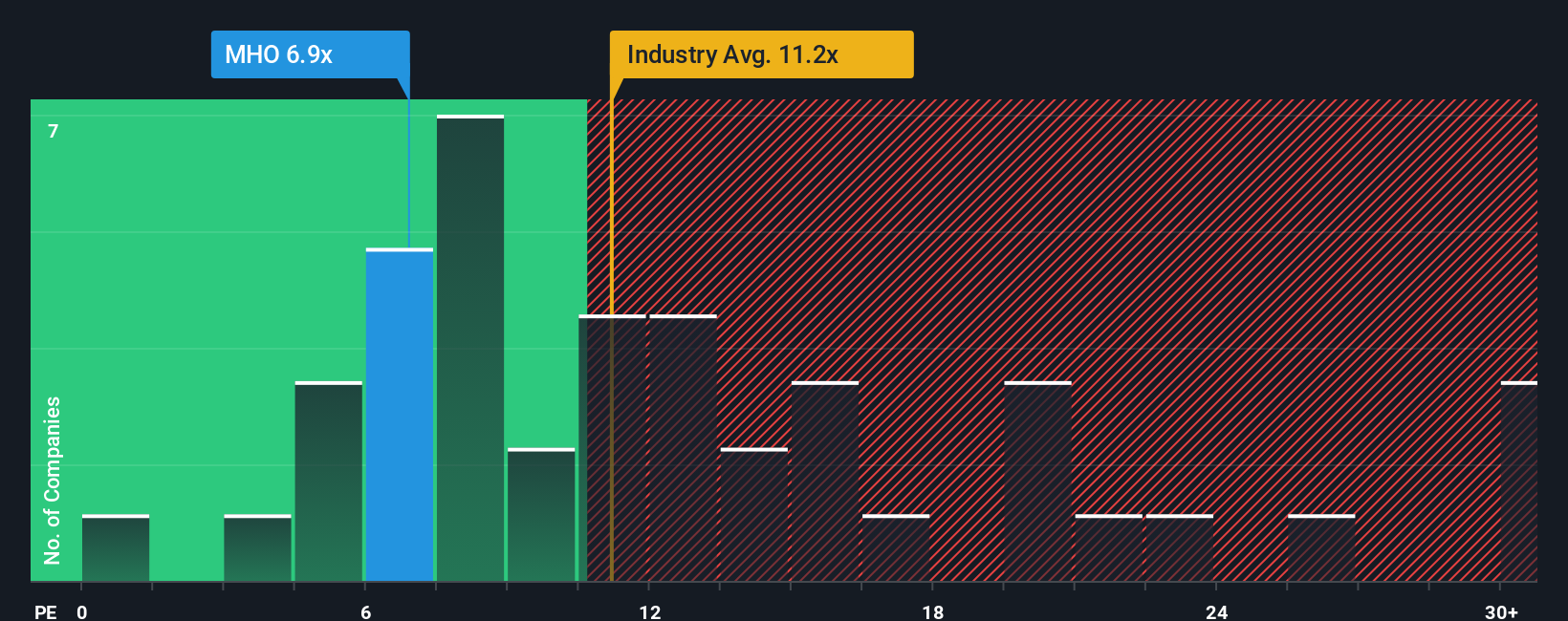

While the narrative fair value suggests M/I Homes is 16.6 percent undervalued, traditional price to earnings metrics still look supportive. The stock trades on 7.1 times earnings versus about 11.1 times for the Consumer Durables industry and 12.4 times for peers, with a fair ratio of 10.7 times.

That gap points to meaningful upside if sentiment normalizes and the market shifts M/I Homes toward its fair ratio. It also raises the question: what if earnings keep sliding and the discount is actually deserved?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out M/I Homes for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own M/I Homes Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a custom view in minutes: Do it your way.

A great starting point for your M/I Homes research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not leave your research at one stock. Use the Simply Wall St Screener to spot fresh opportunities before they hit everyone else’s radar.

- Capture overlooked growth potential by scanning these 914 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has mispriced.

- Position yourself at the frontier of innovation by assessing these 25 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Lock in dependable income streams by reviewing these 13 dividend stocks with yields > 3% offering yields above 3 percent with room for long term compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 华尔街日报

华尔街日报